- Level: For Beginners

- Reading duration: 7 minutes

Summary

- While the MSCI World includes only industrialised countries, the FTSE All World brings both industrialized and emerging markets into your portfolio.

- Emerging Markets have not performed as well as industrialised countries in recent years. But will this also be the case in the future? After reading this article, you will know whether the MSCI World or the FTSE All World is the right ETF for you.

What to learn in this article

Excursus: What is an index?

As a rule, there is no ETF without an index. Think of an index as a basket of shares, for example. And it is precisely this basket that an ETF replicates. Or to put it another way: if an index shows an annual performance of 10%, we expect an ETF on this index to also achieve a performance of 10% if possible. There are factors such as ongoing costs that can cause the two values to diverge. However, the smaller this difference is, the better. The difference between index and ETF performance is called tracking difference or tracking error. An index is therefore nothing more than a benchmark. An example of an index is the S&P 500.justETF tip: The index to which an ETF refers can also be easily recognised by the name of the ETF itself. We have described more about an index in this article.

MSCI World or FTSE All World?

You can't invest "directly" in either the MSCI World or the FTSE All World. Strictly speaking, these two names only refer to the index. If you want to invest in one of the two indices, you can only do so "indirectly" by buying a corresponding ETF. Nevertheless, both indices can be regarded as two investment giants. This is because many investors keep exactly one of the two indices as the hard core of their ETF portfolio. Let's be clear from the outset: neither the MSCI World nor the FTSE All World is better or worse. The choice depends more on your goals. But how do the two differ?The MSCI World Index: The index with the industrialised countries

Let's start with the MSCI World Index.- It was introduced in 1969

- It aims to track the performance of large and mid-cap companies in 23 industrialised countries

- It contains around 1,500 companies that cover around 85% of the capitalisation of each country. This means you can include almost all companies in industrialised countries in your portfolio with just one ETF

- The MSCI World is weighted according to market capitalisation: This means that not every one of the 1,500 or so companies has the same weighting. Larger companies – in line with their size on the stock exchange – have a greater weighting in the index than smaller companies. Market capitalisation is calculated as follows: Market capitalisation = share price x number of shares

- The United States accounts for around 70% of the index, followed by Japan, the United Kingdom and France

