The best Eurozone ETFs

How do I invest in Eurozone stocks?

The easiest way to invest in the whole stock market of the Eurozone is to invest in a broad market index. This can be done at a low cost by using ETFs.

In this curated investment guide, you will find all ETFs that allow you to invest broadly diversified in Eurozone countries. Currently, there are 23 ETFs available.

The total expense ratio (TER) of ETFs tracking stocks from Eurozone countries is between 0,05% p.a. and 0,20% p.a..

0,05% p.a. - 0,20% p.a.

annual total expense ratio (TER) of Eurozone ETFs

tracking stocks from Eurozone countries, which are tracked by ETFs

that track a broadly diversified Eurozone index

How to invest in companies from the EU?

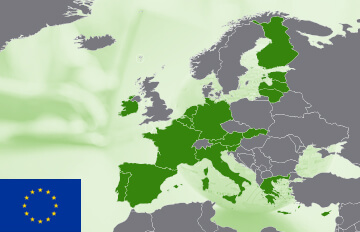

Investing in stocks from Eurozone countries can be very easy and cost-effective by using a single ETF that tracks a broadly diversified Eurozone index which is weighted by market capitalisation. Currently, the following indices can be considered for a diversified investment in EU companies:This curated investment guide allows you to compare both the available ETFs and the underlying indices on Eurozone countries and to select an ETF that fits your preferences best.

As companies from the UK and Switzerland are not included in ETFs that track the EU, French and German companies play a significantly larger role in Eurozone ETFs, compared to similar Europe ETFs. For many ETFs that track indices on Europe or the Eurozone, there are also sustainable strategies available. You can find these in our curated investment guide on socially responsible (SRI) ETFs for Europe.

Performance of broadly diversified Eurozone indices in comparison

Source: justETF Research; As of 19-07-2025; Performance over 1 year in EUR.

Indices in comparison

Indices on stocks from Eurozone countries

The best indices for Eurozone ETFs

For an investment in stocks from Eurozone countries, there are 4 indices available that are tracked by 23 ETFs. The total expense ratio (TER) of ETFs on these indices is between 0,05% p.a. and 0,20% p.a.. Depending on the market environment, stocks from a single country can make up large parts of an index. You can find more information regarding the concentration of countries, companies and sectors in the index factsheets linked below.| Index | Investment focus | Number of ETFs | Number of constituents | Short description |

|---|---|---|---|---|

| EURO STOXX® | Europa | 1 ETF | 299 (28-06-2024) | The EURO STOXX® index tracks stocks from eurozone countries included in the STOXX® Europe 600 Index. The STOXX® Europe 600 index tracks large, mid and small capitalisation stocks from European developed countries. Index factsheet |

| EURO STOXX® 50 | Europa | 14 ETFs | 50 | The EURO STOXX® 50 index tracks the 50 largest companies in the eurozone. Index factsheet |

| MSCI EMU | Europa | 6 ETFs | 216 (31-03-2025) | The MSCI EMU index tracks large and mid cap stocks from countries in the European Economic and Monetary Union. Index factsheet |

| Solactive GBS Developed Markets Eurozone Large & Mid Cap | Europa | 2 ETFs | 195 (28-06-2024) | The Solactive GBS Developed Markets Eurozone Large & Mid Cap index tracks large and mid cap securities from Eurozone countries. Index factsheet |

| Index | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | 5 years in % |

|---|---|---|---|---|---|---|

| EURO STOXX® 50 | -1,12% | +1,37% | +11,42% | +11,45% | +67,56% | +89,00% |

| Solactive GBS Developed Markets Eurozone Large & Mid Cap | -0,54% | +3,65% | +13,55% | +13,84% | +60,89% | +83,99% |

| MSCI EMU | -0,71% | +3,69% | +13,83% | +14,55% | +60,00% | +81,23% |

| EURO STOXX® | -0,63% | +4,02% | +14,39% | +15,23% | +59,97% | +82,38% |

Source: justETF.com; As of 30-06-2025; Calculations in EUR based on the largest ETF of the respective index.

