Top FTSE Emerging ETFs

The FTSE Emerging index Factsheet

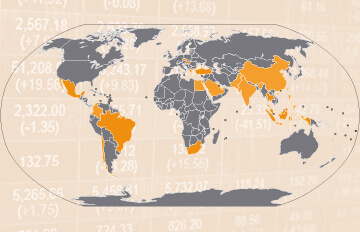

The FTSE Emerging index is an international equity index, which tracks stocks from emerging markets worldwide. As such, it represents FTSE's counterpart to the MSCI Emerging Markets index. With its 2.219 (As of 28-06-2024) constituents, the FTSE Emerging index covers most of the investable market capitalisation in emerging markets.

ETF investors can benefit from price gains and dividends of the FTSE Emerging constituents. Currently, the FTSE Emerging index is tracked by 3 ETFs.

FTSE Emerging Chart 1 year

Source: justETF.com; As of 11-07-2025; Performance in EUR, based on the largest ETF.

Cost of FTSE Emerging ETFs

The total expense ratio (TER) of FTSE Emerging ETFs is between 0,11% p.a. and 0,22% p.a.. In comparison, most actively managed funds do cost much more fees per year. Calculate your individual cost savings by using our cost calculator.

The best FTSE Emerging ETF by 1-year fund return as of 30-06-2025

| 1 | Vanguard FTSE Emerging Markets UCITS ETF Distributing | +6,19% | ||

| 2 | Vanguard FTSE Emerging Markets UCITS ETF Acc | +6,18% | ||

| 3 | Franklin FTSE Emerging Markets UCITS ETF USD Capitalisation | - |

All FTSE Emerging ETFs ranked by fund return

The largest FTSE Emerging ETF by fund size in EUR

| 1 | Vanguard FTSE Emerging Markets UCITS ETF Distributing | 2.329 m | ||

| 2 | Vanguard FTSE Emerging Markets UCITS ETF Acc | 928 m | ||

| 3 | Franklin FTSE Emerging Markets UCITS ETF USD Capitalisation | 9 m |

All FTSE Emerging ETFs ranked by fund size

The cheapest FTSE Emerging ETF by total expense ratio

| 1 | Franklin FTSE Emerging Markets UCITS ETF USD Capitalisation | 0,11% p.a. | ||

| 2 | Vanguard FTSE Emerging Markets UCITS ETF Acc | 0,22% p.a. | ||

| 3 | Vanguard FTSE Emerging Markets UCITS ETF Distributing | 0,22% p.a. |

All FTSE Emerging ETFs ranked by total expense ratio

FTSE Emerging ETFs in comparison

Besides return, there are further important factors to consider when selecting a FTSE Emerging ETF. In order to provide a sound decision basis, you find a list of all FTSE Emerging ETFs with details on size, cost, age, use of profits, fund domicile and replication method ranked by fund size.

Compare all FTSE Emerging ETFs in detail

Compare all FTSE Emerging ETFs in a chart

| ETF name ISIN | Fund size in m EUR | TER in % | Use of profits | Fund domicile | Replication method | |

|---|---|---|---|---|---|---|

| Vanguard FTSE Emerging Markets UCITS ETF DistributingIE00B3VVMM84 | 2.329 | 0,22% p.a. | Distribueren | Ierland | Volledige replicatie | |

| Vanguard FTSE Emerging Markets UCITS ETF AccIE00BK5BR733 | 928 | 0,22% p.a. | Accumulerend | Ierland | Volledige replicatie | |

| Franklin FTSE Emerging Markets UCITS ETF USD CapitalisationIE0004I037N4 | 9 | 0,11% p.a. | Accumulerend | Ierland | Volledige replicatie |

Source: justETF.com; As of 11-07-2025

Return comparison of all FTSE Emerging ETFs

The table shows the returns of all FTSE Emerging ETFs in comparison. All return figures are including dividends as of month end. Besides the return the reference date on which you conduct the comparison is important. In order to find the best ETFs, you can also perform a chart comparison.

| ETF | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | |

|---|---|---|---|---|---|---|

| Vanguard FTSE Emerging Markets UCITS ETF Distributing | +1,16% | -0,66% | -0,60% | +6,19% | +16,26% | |

| Vanguard FTSE Emerging Markets UCITS ETF Acc | +1,15% | -0,66% | -0,60% | +6,18% | +16,27% | |

| Franklin FTSE Emerging Markets UCITS ETF USD Capitalisation | +1,06% | -0,61% | -0,65% | - | - |

| ETF | 2025 in % | 2024 in % | 2023 in % | 2022 in % | 2021 in % | |

|---|---|---|---|---|---|---|

| Franklin FTSE Emerging Markets UCITS ETF USD Capitalisation | -0,61% | - | - | - | - | |

| Vanguard FTSE Emerging Markets UCITS ETF Distributing | -0,66% | +19,19% | +4,11% | -12,40% | +7,62% | |

| Vanguard FTSE Emerging Markets UCITS ETF Acc | -2,12% | +19,20% | +4,12% | -12,40% | +7,62% |

Source: justETF.com; As of 30-06-2025; Calculations in EUR including dividends