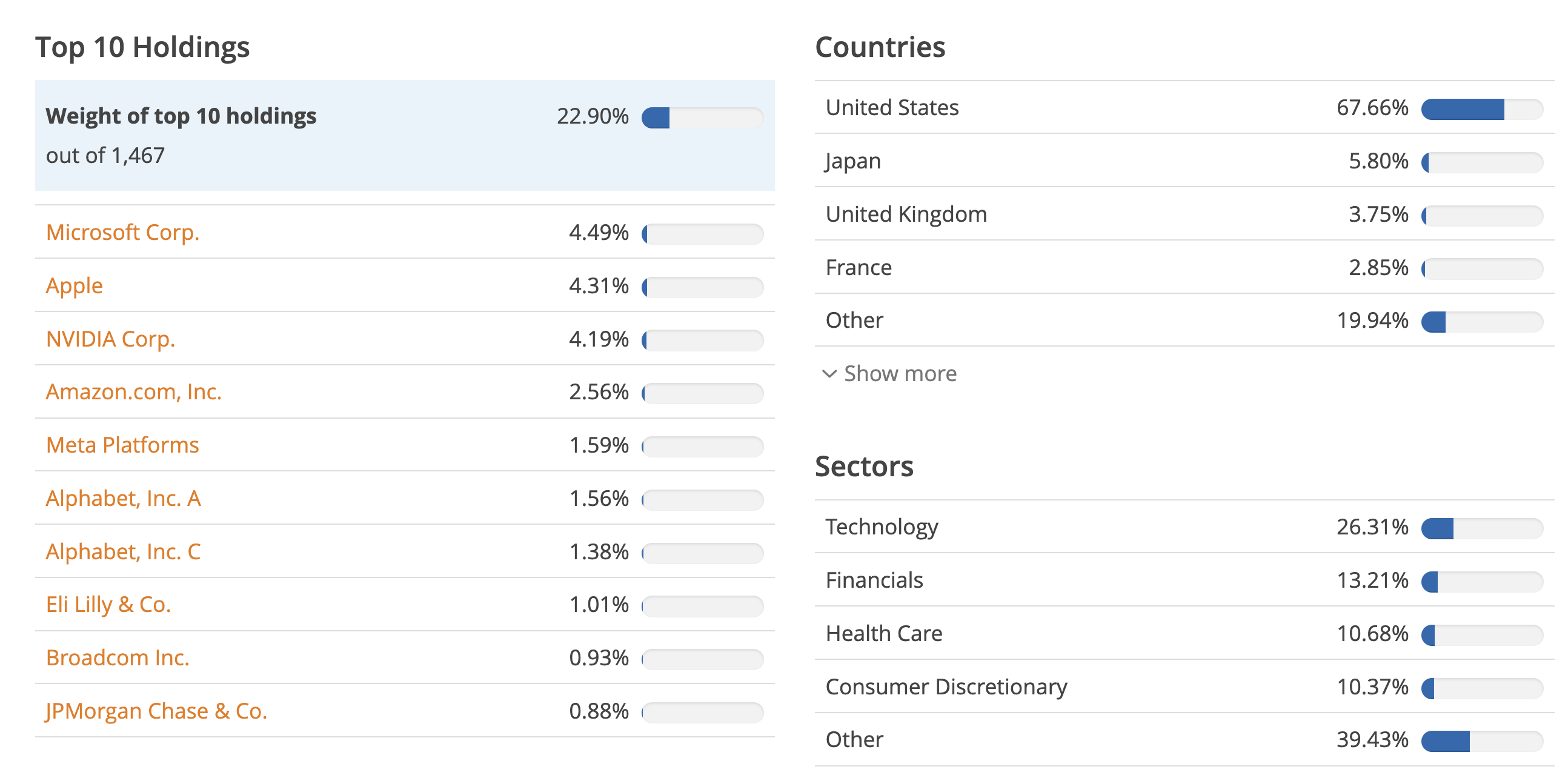

The composition of the MSCI World

Source: justETF, as of: 30/04/2024

What stands out immediately

- As the MSCI World Index excludes equities from emerging and frontier countries, it is less global than its name suggests

- 20% of the companies in the index belong to the technology sector, followed by the financial sector

- Many American tech giants, including Microsoft, Apple, Nvidia and Amazon are among the Top10

justETF tip: The MSCI World makes the headlines from time to time. What is the truth behind the criticism of the MSCI World?