ETFs in comparison

ETFs tracking stocks from Eurozone countries

All Eurozone ETFs in comparison

In the table below we have listed the currently available Eurozone ETFs. Via the "Properties" and "Performance" tabs, you can find detailed information on these ETFs and sort them according to your desired criterion. More information about the different criteria when choosing an ETF can be found in our article on ETF selection.| ETF ISIN | Fund size in m EUR | TER in % | Inception date | Use of profits | Fund domicile | Replication method |

|---|---|---|---|---|---|---|

| iShares EURO STOXX 50 UCITS ETF (DE)DE0005933956 | 7.944 | 0,09% p.a. | 27-12-2000 | Distribueren | Duitsland | Volledige replicatie |

| iShares Core EURO STOXX 50 UCITS ETF EUR (Acc)IE00B53L3W79 | 5.362 | 0,10% p.a. | 26-01-2010 | Accumulerend | Ierland | Volledige replicatie |

| iShares Core MSCI EMU UCITS ETF EUR (Acc)IE00B53QG562 | 4.943 | 0,12% p.a. | 12-01-2010 | Accumulerend | Ierland | Volledige replicatie |

| Xtrackers EURO STOXX 50 UCITS ETF 1DLU0274211217 | 4.903 | 0,09% p.a. | 04-01-2007 | Distribueren | Luxemburg | Volledige replicatie |

| Xtrackers EURO STOXX 50 UCITS ETF 1CLU0380865021 | 4.886 | 0,09% p.a. | 29-08-2008 | Accumulerend | Luxemburg | Volledige replicatie |

| iShares Core EURO STOXX 50 UCITS ETF EUR (Dist)IE0008471009 | 4.528 | 0,10% p.a. | 03-04-2000 | Distribueren | Ierland | Volledige replicatie |

| Amundi EURO STOXX 50 II UCITS ETF AccFR0007054358 | 3.640 | 0,20% p.a. | 19-02-2001 | Accumulerend | Frankrijk | Volledige replicatie |

| Amundi EURO STOXX 50 UCITS ETF EUR (C)LU1681047236 | 2.707 | 0,09% p.a. | 16-09-2008 | Accumulerend | Luxemburg | Volledige replicatie |

| iShares EURO STOXX UCITS ETF (DE)DE000A0D8Q07 | 2.510 | 0,20% p.a. | 03-05-2005 | Distribueren | Duitsland | Volledige replicatie |

| Xtrackers MSCI EMU UCITS ETF 1DLU0846194776 | 1.628 | 0,12% p.a. | 28-11-2012 | Distribueren | Luxemburg | Volledige replicatie |

| UBS Core MSCI EMU UCITS ETF EUR disLU0147308422 | 1.399 | 0,12% p.a. | 19-09-2002 | Distribueren | Luxemburg | Volledige replicatie |

| HSBC EURO STOXX 50 UCITS ETF EURIE00B4K6B022 | 1.193 | 0,05% p.a. | 05-10-2009 | Distribueren | Ierland | Volledige replicatie |

| Invesco EURO STOXX 50 UCITS ETFIE00B60SWX25 | 955 | 0,05% p.a. | 18-03-2009 | Accumulerend | Ierland | Niet-gefinancierde swap |

| Amundi EURO STOXX 50 UCITS ETF DR - EUR (D)LU1681047319 | 764 | 0,09% p.a. | 29-06-2010 | Distribueren | Luxemburg | Volledige replicatie |

| Amundi MSCI EMU UCITS ETF DistLU1646360971 | 683 | 0,12% p.a. | 06-08-2003 | Distribueren | Luxemburg | Volledige replicatie |

| UBS EURO STOXX 50 UCITS ETF EUR disLU0136234068 | 574 | 0,09% p.a. | 29-10-2001 | Distribueren | Luxemburg | Volledige replicatie |

| SPDR MSCI EMU UCITS ETFIE00B910VR50 | 270 | 0,18% p.a. | 25-01-2013 | Accumulerend | Ierland | Volledige replicatie |

| HSBC EURO STOXX 50 UCITS ETF EUR (Acc)IE000MWUQBJ0 | 239 | 0,05% p.a. | 28-06-2022 | Accumulerend | Ierland | Volledige replicatie |

| Amundi MSCI EMU UCITS ETF AccLU1646361276 | 206 | 0,12% p.a. | 06-02-2020 | Accumulerend | Luxemburg | Volledige replicatie |

| Amundi Prime Eurozone UCITS ETF DR (C)LU2089238112 | 78 | 0,05% p.a. | 15-01-2020 | Accumulerend | Luxemburg | Volledige replicatie |

| Invesco EURO STOXX 50 UCITS ETF DistIE00B5B5TG76 | 45 | 0,05% p.a. | 25-11-2009 | Distribueren | Ierland | Niet-gefinancierde swap |

| Amundi Prime Eurozone UCITS ETF DR (D)LU1931974429 | 42 | 0,05% p.a. | 30-01-2019 | Distribueren | Luxemburg | Volledige replicatie |

