Top MSCI World Equal Weighted ETFs

The MSCI World Equal Weighted index Factsheet

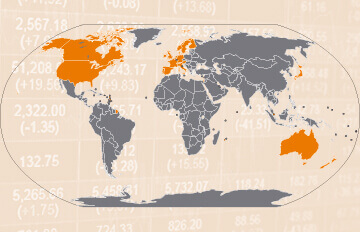

The MSCI World Equal Weighted (EW) is an equity index that tracks the performance of companies from 23 developed markets worldwide. The key difference compared to the standard MSCI World index is that all companies are weighted equally in the MSCI World Equal Weighted index. These equal weights are re-established on a quarterly basis by means of rebalancing. By contrast, in the conventional MSCI World index, all companies are weighted according to their market capitalisation. The equal weighting of companies in the MSCI World EW index reduces the impact of single major companies on the performance of the index. In addition, US companies play a significantly smaller role in the MSCI World EW index compared to the classic index variant. ETFs on the MSCI World Equal Weighted index are therefore a possible alternative for investors for whom the US share or the weighting of specific companies in the MSCI World index is too high.

ETF investors can benefit from price gains and dividends of the MSCI World Equal Weighted constituents. Currently, the MSCI World Equal Weighted index is tracked by 1 ETFs.

MSCI World Equal Weighted Chart 1 year

Source: justETF.com; As of 07.12.25; Performance in EUR, based on the largest ETF.

Cost of MSCI World EW ETFs

The total expense ratio (TER) of MSCI World EW ETFs is at 0.20% p.a.. In comparison, most actively managed funds do cost much more fees per year. Calculate your individual cost savings by using our cost calculator.

MSCI World Equal Weighted ETFs in comparison

Besides return, there are further important factors to consider when selecting a MSCI World Equal Weighted ETF. In order to provide a sound decision basis, you find a list of all MSCI World EW ETFs with details on size, cost, age, use of profits, fund domicile and replication method ranked by fund size.

Compare all MSCI World EW ETFs in detail

Compare all MSCI World EW ETFs in a chart

| ETF name ISIN | Fund size in m EUR | TER in % | Use of profits | Fund domicile | Replication method | |

|---|---|---|---|---|---|---|

| Invesco MSCI World Equal Weight UCITS ETF AccIE000OEF25S1 | 687 | 0.20% p.a. | Accumulating | Ireland | Optimized sampling |

Source: justETF.com; As of 07.12.25

Return comparison of all MSCI World EW ETFs

The table shows the returns of all MSCI World EW ETFs in comparison. All return figures are including dividends as of month end. Besides the return the reference date on which you conduct the comparison is important. In order to find the best ETFs, you can also perform a chart comparison.

| ETF | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | |

|---|---|---|---|---|---|---|

| Invesco MSCI World Equal Weight UCITS ETF Acc | 1.16% | 2.75% | 6.73% | 4.60% | - |

| ETF | 2025 in % | 2024 in % | 2023 in % | 2022 in % | 2021 in % | |

|---|---|---|---|---|---|---|

| Invesco MSCI World Equal Weight UCITS ETF Acc | 7.17% | - | - | - | - |

Source: justETF.com; As of 30.11.25; Calculations in EUR including dividends