- Level: Advanced

- Reading duration: 5 minutes

What to expect in this article

The problem with the Magnificent 7

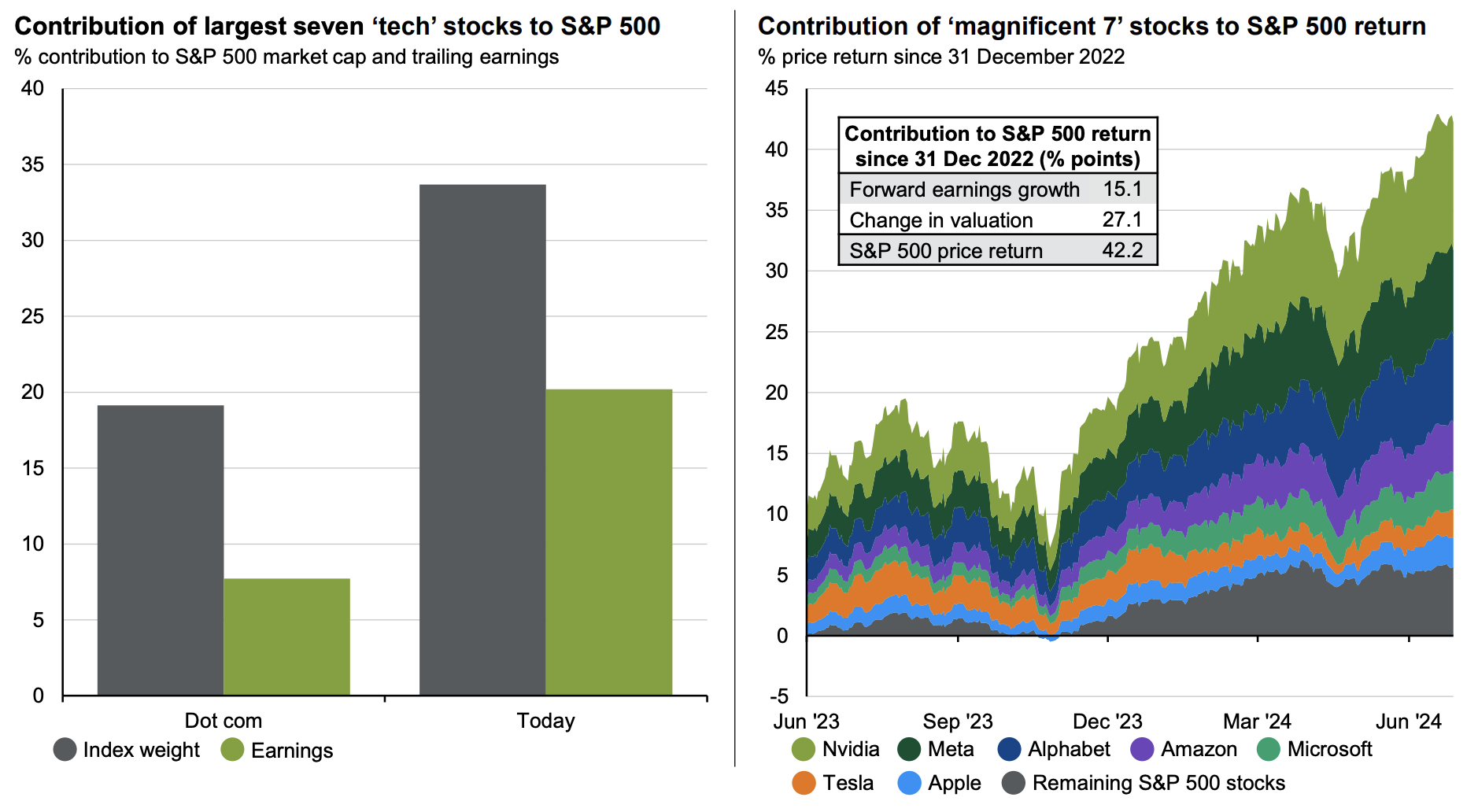

Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla. These 7 leading US companies are not only market leaders in their respective sectors - they also dominate the S&P 500 with a share of around 30 %. Therefore, they are an important factor in the performance of the global equity market. The following chart shows how relevant these companies actually are for the return of the leading US S&P 500 index:

Source: J.P. Morgan Guide to the Markets, as of 2024

Since the beginning of 2023 alone, the 7 heavyweights represent a return of almost 44 %. The remaining 493 companies in the S&P 500 together only achieved a total return of around 5 %. This indicates that without the Magnificent 7, the S&P 500 would have had returns of almost 90 % less than it actually did over this period.

Sure, this highlights a focus on the technology sector. But is that a problem? Yes and no. Yes, because the performance of the S&P 500 is largely dependent on a few stocks. If these stocks decline, this will further have a negative impact on the corresponding indices and ETFs (because they have a high weighting in the index).

On the other hand, it is not a problem considering that in the past the global stock market return has proven that it is mostly produced by only a few stocks - while most stocks hardly contribute to the performance of the index.

