- Level: For beginners

- Reading duration: 9 minutes

What to expect in this article

- What are emerging markets?

- Does strong economic growth mean strong stock market growth?

- How are the most important emerging markets currently performing?

- Which emerging markets index performs best?

- Emerging markets vs global ETFs

- What are the main risks?

- Conclusion: should you invest in emerging markets?

What are emerging markets?

Emerging markets are typically defined as countries transitioning between developing and developed status. These economies are characterised by:- Rapid growth: Emerging countries, such as India and Vietnam, often notch up gross domestic product (GDP) growth figures of 6 % or 7 % per year. Compare that to developed economies like Germany, Japan, and the US which more typically range from 0 % to 3 %. Emerging market growth is generally powered by industrialisation, urbanisation, and increasing consumer demand.

- Rising income levels: Although emerging nations normally have lower per capita incomes than developed countries, they are on an upward trajectory as their populations move into higher income brackets. Inevitably that shift is accompanied by noticeable improvements in infrastructure, education, and healthcare, contributing to a gradual rise in living standards.

- Capital market development and accessibility: Emerging markets tend to have less mature financial markets with lower levels of liquidity, fewer financial instruments, and often less transparency compared to developed markets. Foreign ownership and capital flow restrictions are also relatively common, while legal and regulatory systems are generally not as strong.

justETF Tipp:Index firm MSCI classify countries as belonging to one of three tiers:

- Developed markets

- Emerging markets

- Frontier markets

Does strong economic growth mean strong stock market growth?

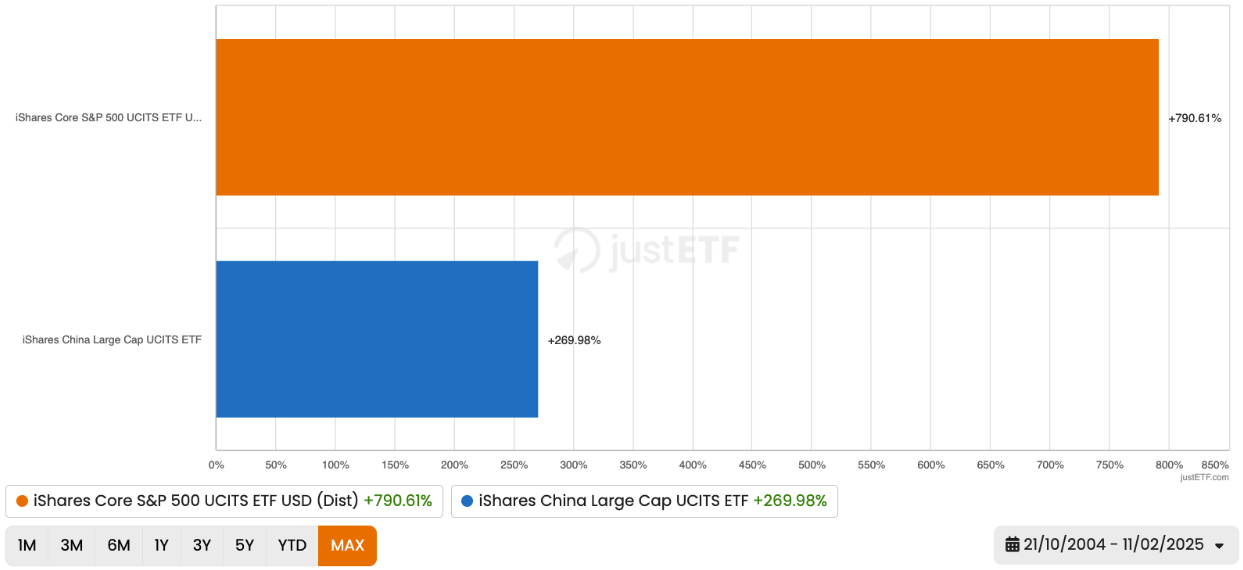

While a strong economy does support corporate profits, the relationship between GDP growth and domestic stock market success is not simple nor linear. For example, a high proportion of economic activity in some emerging markets is driven by sectors that lack publicly listed companies, i.e. the population of firms that are traded on the stock exchange. This is especially the case in India, where the agricultural sector and state-backed projects are major drivers of GDP. However, many of India’s listed companies are consumer goods or tech stocks which benefit little, if at all, from the agricultural economy. China, meanwhile, is renowned for its state-owned firms, which aren’t accessible to stock exchange investors. Corporate governance is another important factor. Management inefficiency, corruption, and misallocation of capital are perennial problems in all markets - lowering company profits and thus investor returns. However, these issues are exacerbated in emerging markets, where weaker accounting procedures or shareholder protections can prevent management being held to account for underperformance. For example, many Russian companies have failed to deliver profits in line with the underlying strength of their energy and raw materials sectors. Corruption, state control, and management incentives that aren’t aligned with shareholder value are believed to explain much of the discrepancy. Direct government intervention can also divert company profits away from shareholders. Think unexpected tax increases, nationalization of key industries, and heavy-handed regulation that reduces the potential of the private sector. We can clearly answer the question, “Does economic growth translate into stock market growth” by comparing a US stock ETF versus a China stock ETF over the longest possible timeframe:S&P 500 ETF vs China Large Cap ETF (2004 to 2025)

US stocks delivered almost three times more growth than Chinese stocks over the past 21 years.