| Amundi EURO STOXX 50 UCITS ETF DR USD (C)LU1681047400 | 35 | 0,09% p.a. | 15-10-2015 | Accumulerend | Luxemburg | Volledige replicatie |

| ETF ISIN | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | 5 years in % |

|---|---|---|---|---|---|---|

| iShares EURO STOXX 50 UCITS ETF (DE)DE0005933956 | -1,12% | +1,37% | +11,42% | +11,45% | +67,56% | +89,00% |

| iShares Core EURO STOXX 50 UCITS ETF EUR (Acc)IE00B53L3W79 | -1,11% | +1,39% | +11,43% | +11,48% | +67,58% | +89,13% |

| iShares Core MSCI EMU UCITS ETF EUR (Acc)IE00B53QG562 | -0,71% | +3,69% | +13,83% | +14,55% | +60,00% | +81,23% |

| Xtrackers EURO STOXX 50 UCITS ETF 1DLU0274211217 | -1,12% | +1,37% | +11,42% | +11,47% | +67,57% | +89,22% |

| Xtrackers EURO STOXX 50 UCITS ETF 1CLU0380865021 | -1,10% | +1,39% | +11,43% | +11,48% | +67,63% | +89,27% |

| iShares Core EURO STOXX 50 UCITS ETF EUR (Dist)IE0008471009 | -1,11% | +1,38% | +11,43% | +11,46% | +67,56% | +89,15% |

| Amundi EURO STOXX 50 II UCITS ETF AccFR0007054358 | -1,11% | +1,36% | +11,36% | +11,40% | +67,34% | +88,43% |

| Amundi EURO STOXX 50 UCITS ETF EUR (C)LU1681047236 | -1,11% | +1,38% | +11,42% | +11,47% | +67,49% | +89,04% |

| iShares EURO STOXX UCITS ETF (DE)DE000A0D8Q07 | -0,63% | +4,02% | +14,39% | +15,23% | +59,97% | +82,38% |

| Xtrackers MSCI EMU UCITS ETF 1DLU0846194776 | -0,72% | +3,69% | +13,82% | +14,50% | +59,89% | +80,85% |

| UBS Core MSCI EMU UCITS ETF EUR disLU0147308422 | -0,71% | +3,70% | +13,84% | +14,49% | +59,82% | +80,49% |

| HSBC EURO STOXX 50 UCITS ETF EURIE00B4K6B022 | -1,10% | +1,40% | +11,44% | +11,51% | +67,69% | +89,62% |

| Invesco EURO STOXX 50 UCITS ETFIE00B60SWX25 | -1,13% | +1,44% | +11,45% | +11,34% | +67,03% | +87,83% |

| Amundi EURO STOXX 50 UCITS ETF DR - EUR (D)LU1681047319 | -1,10% | +1,39% | +11,42% | +11,48% | +67,64% | +89,18% |

| Amundi MSCI EMU UCITS ETF DistLU1646360971 | -0,71% | +3,68% | +13,84% | +14,59% | +59,87% | +80,59% |

| UBS EURO STOXX 50 UCITS ETF EUR disLU0136234068 | -1,09% | +1,40% | +11,43% | +11,42% | +67,46% | +88,85% |

| SPDR MSCI EMU UCITS ETFIE00B910VR50 | -0,93% | +3,66% | +13,77% | +14,43% | +59,38% | +80,08% |

| HSBC EURO STOXX 50 UCITS ETF EUR (Acc)IE000MWUQBJ0 | -1,11% | +1,40% | +11,45% | +11,52% | - | - |

| Amundi MSCI EMU UCITS ETF AccLU1646361276 | -0,71% | +3,69% | +13,83% | +14,59% | +59,81% | +80,72% |

| Amundi Prime Eurozone UCITS ETF DR (C)LU2089238112 | -0,54% | +3,65% | +13,55% | +13,84% | +60,89% | +83,99% |

| Invesco EURO STOXX 50 UCITS ETF DistIE00B5B5TG76 | -1,12% | +1,47% | +11,46% | +11,35% | +67,21% | +88,13% |

| Amundi Prime Eurozone UCITS ETF DR (D)LU1931974429 | -0,54% | +3,63% | +13,55% | +13,84% | +60,87% | +83,96% |

| Amundi EURO STOXX 50 UCITS ETF DR USD (C)LU1681047400 | -1,06% | +1,29% | +12,27% | +11,52% | +66,69% | +88,75% |

Source: justETF.com; As of 30-06-2025