- Level: For beginners

- Reading duration: 7 minutes

What to expect in this article

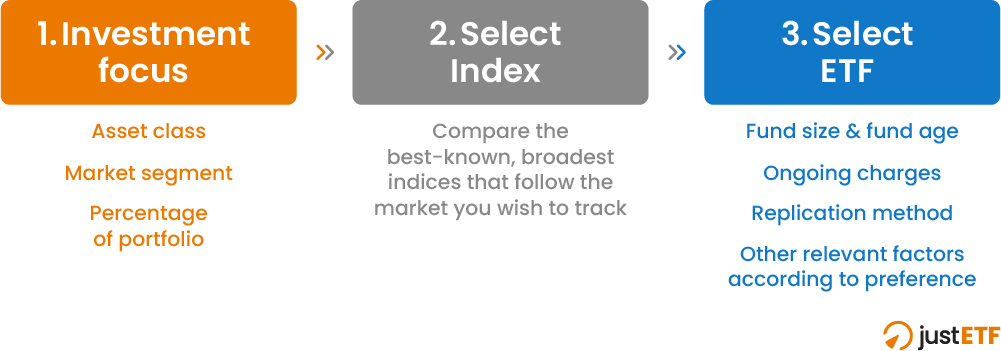

Select the right ETF in 3 steps

Source: justETF Research

1. Determine investment focus

Before you start selecting a specific ETF, you first determine your investment focus. You decide on an asset class (such as equities, bonds or commodities) and determine its weighting in your portfolio. If you’re not sure what percentage of your portfolio should be allocated to each class then try our ETF Strategy Builder to help you decide. Next up is your diversification strategy. Do you want to spread your wealth widely across an asset class or capture unique market segments? For example, in equities, you can invest across the entire world with one ETF, or tilt towards regions such as the Emerging Markets, or drill down into individual countries (e.g. the UK). Furthermore, you can focus on specific industries, a specific equity strategy or specific investment themes (e.g. renewable energy). Our ETF overview by theme offers you a good start. Here you can quickly find the right ETFs for the various investment strategies.justETF tip: Diversify! Spread your money across as many different companies around the globe as you can. The simplest way to do this is with a World/All-world-ETF.

2. Select index

OK, its time to think about the index your ETF will track. A good index covers as much of the market you want to follow as possible. Once you have selected one or more indices, you can compare the available ETFs on justETF. For example, the FTSE All-Share index tracks 98% of the investible UK stock market. That makes FTSE All-Share ETFs an excellent way of gaining exposure to UK equities. ETFs on well-known stock indices such as the FTSE All-World or the MSCI World are offered by almost every major ETF provider and, as a result, the corresponding products are usually very inexpensive. You can google any index to find out more about it, but useful rules of thumb are:- The more equities a market-cap index tracks, the better it represents its market.

- Broad market indices are best for diversification - regardless of whether you want to invest in just one ETF or build a portfolio of several ETFs.

- The more an index concentrates on particular firms, industries and countries, the riskier it will be in comparison to a broader index.

justETF tip: We support you in selecting the right index or ETF with our ETF Investment Guides. These show you how you can invest with ETFs in the stock market of individual regions or countries, or in various themes. With index comparisons and rankings of available ETFs, you can quickly find your way into the ETF selection.

3. Select ETF

Now you have the topline questions answered, it’s time to dive deeper into the filters that help you pick out a top-notch ETF... Many different factors play a role in ETF selection, which are highlighted in detail below. Decide according to your individual needs, which ETFs fit your investment structure and how you would like to prioritise the individual criteria.ETF selection criteria: This is what you should consider when selecting an ETF

Objective criteria:

Subjective criteria:

Objective ETF selection criteria

First of all, let's look at ETF selection criteria that can be assessed according to objective evaluation standards. Thus, the assessment of an ETF in terms of these criteria is independent of your personal situation or preferences. For example, the lower the ongoing charges of an ETF, the better. If two ETFs differed solely in terms of their ongoing charges, the cheaper ETF would always be the better choice. This assessment would apply equally to all investors. Note, however, that the weighting of these objective criteria is quite subjective and thus depends on your personal assessment. It is therefore up to you whether and to what extent you want to take these criteria into account when selecting an ETF.justETF tip: Above all, the ongoing charges, the fund size and the age of an ETF are essential ETF selection criteria and should be applied if possible.