FTSE All World: The index with industrialised and emerging markets

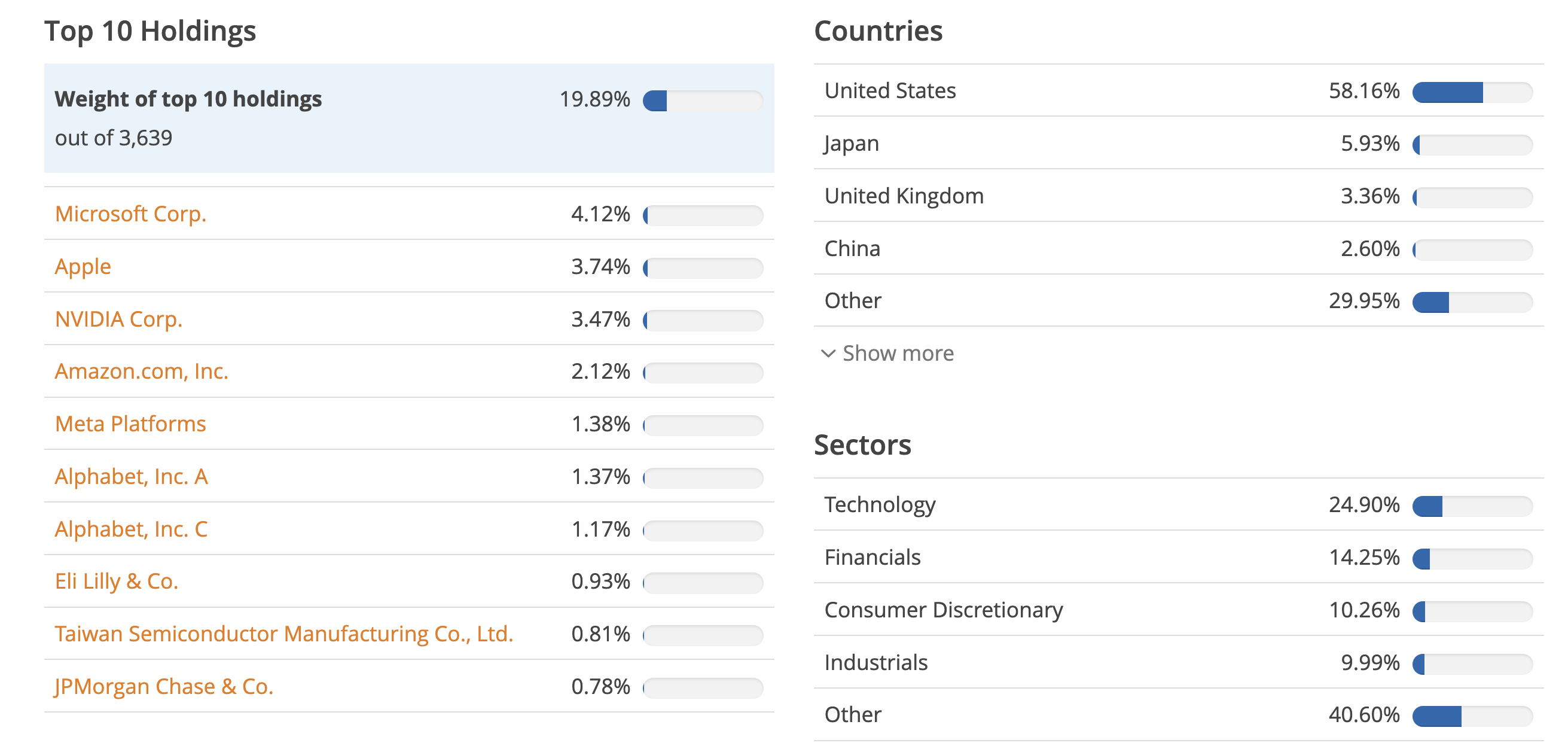

Let's talk about the FTSE All World.- This index is also weighted according to market capitalisation

- In contrast to the MSCI World, the FTSE All World tracks the performance of large and mid-cap shares from industrialised and emerging countries – i.e. large and medium-sized companies – with the latter accounting for around 10%

- In addition, the FTSE All World includes many more companies, namely around 4,300

- The country with the largest weighting is still the United States, which accounts for 60%, and the largest sector is the technology sector with around 26%

- Special attention is paid to China. China is not included in the MSCI World, but accounts for just under 3% of the FTSE All World. Its weighting within the index has fallen considerably in recent years due to the negative development of the Chinese stock market and the resulting decline in the market capitalisation of many companies in the index

The composition of the FTSE All World

Source: justETF, as of: 28/04/2024

MSCI World vs FTSE All World in comparison

So which index do you prefer? With the MSCI World you exclude, with the FTSE All World you include emerging markets. The question is: do you want companies from emerging markets in your portfolio or not?- If your answer is no, the decision is simple: then it is probably in favour of the MSCI World

- However, if you say yes and only want one ETF in your portfolio, the FTSE All World could be the right index for you

justETF tip: You already have an MSCI World and still want to add emerging markets? Then you don't need to sell your MSCI World. Instead, invest separately in emerging markets with f.e. the MSCI Emerging Markets. Quite simple with just one more ETF.