You don’t need me to tell you that the Chinese economy grew far faster than the US during that time.

According to the World Bank, Chinese GDP rose 807 % from 2004 to 2023 (the last year figures are currently available for).

US GDP grew 127 % in the same period.

Clearly, US stocks delivered far higher profits relative to national economic performance than their Chinese equivalents.

US stocks delivered almost three times more growth than Chinese stocks over the past 21 years.

You don’t need me to tell you that the Chinese economy grew far faster than the US during that time.

According to the World Bank, Chinese GDP rose 807 % from 2004 to 2023 (the last year figures are currently available for).

US GDP grew 127 % in the same period.

Clearly, US stocks delivered far higher profits relative to national economic performance than their Chinese equivalents.

How are the most important emerging markets currently performing?

You can find the latest data on every emerging market ETF on our best emerging markets ETF page. The performance of those ETFs is mainly determined by their choice of index. The three most important emerging market indices are:- The MSCI Emerging Markets IMI is the most diversified emerging markets index. It includes 3,337 companies from 24 major stock markets and covers the broad spectrum of company sizes – from large to mid to small caps.

- In contrast, the MSCI Emerging Markets encompasses 1,277 companies and focuses on the large and mid-sized segments. Though less diverse than the IMI, the MSCI EM still captures the vast bulk of the emerging market stock universe, around 86 % by market capitalisation.

- The FTSE Emerging Index also concentrates on large and mid-cap firms. It covers 90 % of the market and comprises 2,226 stocks in total. However, a key difference between the MSCI and FTSE stock universes is that South Korean firms appear in the FTSE Developed Index and not in its Emerging Index. Conversely, South Korean stocks don’t appear in the MSCI World - the famed developed market index.

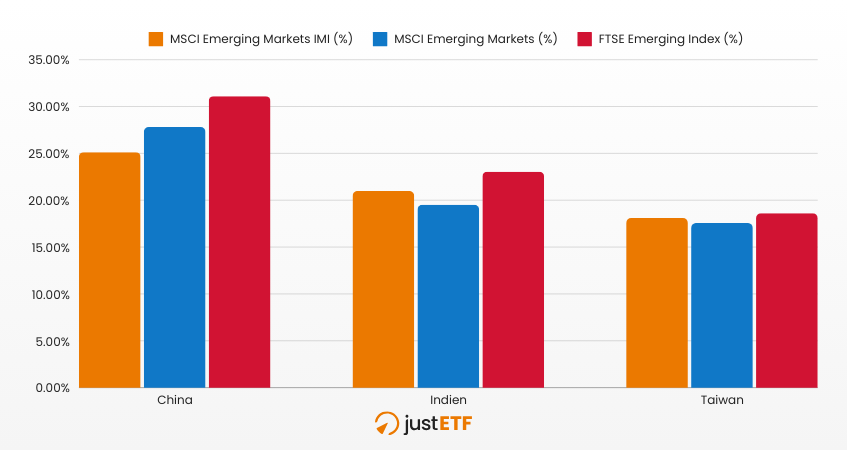

Geographical distribution

China, India and Taiwan dominate the asset allocations of each of the main EM indices. Each country’s market share is as follows:

Source: justETF Research; 25.10.2024

Technology and Finance are the two most important sectors. That pair comprises more than 40 % of the MSCI EM indices and over 50 % of the FTSE benchmark.

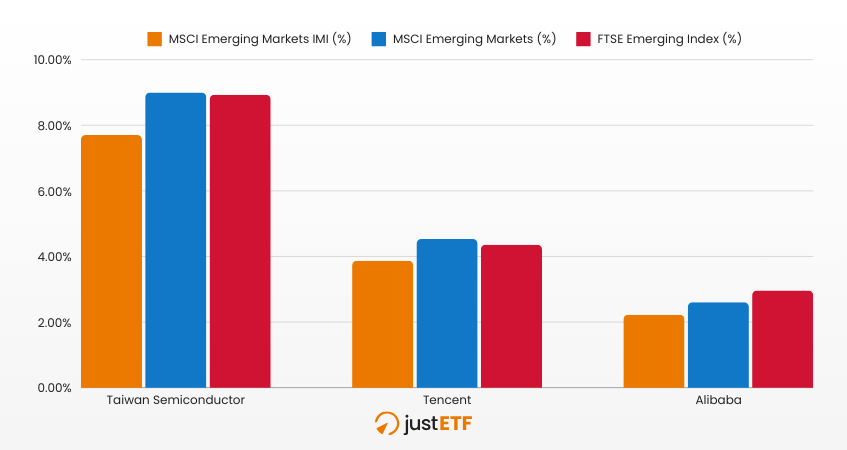

Most valuable companies

The strategically critical Taiwan Semiconductor Manufacturing (TSMC) is the number one stock, with Tencent and Alibaba rounding out the top three.

