The best Emerging Markets ETFs

How do I invest in stocks from Emerging Markets?

The easiest way to invest in Emerging Markets worldwide is to invest in a broad market index. This can be done at a low cost by using ETFs.

In this curated investment guide, you will find all ETFs that allow you to invest broadly diversified in Emerging Markets worldwide. Currently, there are 25 ETFs available.

El ratio de gastos totales (TER) de los ETFs de emerging markets se sitúan entre el 0,11% p.a. y el 0,55% p.a..

0,11% p.a. - 0,55% p.a.

Ratio de gastos totales (TER) anuales de ETFs de emerging markets

de valores Emerging Markets , que son seguidos por ETFs

que siguen un índice ampliamente diversificado de valores Emerging Markets

How do I invest in companies from emerging markets?

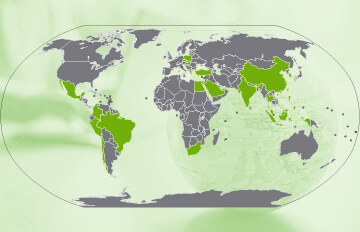

Investing in emerging markets worldwide can be very easy and cost-effective by using a single ETF that tracks a broadly diversified emerging markets index which is weighted by market capitalisation. Currently, the following indices can be considered for a globally diversified investment in emerging market equities:This curated investment guide allows you to compare both the available ETFs and the underlying indices on emerging markets worldwide and to select an ETF that fits your preferences best. For more information on investing in emerging markets and the indices mentioned above, see our article Emerging Markets ETFs: Investing in Emerging Markets with ETFs.

A worldwide emerging markets ETF is an excellent complement to a global developed markets ETF, like an MSCI World ETF. You can construct a globally diversified, yet simple and cost-efficient portfolio by combining two such ETFs. When using indices from different providers, you should make sure that none of the countries you want to cover is missing or included twice. You can ensure this by selecting two ETFs that track indices from the same provider. For more information on this topic, please have a look at our article MSCI Vs FTSE: Which is the best index provider?.

Alternatively, you may invest in a single World ETF that covers both developed and emerging markets.

In our ETF screener, you will find additional emerging markets ETFs, like sustainable emerging markets ETFs and dividend ETFs on emerging markets. In addition, you can monitor the performance of various emerging market indices with our market overview “ETF Emerging Markets”.

Comparación de la rentabilidad de los índices Emerging Markets ampliamente diversificados

Fuente: justETF.com; A partir de 16/7/25; Rentabilidad a 1 año en euros.

Índices comparativos

Índices de valores Emerging Markets

Los mejores índices sobre los ETFs Emerging Markets

Para invertir en valores Emerging Markets , existen 3 índices disponibles que son seguidos por 25 ETFs. El ratio de gastos totales (TER) de los ETFs sobre estos índices está entre el 0,11% p.a. y el 0,55% p.a.. Dependiendo del entorno del mercado, las acciones de un solo país pueden constituir grandes partes de un índice. Encontrarás más información sobre la concentración de países, empresas y sectores en las fichas de los índices que figuran a continuación.| Índice | Enfoque de inversión | Número de ETF | Número de componentes | Descripción breve |

|---|---|---|---|---|

| FTSE Emerging | Mercados emergentes | 3 ETFs | 2.219 (28/6/24) | El índice FTSE Emerging sigue los valores de los mercados emergentes de todo el mundo. Ficha del índice |

| MSCI Emerging Markets | Mercados emergentes | 20 ETFs | 1.206 (31/3/25) | El índice MSCI Emerging Markets sigue los valores de los mercados emergentes de todo el mundo. Ficha del índice |

| MSCI Emerging Markets Investable Market (IMI) | Mercados emergentes | 2 ETFs | 3.146 (31/3/25) | The MSCI Emerging Markets (IMI) index tracks stocks from emerging markets worldwide. Ficha del índice |

| Índice | 1 mes en % | 3 meses en % | 6 meses en % | 1 año en % | 3 años en % | 5 años en % |

|---|---|---|---|---|---|---|

| MSCI Emerging Markets Investable Market (IMI) | +2,58% | +2,08% | +2,01% | +4,56% | +18,79% | +38,17% |

| MSCI Emerging Markets | +2,62% | +1,48% | +2,47% | +5,34% | +16,64% | +31,96% |

| FTSE Emerging | +1,16% | -0,66% | -0,60% | +6,19% | +16,26% | +35,39% |

Fuente: justETF.com; a 30/6/25; cálculos en euros basados en el mayor ETF del índice respectivo.