Ongoing charges (TER)

One of the great advantages of ETFs is their low cost compared to other investments such as actively managed funds. Nevertheless, there are often big differences in terms of costs even between different ETFs. To assess the cost of an ETF, you can look at the Total Expense Ratio (TER). The TER measures the approximate annual charge you can expect to pay for holding an ETF. It tots up the various administrative, legal, operational and marketing costs incurred by the ETF’s management and deducts those expenses from your returns. The Ongoing Charge Figure (OCF) is another term for the same thing. Since the TER is subject to a uniform definition by the investment industry and the European Union and must be dutifully reported, it is particularly well suited as a cost indicator and selection criterion. The information provided by the various ETF providers on the TER is thus comparable and should definitely be taken into account when selecting an ETF. The calculation is simple: low ongoing costs should be reflected in a higher return over the short or long term. The snag is that neither the TER nor the OCF is a complete account of the costs you’ll pay for an ETF. They do not include transaction costs or taxes, for example. These hidden costs do show up in an ETF’s annual return, though, so you can use performance data to more accurately compare the cost of ETFs. See tracking difference below.Fund size (over £100 million)

The fund volume determines the profitability of an ETF. Favour a fund size (assets under management) of more than £100 million. The ETF is liable to be profitable enough to be safe from liquidation once it grows beyond this threshold.Rule of thumb: With a fund volume of more than £100 million, the economic efficiency is given in most cases.

Fund age (older than one year)

You can better compare ETFs once they’ve built up a reasonable track record. You need a bare minimum of one year’s performance data, three years is much better and five years is better still for a long term investment. In addition, if the ETF has some history, you can better assess whether it is at risk of timely closure. ETFs that have only recently been launched usually have a rather low fund volume. In such cases, it is often unclear whether the ETF has a low volume simply because of its short duration or whether it is simply not in demand among investors. If the latter is the case, the ETF runs the risk of being closed again.justETF tip: In our ETF search, you have the option to filter the available ETFs according to the criteria "fund size larger than £100 million," and "fund age older than 1 year" and to sort the corresponding ETFs according to the lowest expense ratio (TER).

Performance and tracking difference

The perfect ETF would deliver exactly the same return as its index. But ETFs are subject to real-world frictions that don’t affect indices. ETFs must pay transaction charges, taxes, employee salaries, regulatory fees and a laundry list of other costs. Indices, meanwhile, are virtual world league tables so are free to compute the return of a market untroubled by ETF drag factors. The gap between an ETF’s real-world return and an index’s virtual return is called tracking difference. A good ETF minimises the tracking difference, which theoretically equals the market return of the index minus the running costs of the ETF. You can assess tracking difference by comparing ETFs that follow the same index across the same time period. Simply contrast their overall returns against each other, over the longest time period available, using justETF's charting tools. The returns of an ETF measure its all-important performance. Our charts and returns snapshots give you a comprehensive picture of each ETF’s performance over a variety of time periods. Remember, there are quite a few pitfalls when it comes to assessing returns, but our data enables you to make apples-to-apples comparisons more easily. Please also bear in mind that such comparisons only relate to the past. Future performance may differ. For example, it could be that an ETF has only recently reduced its costs. Such a cost reduction would have little impact on a long-term historical view, but a very large impact on the future performance of the ETF. For this reason, ongoing costs are often a more meaningful selection criterion for ETFs than historical performance or tracking difference.justETF tip: In the justETF search, you can find comparable returns both on an annual basis and for current periods. Furthermore, you can make chart comparisons with just a few clicks. You can learn how to do this in our tutorial Compare ETFs in the ETF Screener.

Trading costs

Order fees are incurred when buying an ETF. These vary depending on the broker. ETFs are usually bought and sold via the stock exchange. In addition to the order fees, the spread between the buying and selling price must also be taken into account. How high this spread is, depends on the liquidity of the traded ETF. Liquidity refers to how efficiently you can trade an ETF on the stock exchange. The more liquid an ETF, the more likely it is you can buy and sell it swiftly for minimal cost. Broad market ETFs are usually very liquid because the underlying securities they hold are regularly traded in massive volumes. For example, the majority of shares traded on the UK stock market are highly liquid, so an ETF that holds the same securities (e.g. FTSE 100 shares) can also be exchanged rapidly with a minimal markup on the price. That markup is called the bid-offer spread and is the difference between the buy and sell price of an investment. It works the same way as buying foreign currency when you go on holiday. You always get a slightly lower price when you sell than you must pay when you buy. The spread is the middleman’s cut for offering binding buying and selling prices. These middlemen are known as market-makers, and they help maintain market liquidity. The bid-offer spread increases as liquidity declines and because it’s a cost of trading - that you pay on top of broker/platform dealing fees - it pays to choose the most liquid ETF in any given category. The key liquidity factors are:- The underlying securities of the ETF - highly tradable are better.

- Fund size - larger tends to be better.

- Daily trading volume - more tends to be better.

- Market makers - more is better.

- Market conditions - liquidity can decline when the markets are very volatile.

justETF tip: You can find out what to look out for in ETF trading in our article How does ETF trading work?.

Tax status

Always make sure your ETFs have reporting fund status. This enables you to avoid a nasty tax shock in the future. Offshore capital gains are liable to tax at unfavourable income tax rates instead of relatively benign capital gains tax rates unless they are reporting funds. All ETFs are domiciled outside the UK and so count as offshore. The good news is that most UCITS ETFs are reporting funds, but it’s always worth a quick check on the factsheet. Investments in ISAs and SIPPs are immune from this problem. ETFs are eligible investments for SIPPs and ISAs except Help To Buy ISAs. You can now hold cash and investments in a single ISA, although your account must be with an institution that can hold investments on your behalf. Investments in SIPPs and ISAs are protected from tax on interest, dividends and capital gains.justETF tip: You can find further information about how ETFs are taxed in the UK in our How ETFs are taxed in the UK.