Source: justETF Research; 25.10.2024

TSMC is essentially twice the size of its nearest rivals. That’s quite unlike Apple - the most valuable firm in the developed market indices - which is run close by Nvidia and Microsoft.

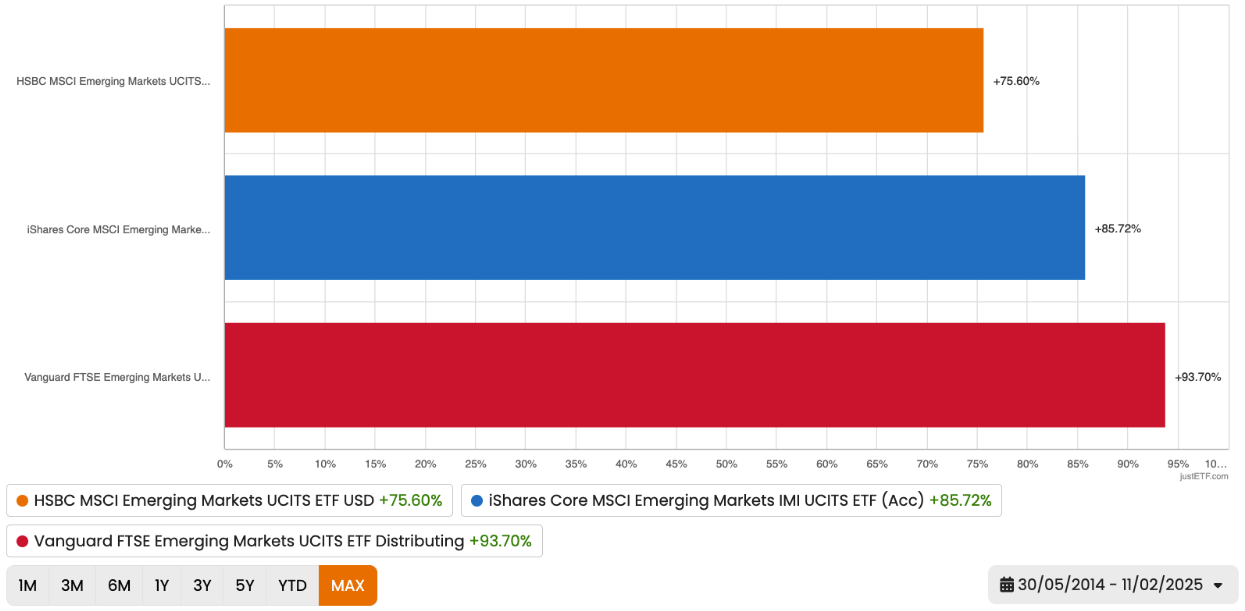

Which emerging markets index performs best?

Let’s find out by comparing three ETFs, each powered by one of the main EM indices:Emerging markets ETF comparison

The FTSE Emerging Markets ETF edges its two rivals over the max timeframe. The chart shows cumulative returns while the annualised return numbers (EUR) are:

The FTSE Emerging Markets ETF edges its two rivals over the max timeframe. The chart shows cumulative returns while the annualised return numbers (EUR) are:

- 6.4 % FTSE Emerging (red bar)

- 6 % MSCI Emerging Markets IMI (blue bar)

- 5.4 % MSCI Emerging Markets (orange bar)

justETF Tipp: You can check the annualised return numbers yourself by switching to the Risk-Return tab on the chart comparison.