Comparación de ETF

ETFs sobre acciones Emerging Markets

Todos los ETFs Emerging Markets en comparación

En la siguiente tabla hemos enumerado los ETFs Emerging Markets disponibles actualmente. A través de las pestañas "Características" y "Rendimiento", puedes encontrar información detallada sobre estos ETF y ordenarlos según el criterio que desees. Para más información sobre los distintos criterios a la hora de elegir un ETF, consulta nuestro artículo sobre la selección correcta del ETF.| ETF ISIN | Patrimonio en m EUR | Gastos corrientes en % | Fecha de inicio | Uso del beneficio | Domicilio del fondo | Método de replica |

|---|---|---|---|---|---|---|

| iShares Core MSCI Emerging Markets IMI UCITS ETF (Acc)IE00BKM4GZ66 | 22.724 | 0,18% p.a. | 30/5/14 | Acumulación | Irlanda | Replicación física perfecta |

| Xtrackers MSCI Emerging Markets UCITS ETF 1CIE00BTJRMP35 | 6.301 | 0,18% p.a. | 21/6/17 | Acumulación | Irlanda | Optimizada muestreo |

| iShares MSCI EM UCITS ETF (Dist)IE00B0M63177 | 4.763 | 0,18% p.a. | 18/11/05 | Distribución | Irlanda | Replicación física perfecta |

| iShares MSCI EM UCITS ETF (Acc)IE00B4L5YC18 | 4.216 | 0,18% p.a. | 25/9/09 | Acumulación | Irlanda | Replicación física perfecta |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (C)LU1437017350 | 2.949 | 0,18% p.a. | 9/5/17 | Acumulación | Luxemburgo | Replicación física perfecta |

| Amundi MSCI Emerging Markets II UCITS ETF DistLU2573966905 | 2.823 | 0,14% p.a. | 24/3/23 | Distribución | Luxemburgo | Swap sin fondos |

| Amundi MSCI Emerging Markets UCITS ETF EUR (C)LU1681045370 | 2.551 | 0,20% p.a. | 30/11/10 | Acumulación | Luxemburgo | Swap sin fondos |

| Vanguard FTSE Emerging Markets UCITS ETF DistributingIE00B3VVMM84 | 2.361 | 0,22% p.a. | 22/5/12 | Distribución | Irlanda | Replicación física perfecta |

| Amundi MSCI Emerging Markets II UCITS ETF AccLU2573967036 | 2.272 | 0,14% p.a. | 24/3/23 | Acumulación | Luxemburgo | Swap sin fondos |

| HSBC MSCI Emerging Markets UCITS ETF USDIE00B5SSQT16 | 2.038 | 0,15% p.a. | 5/9/11 | Distribución | Irlanda | Replicación física perfecta |

| UBS Core MSCI EM UCITS ETF USD disLU0480132876 | 1.642 | 0,15% p.a. | 12/11/10 | Distribución | Luxemburgo | Optimizada muestreo |

| iShares Core MSCI Emerging Markets IMI UCITS ETFIE00BD45KH83 | 1.097 | 0,18% p.a. | 5/3/18 | Distribución | Irlanda | Replicación física perfecta |

| Amundi MSCI Emerging Markets UCITS ETF USDLU1681045453 | 953 | 0,20% p.a. | 21/12/10 | Acumulación | Luxemburgo | Swap sin fondos |

| Vanguard FTSE Emerging Markets UCITS ETF AccIE00BK5BR733 | 937 | 0,22% p.a. | 24/9/19 | Acumulación | Irlanda | Replicación física perfecta |

| Amundi MSCI Emerging Markets III UCITS ETF EUR AccFR0010429068 | 839 | 0,55% p.a. | 17/4/07 | Acumulación | Francia | Swap sin fondos |

| SPDR MSCI Emerging Markets UCITS ETFIE00B469F816 | 719 | 0,18% p.a. | 13/5/11 | Acumulación | Irlanda | Replicación física perfecta |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (D)LU1737652583 | 634 | 0,18% p.a. | 5/2/18 | Distribución | Luxemburgo | Replicación física perfecta |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1CLU0292107645 | 582 | 0,49% p.a. | 22/6/07 | Acumulación | Luxemburgo | Swap sin fondos |

| HSBC MSCI Emerging Markets UCITS ETF USD (Acc)IE000KCS7J59 | 436 | 0,15% p.a. | 28/6/22 | Acumulación | Irlanda | Replicación física perfecta |

| Invesco MSCI Emerging Markets UCITS ETFIE00B3DWVS88 | 331 | 0,19% p.a. | 26/4/10 | Acumulación | Irlanda | Swap sin fondos |

| Amundi Index MSCI Emerging Markets UCITS ETF DR - USD (D)LU2277591868 | 166 | 0,18% p.a. | 2/2/21 | Distribución | Luxemburgo | Replicación física perfecta |

| UBS MSCI EM SF UCITS ETF USD accIE00B3Z3FS74 | 111 | 0,14% p.a. | 27/4/11 | Acumulación | Irlanda | Swap |

