Top MSCI Emerging Markets ETFs

The MSCI Emerging Markets index Factsheet

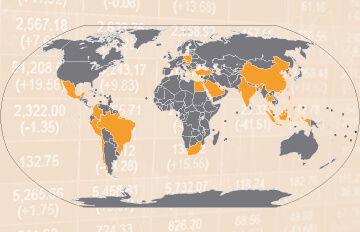

The MSCI Emerging Markets is an international equity index which tracks stocks from 24 emerging market countries. With 1,206 constituents (as of 31/03/2025), the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Stocks from China make up the biggest weight in the MSCI Emerging Markets index with 31.29%, followed by India (18.52%) and Taiwan (16.85%). Top sectors within the MSCI Emerging Markets index are financial services (24.35%), information technology (21.68%) and consumer discretionary (14.58%). Source: MSCI; As of 31/03/2025

ETF investors can benefit from price gains and dividends of the MSCI Emerging Markets constituents. Currently, the MSCI Emerging Markets index is tracked by 20 ETFs.

MSCI Emerging Markets Chart 1 year

Source: justETF.com; As of 27.04.25; Performance in EUR, based on the largest ETF.

Cost of MSCI Emerging Markets ETFs

The total expense ratio (TER) of MSCI Emerging Markets ETFs is between 0.14% p.a. and 0.66% p.a.. In comparison, most actively managed funds do cost much more fees per year. Calculate your individual cost savings by using our cost calculator.

The best MSCI Emerging Markets ETF by 1-year fund return as of 31.03.25

| 1 | Amundi Index MSCI Emerging Markets UCITS ETF DR (C) | +8.64% | ||

| 2 | Amundi Index MSCI Emerging Markets UCITS ETF DR (D) | +8.52% | ||

| 3 | SPDR MSCI Emerging Markets UCITS ETF | +8.34% |

All MSCI Emerging Markets ETFs ranked by fund return

The largest MSCI Emerging Markets ETF by fund size in EUR

| 1 | Xtrackers MSCI Emerging Markets UCITS ETF 1C | 5,332 m | ||

| 2 | iShares MSCI EM UCITS ETF (Dist) | 4,247 m | ||

| 3 | iShares MSCI EM UCITS ETF (Acc) | 3,485 m |

All MSCI Emerging Markets ETFs ranked by fund size

The cheapest MSCI Emerging Markets ETF by total expense ratio

| 1 | Amundi MSCI Emerging Markets II UCITS ETF Dist | 0.14% p.a. | ||

| 2 | UBS ETF (IE) MSCI Emerging Markets SF UCITS ETF (USD) A-acc | 0.14% p.a. | ||

| 3 | HSBC MSCI Emerging Markets UCITS ETF USD | 0.15% p.a. |

All MSCI Emerging Markets ETFs ranked by total expense ratio

MSCI Emerging Markets ETFs in comparison

Besides return, there are further important factors to consider when selecting a MSCI Emerging Markets ETF. In order to provide a sound decision basis, you find a list of all MSCI Emerging Markets ETFs with details on size, cost, age, use of profits, fund domicile and replication method ranked by fund size.

Compare all MSCI Emerging Markets ETFs in detail

Compare all MSCI Emerging Markets ETFs in a chart

| ETF name ISIN | Fund size in m EUR | TER in % | Use of profits | Fund domicile | Replication method | |

|---|---|---|---|---|---|---|

| Xtrackers MSCI Emerging Markets UCITS ETF 1CIE00BTJRMP35 | 5,332 | 0.18% p.a. | Accumulating | Ireland | Optimized sampling | |

| iShares MSCI EM UCITS ETF (Dist)IE00B0M63177 | 4,247 | 0.18% p.a. | Distributing | Ireland | Full replication | |

| iShares MSCI EM UCITS ETF (Acc)IE00B4L5YC18 | 3,485 | 0.18% p.a. | Accumulating | Ireland | Full replication | |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (C)LU1437017350 | 2,680 | 0.18% p.a. | Accumulating | Luxembourg | Full replication | |

| Amundi MSCI Emerging Markets II UCITS ETF DistLU2573966905 | 2,502 | 0.14% p.a. | Distributing | Luxembourg | Unfunded swap | |

| Amundi MSCI Emerging Markets UCITS ETF EUR (C)LU1681045370 | 2,234 | 0.20% p.a. | Accumulating | Luxembourg | Unfunded swap | |

| HSBC MSCI Emerging Markets UCITS ETF USDIE00B5SSQT16 | 1,884 | 0.15% p.a. | Distributing | Ireland | Full replication | |

| UBS ETF (LU) MSCI Emerging Markets UCITS ETF (USD) A-disLU0480132876 | 1,193 | 0.18% p.a. | Distributing | Luxembourg | Optimized sampling | |

| Amundi MSCI Emerging Markets III UCITS ETF EUR AccFR0010429068 | 794 | 0.55% p.a. | Accumulating | France | Unfunded swap | |

| Amundi MSCI Emerging Markets UCITS ETF USDLU1681045453 | 791 | 0.20% p.a. | Accumulating | Luxembourg | Unfunded swap | |

| SPDR MSCI Emerging Markets UCITS ETFIE00B469F816 | 719 | 0.18% p.a. | Accumulating | Ireland | Full replication | |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (D)LU1737652583 | 534 | 0.18% p.a. | Distributing | Luxembourg | Full replication | |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1CLU0292107645 | 518 | 0.49% p.a. | Accumulating | Luxembourg | Unfunded swap | |

| HSBC MSCI Emerging Markets UCITS ETF USD (Acc)IE000KCS7J59 | 367 | 0.15% p.a. | Accumulating | Ireland | Full replication | |

| Invesco MSCI Emerging Markets UCITS ETFIE00B3DWVS88 | 349 | 0.19% p.a. | Accumulating | Ireland | Unfunded swap | |

| Xtrackers MSCI Emerging Markets UCITS ETF 1DIE000GWA2J58 | 193 | 0.18% p.a. | Distributing | Ireland | Full replication | |

| Amundi MSCI Emerging Markets III UCITS ETF USD AccFR0010435297 | 100 | 0.55% p.a. | Accumulating | France | Unfunded swap | |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1DLU2675291913 | 98 | 0.18% p.a. | Distributing | Luxembourg | Unfunded swap | |

| Deka MSCI Emerging Markets UCITS ETF DE000ETFL342 | 98 | 0.66% p.a. | Accumulating | Germany | Unfunded swap | |

| UBS ETF (IE) MSCI Emerging Markets SF UCITS ETF (USD) A-accIE00B3Z3FS74 | 92 | 0.14% p.a. | Accumulating | Ireland | Swap-based |

Source: justETF.com; As of 27.04.25

Return comparison of all MSCI Emerging Markets ETFs

The table shows the returns of all MSCI Emerging Markets ETFs in comparison. All return figures are including dividends as of month end. Besides the return the reference date on which you conduct the comparison is important. In order to find the best ETFs, you can also perform a chart comparison.

Source: justETF.com; As of 31.03.25; Calculations in EUR including dividends