This means that with broad diversified ETFs, you are primarily ensuring that you also have the high-flyers, which are the main contributors regarding return, included in your portfolio.

Need a current example?

The multifamily office HQ Trust recently analysed the performance of the German benchmark index DAX year to date. The result: 7 stocks in the DAX were responsible for 92 % of the index's price performance in the first half of 2024. In comparison: in the S&P 500, the Magnificent 7 were "only" responsible for around 60 % of performance. "With most indices - and therefore also ETFs - it is normal for only a few, usually large individual stocks to drive performance," explains Pascal Kielkopf from HQ Trust (Fonds professionell online. 09.07.2024).

Some might object: "But it has never been as extreme as it is now." After all, at over 30 %, the weighting of the 7 largest tech stocks is over a third higher than during the dotcom bubble (when it was just under 20 %). That is true, although this comparison tends to forget the other side of the story: the actual company profits. While the dotcom stocks were companies that, in some cases, did not generate any profits, today's Magnificent 7 are some of the most profitable companies in the world.

Millions of people can hardly imagine life without Apple, Microsoft, Google or Meta platforms (Instagram, Facebook & Whatsapp). In some cases, they are indispensable - just think of the enterprise software licensed by Microsoft to almost all companies in the (western) world or the cloud solutions from Amazon and Co. that are also deeply embedded in the everyday lives of many companies.

Such comparisons should therefore always consider the actual economic dynamics of companies, which are undoubtedly more evident today than they were at the turn of the millennium.

But what about the overall clustering of the equity market? What about certain sectors or country weightings? Let us look at the bigger picture …

That has never happened before, has it?

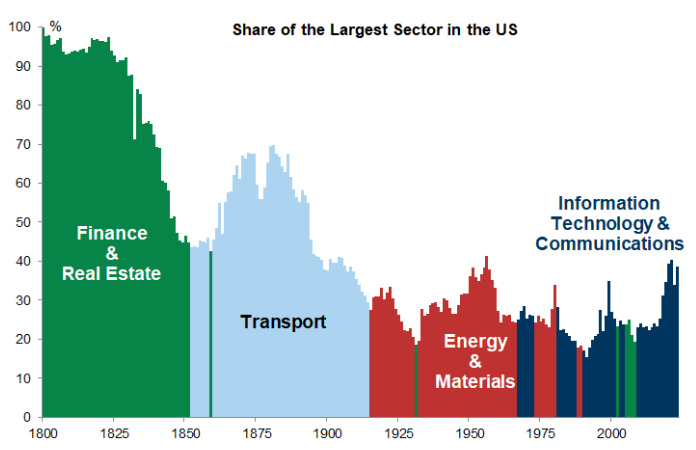

Yes, the weight of the Glorious 7 should not be underestimated. And yes, the technology sector in the United States in particular is remarkably dominant. But is this - as often claimed by private investors or the media - really an unprecedented phenomenon?

Source: Goldman Sachs, as of 2024

No, because there have always been such concentrations in the past. In some cases, they were even higher than today. When industrialization picked up speed in the middle of the 19th century, railroad tracks sprouted from the ground. A development that naturally left its mark on the US stock market. At the end of the 19th century, the transport sector - which essentially consisted of railroad companies - accounted for around 70 % of the total market capitalization of the United States. This is still almost twice as much as the technology sector currently accounts for. Even in the recent past - in the middle of the last century - the energy sector had a similarly high level as the technology sector today.

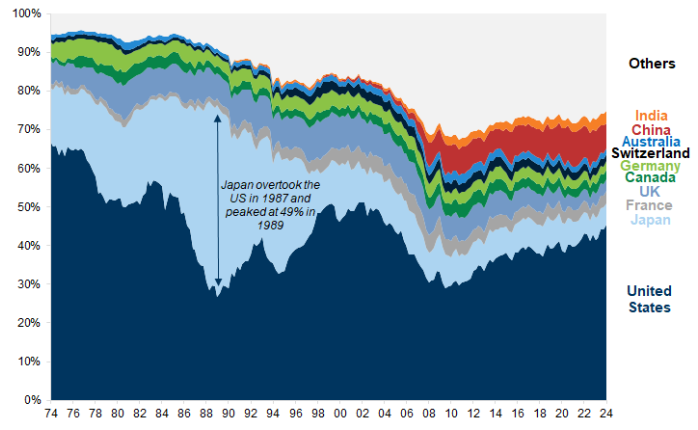

The same applies to country allocation. The US currently accounts for a share of 50 % to 70 % in many global indices. However, this is nothing new from a historical perspective. In the 1970s, the share of US equities in global market capitalization was significantly higher. At the end of the 1980s, Japan even took the world lead for a short time, before its share quickly fell back to its previous level and is now even lower than at that time. Instead, two new major players, China and India, entered the global equity market and now contribute more to global market capitalization than many European economic powers.

Source: Goldman Sachs, as of 2024