| Amundi MSCI Emerging Markets III UCITS ETF USD AccFR0010435297 | 103 | 0,55% p.a. | 23/4/07 | Acumulación | Francia | Swap sin fondos |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1DLU2675291913 | 78 | 0,18% p.a. | 11/10/23 | Distribución | Luxemburgo | Swap sin fondos |

| Franklin FTSE Emerging Markets UCITS ETF USD CapitalisationIE0004I037N4 | 9 | 0,11% p.a. | 22/10/24 | Acumulación | Irlanda | Replicación física perfecta |

| ETF ISIN | 1 mes en % | 3 meses en % | 6 meses en % | 1 año en % | 3 años en % | 5 años en % |

|---|---|---|---|---|---|---|

| iShares Core MSCI Emerging Markets IMI UCITS ETF (Acc)IE00BKM4GZ66 | +2,58% | +2,08% | +2,01% | +4,56% | +18,79% | +38,17% |

| Xtrackers MSCI Emerging Markets UCITS ETF 1CIE00BTJRMP35 | +2,62% | +1,48% | +2,47% | +5,34% | +16,64% | +31,96% |

| iShares MSCI EM UCITS ETF (Dist)IE00B0M63177 | +2,61% | +1,44% | +2,48% | +5,47% | +16,88% | +32,55% |

| iShares MSCI EM UCITS ETF (Acc)IE00B4L5YC18 | +2,62% | +1,45% | +2,51% | +5,49% | +17,02% | +32,73% |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (C)LU1437017350 | +2,61% | +1,43% | +2,47% | +5,35% | +16,69% | +32,15% |

| Amundi MSCI Emerging Markets II UCITS ETF DistLU2573966905 | +2,58% | +1,45% | +2,56% | +5,47% | - | - |

| Amundi MSCI Emerging Markets UCITS ETF EUR (C)LU1681045370 | +2,52% | +1,54% | +1,73% | +5,17% | +17,29% | +31,92% |

| Vanguard FTSE Emerging Markets UCITS ETF DistributingIE00B3VVMM84 | +1,16% | -0,66% | -0,60% | +6,19% | +16,26% | +35,39% |

| Amundi MSCI Emerging Markets II UCITS ETF AccLU2573967036 | +2,58% | +1,44% | +2,56% | +5,46% | - | - |

| HSBC MSCI Emerging Markets UCITS ETF USDIE00B5SSQT16 | +2,46% | +1,08% | +2,23% | +5,10% | +15,69% | +30,60% |

| UBS Core MSCI EM UCITS ETF USD disLU0480132876 | +2,66% | +1,49% | +2,52% | +5,60% | +17,01% | +32,01% |

| iShares Core MSCI Emerging Markets IMI UCITS ETFIE00BD45KH83 | +2,68% | +2,22% | +2,04% | +4,70% | +18,93% | +38,30% |

| Amundi MSCI Emerging Markets UCITS ETF USDLU1681045453 | +2,51% | +1,34% | +2,51% | +5,16% | +16,74% | +31,51% |

| Vanguard FTSE Emerging Markets UCITS ETF AccIE00BK5BR733 | +1,15% | -0,66% | -0,60% | +6,18% | +16,27% | +35,40% |

| Amundi MSCI Emerging Markets III UCITS ETF EUR AccFR0010429068 | +2,51% | +1,40% | +1,48% | +4,90% | +16,18% | +30,05% |

| SPDR MSCI Emerging Markets UCITS ETFIE00B469F816 | +3,04% | +1,41% | +2,50% | +5,56% | +17,21% | +32,43% |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (D)LU1737652583 | +2,61% | +1,42% | +2,47% | +5,34% | +16,69% | +31,76% |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1CLU0292107645 | +2,53% | +1,32% | +2,31% | +5,05% | +16,07% | +30,48% |

| HSBC MSCI Emerging Markets UCITS ETF USD (Acc)IE000KCS7J59 | +2,48% | +1,09% | +2,20% | +5,08% | +15,63% | - |

| Invesco MSCI Emerging Markets UCITS ETFIE00B3DWVS88 | +2,56% | +1,33% | +2,29% | +5,01% | +16,01% | +30,69% |

| Amundi Index MSCI Emerging Markets UCITS ETF DR - USD (D)LU2277591868 | +2,61% | +1,42% | +2,47% | +5,35% | +16,71% | - |

| UBS MSCI EM SF UCITS ETF USD accIE00B3Z3FS74 | +2,55% | +1,36% | +2,37% | +5,15% | +16,95% | +32,29% |

| Amundi MSCI Emerging Markets III UCITS ETF USD AccFR0010435297 | +2,59% | +1,32% | +2,27% | +4,97% | +15,64% | +29,86% |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1DLU2675291913 | +2,49% | +1,34% | +2,47% | +5,42% | - | - |

| Franklin FTSE Emerging Markets UCITS ETF USD CapitalisationIE0004I037N4 | +1,06% | -0,61% | -0,65% | - | - | - |

Fuente: justETF.com; a 30/6/25