Emerging markets vs global ETFs

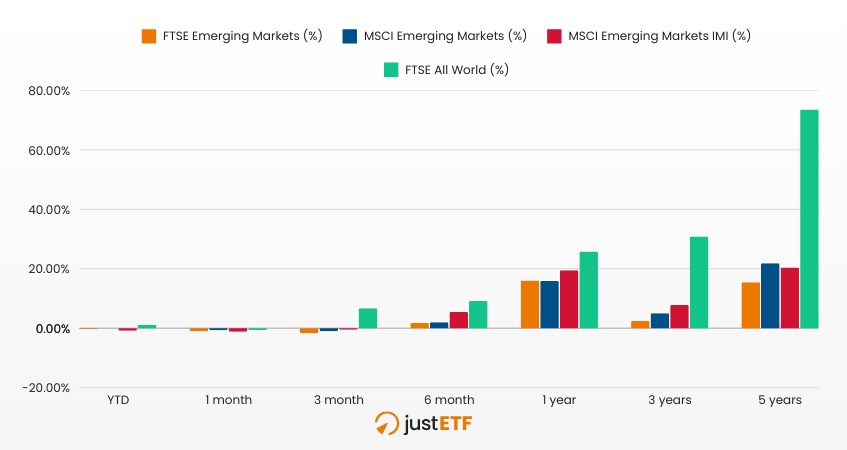

Some investors like to buy emerging market stocks as part of a global ETF, while others prefer to hold a separate emerging market ETF. Here’s how the two approaches measure up:FTSE All World Performance Comparison

Over recent years, you can see that the global ETF has outperformed its emerging market rivals, but it wasn’t always so.

The next chart shows you that emerging markets beat developed markets for the first ten years after the launch of the first EM ETF. Developed markets only took the lead in 2015:

Over recent years, you can see that the global ETF has outperformed its emerging market rivals, but it wasn’t always so.

The next chart shows you that emerging markets beat developed markets for the first ten years after the launch of the first EM ETF. Developed markets only took the lead in 2015:

MSCI World vs. MSCI Emerging Markets

In fact, emerging markets were within touching distance of developed markets into 2021 before the astonishing performance of the US tech titans pulled the MSCI World ETF clear.

What’s more, if we go further back in time - to the launch of the MSCI Emerging Market Index - we’d see that the EM stock lead stretched back to 2001.

So there’s no reason to believe that developed markets are an inherently superior investment. Conditions may change again to favour emerging markets. Indeed, that diversification argument explains why some investors like to hold a separate emerging market ETF.

They’re aware that emerging market economic cycles do not always move in tandem with developed markets. Moreover, emerging markets are riskier than developed markets. Which indicates a risk premium could be available to EM stocks, i.e. a potential long-run reward which may compensate the investor for holding riskier investments instead of less risky alternatives.

Some also believe that EM stock markets are under-represented in the global indices. For example, the US occupies 65 % of the FTSE All World index but only around 15 % of global GDP based on Purchasing Power Parity. Meanwhile, the Japanese and UK stock markets are the second and third-largest players in the index.

Thus, some emerging market advocates respond to this apparent imbalance by using a separate ETF to increase the weight of EM countries in their portfolio, reflecting the increasing global significance of these markets.

In fact, emerging markets were within touching distance of developed markets into 2021 before the astonishing performance of the US tech titans pulled the MSCI World ETF clear.

What’s more, if we go further back in time - to the launch of the MSCI Emerging Market Index - we’d see that the EM stock lead stretched back to 2001.

So there’s no reason to believe that developed markets are an inherently superior investment. Conditions may change again to favour emerging markets. Indeed, that diversification argument explains why some investors like to hold a separate emerging market ETF.

They’re aware that emerging market economic cycles do not always move in tandem with developed markets. Moreover, emerging markets are riskier than developed markets. Which indicates a risk premium could be available to EM stocks, i.e. a potential long-run reward which may compensate the investor for holding riskier investments instead of less risky alternatives.

Some also believe that EM stock markets are under-represented in the global indices. For example, the US occupies 65 % of the FTSE All World index but only around 15 % of global GDP based on Purchasing Power Parity. Meanwhile, the Japanese and UK stock markets are the second and third-largest players in the index.

Thus, some emerging market advocates respond to this apparent imbalance by using a separate ETF to increase the weight of EM countries in their portfolio, reflecting the increasing global significance of these markets.

What are the main risks?

The emerging markets are a source of great potential but also significant risk:- Political instability: Emerging markets can be more susceptible to political unrest, adverse policy shifts, and institutional challenges which impact economic performance and investor confidence. For example: electoral interference, civil disturbances, and coups can trigger financial turmoil. Meanwhile, government intervention such as nationalisation, price controls, and tax hikes can undermine corporate profitability and discourage investment, reducing growth potential.

- Raw material dependence: Some emerging economies rely heavily on the export of commodities such as oil and gas. Hence, they’re vulnerable to downward moves in global prices or changes in exchange rates, which curtail national income. Raw material prices are notoriously volatile, and sharp drops can spark economic crises that lead directly to the political instability described above.

- Inflation and currency instability: Weaker economies are more susceptible to negative shocks, changes in U.S. interest rates, and shifts in global trade and investment flows that can depreciate their currency and send inflation soaring, hurting investor returns.

- Weak corporate governance: Shareholders can lose out when company management is not strongly incentivised to protect their interests, and when they are insufficiently protected by law or regulation.