Subjective ETF selection criteria

In addition to the objective ETF selection criteria mentioned so far, there are also factors whose evaluation is subjective. In these selection criteria, whether a particular ETF feature is desirable or not depends on your individual needs and preferences. Again, depending on your personal situation, the following ETF criteria can be given a very high priority or even completely ignored if necessary.Sustainability

Do you want to invest exclusively in companies that meet certain sustainability, social and governance (ESG) standards? Then this aspect is a key criterion for you when selecting an ETF. In our ETF search, you have the option of limiting your selection to ETFs that take sustainability criteria into account. In addition, when selecting an index, you should ensure that the orientation of the selected index matches your personal motives with regard to sustainable investment.justETF tip: Learn more about how to invest sustainably worldwide with just one ETF.

Replication method

How does your ETF track its index? There are three main methods: Full physical replication where the ETF holds the same securities as the index, in the same proportions, to provide accurate performance (costs notwithstanding). Sampling is another type of physical replication but this time the ETF holds a representative sample of the index’s securities rather than every last one. This method trades off precision index-tracking against paying the huge expenses that would otherwise be incurred in following an index full of small and illiquid securities. Synthetic replication tracks an index using a total return swap. This is a financial product that pays the ETF the exact return of the index it shadows. Swaps are commonly provided by institutions such as global investment banks in exchange for cash from the ETF provider. Synthetic replication frees an ETF from physically holding the securities of the index, which is useful when they are inaccessible, illiquid or so numerous that holding them all becomes impractical. Synthetic replication exposes you to counterparty risk - the possibility that the swap provider could default on its obligations. Physical replication can also expose you to counterparty risk if your ETF provider engages in security lending - the practise of loaning out securities to other financial operators for the purpose of short-selling. A provider’s security lending policy should be published on their website. Full physical replication is obviously the most straightforward method, but it’s not always available for every market.justETF tip: In the ETF Search you have the option to filter only for fully replicating ETFs, for all physically replicating ETFs or for synthetic ETFs.

Income treatment (Use of profit)

Distributing ETFs pay income (interest or dividends) directly into your platform/broker’s account, so you can spend it or reinvest it as you see fit. Accumulating (or capitalising) ETFs don’t pay out income, but automatically reinvest it back into the product. That increases the value of your ETF share, saves on transaction costs, and will grow the value of your investment over time using the compound effect. Depending on your personal situation, distributing or accumulating ETFs may be more suitable for you.justETF tip: With the justETF search, you can easily filter for distributing or accumulating ETFs.

ETF provider

ETFs are run by many major banks and fund companies. The mark of a good provider is how it treats its customers, so look out for:- clear presentation of important information and policies

- easy accessibility of product details, documentation and data on their website

- key information and documents that are regularly updated

- information that is designed to be understood, not to confuse

justETF tip: For information on the various ETF providers, please refer to our ETF provider overview.

Fund currency

The fund assets of an ETF are managed and settled in the fund currency. All official reports and distributions are also made in the fund currency. The fund currency for ETFs is usually based on the currency used for the underlying index. The index currency, in turn, is usually identical to the currency in which most of the securities included in the index are traded. The good news is that your bank will convert all the data for you into the currency in which your securities account is held. Also, possible ETF currency risks are not related to the fund currency. For this reason, you can ignore the fund currency as a criterion for ETF selection with a clear conscience.justETF tip: At justETF, the fund currency is displayed on each ETF profile.

Fund domicile

Its worth knowing the registered home of your ETF to avoid tax complications later. ETFs domiciled in Ireland and Luxembourg don't levy withholding tax on UK investors, which can be an issue if your product hails from other countries such as the US or France. ETFs approved for sale in the EU are recognisable by the acronym UCITS in their name. UCITS is a set of EU regulations that sets standards for counterparty risk, asset diversification, information disclosure and other consumer protections. Most ETFs are still available in the post-Brexit era for investors from the United Kingdom. This is important as there are no ETFs domiciled in the UK. US and Canadian ETFs are not governed by UCITS principles and may also be subject to further tax, legal and currency exchange disadvantages. Such ETFs are usually recognisable because UCITS is not in their name and their securities identification number (ISIN) begins with US or CA. You'll only find ETFs launched in Europe through justETF’s search. This is because most US products don’t have a European or UK distribution licence and therefore cannot be advertised. Using the "Fund domicile" filter, you have the option of limiting your selection to ETFs that were launched in a specific country.justETF tip: For physically replicating ETFs on US stocks, you should make sure that the ETF is issued in Ireland. In the ETF search, you have the possibility to filter by the corresponding criteria.