MSCI World Equal Weighted-ETFs: Welcher ist der beste?

Der MSCI World Equal Weighted (EW)-Index Factsheet

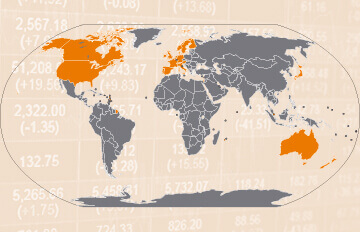

Der MSCI World Equal Weighted (EW) ist ein Aktienindex, der die Wertentwicklung von Unternehmen aus 23 Industrieländern weltweit abbildet. Der entscheidende Unterschied im Vergleich zum MSCI World Index besteht darin, dass im MSCI World Equal Weighted Index alle Unternehmen gleich gewichtet sind. Diese Gleichgewichtung wird vierteljährlich durch ein Rebalancing wiederhergestellt. Im Gegensatz dazu werden im klassischen MSCI World Index alle Unternehmen nach ihrer Marktkapitalisierung gewichtet. Die Gleichgewichtung hat beim MSCI World EW Index zur Folge, dass der Einfluss einzelner grosser Unternehmen auf die Wertentwicklung des Index deutlich geringer ist. Zudem haben Unternehmen aus den USA im MSCI World EW Index ein signifikant geringeres Gewicht als in der klassischen Index-Variante. Für Anlegende, denen der US-Anteil oder das Gewicht einzelner Unternehmen im MSCI World Index zu gross ist, stellen ETFs auf den MSCI World Equal Weighted Index daher eine mögliche Alternative dar.

Mit einem Investment in den MSCI World Equal Weighted über ETFs partizipierst du neben Kursgewinnen an den Dividenden der Unternehmen. Aktuell steht dir 1 ETF für eine Anlage in den MSCI World Equal Weighted zur Verfügung.

MSCI World Equal Weighted Chart 1 Jahr

Quelle: justETF.com; Stand: 08.07.25; Wertentwicklung in CHF, basierend auf dem grössten ETF.

Kosten von MSCI World Equal Weighted-ETFs

Die Gesamtkostenquote – auch Total Expense Ratio (TER) genannt – eines MSCI World Equal Weighted-ETFs liegt bei 0,20% p.a.. Damit sind ETFs deutlich günstiger als aktiv verwaltete Fonds. Berechnen Sie Ihre persönliche Kostenersparnis mit unserem Fonds-Kostenrechner.

MSCI World Equal Weighted-ETFs im Vergleich

Für die Auswahl eines MSCI World Equal Weighted-ETF sind neben der Wertentwicklung weitere Faktoren für die Entscheidungsfindung wichtig. Zum besseren Vergleich finden Sie eine Liste aller MSCI World Equal Weighted-ETFs mit Angaben zu Grösse, Kosten, Ertragsverwendung, Fondsdomizil und Replikationsmethode sortiert nach Fondsgrösse.

Alle MSCI World Equal Weighted-ETFs im Detail vergleichen

Alle MSCI World Equal Weighted-ETFs im Chart-Vergleich

| ETF ISIN | Fondsgrösse in Mio. CHF | TER in % | Ertrags- verwendung | Fonds- domizil | Replikations- methode | |

|---|---|---|---|---|---|---|

| Invesco MSCI World Equal Weight UCITS ETF AccIE000OEF25S1 | 375 | 0,20% p.a. | Thesaurierend | Irland | Optimiertes Sampling |

Quelle: justETF.com; Stand: 08.07.25

Performance-Vergleich der MSCI World Equal Weighted-ETFs

Die folgende Tabelle zeigt Ihnen die Wertentwicklung aller ETFs auf den MSCI World Equal Weighted im Vergleich. Alle Angaben zur Wertentwicklung sind per Monatsende und inklusive Ausschüttungen. Neben der Wertentwicklung zu einem Stichtag ist für den Vergleich von ETFs die Wertentwicklung im Zeitverlauf entscheidend. Nutzen Sie hierfür auch unseren Chartvergleich.

| ETF | 1 Monat in % | 3 Monate in % | 6 Monate in % | 1 Jahr in % | 3 Jahre in % | |

|---|---|---|---|---|---|---|

| Invesco MSCI World Equal Weight UCITS ETF Acc | -0,22% | -1,08% | +0,22% | - | - |

| ETF | 2025 in % | 2024 in % | 2023 in % | 2022 in % | 2021 in % | |

|---|---|---|---|---|---|---|

| Invesco MSCI World Equal Weight UCITS ETF Acc | + 0,00% | - | - | - | - |

Quelle: justETF.com; Stand: 30.06.25; Angaben in CHF inklusive Ausschüttungen