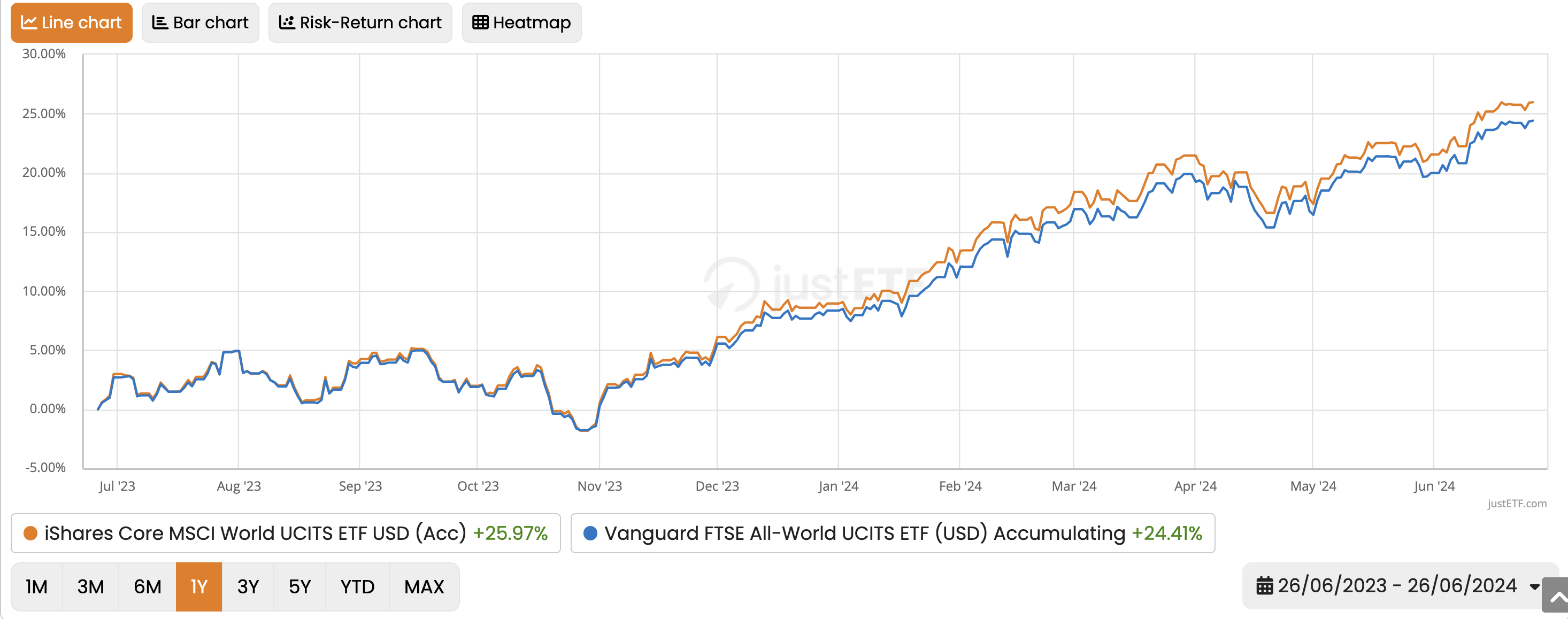

MSCI World vs FTSE All World: The big performance comparison

Now let's take a look at the performance. On the justETF website you will find 21 ETFs that track the MSCI World and 4 on the FTSE All World. For the sake of simplicity, I have selected the two largest accumulating ETFs on both indices. However, this does not mean that they are necessarily the absolute best. For the MSCI World I have picked this ETF from iShares and for the FTSE All World this ETF from Vanguard as an example. Once again: I made the choice based on the size of the ETFs and not because I want to recommend you to buy these ETFs. Both are accumulating ETFs with a very similar TER (total expense ratio). Although at first glance the TER is a very good way of understanding the running costs of an ETF, it does not include all the costs you have to bear. To check how both ETFs perform compared to the index they track, we use the tracking difference. This way we can see all the internal costs of our ETFs. For the iShares ETF, we see that the tracking difference has been positive since 2014, i.e. the ETF actually outperforms the index.Tracking difference in our MSCI World ETF

Source: justETF, as of: 28/04/2024

Let us now turn to the ETF from Vanguard. In this case we have less data as it was launched later, but as we can see, the ETF is on average less than 0.22% behind the TER. So once again: very good!

Tracking difference in our FTSE All World ETF

Source: justETF, as of: 28/04/2024

justETF tip: How an ETF has performed in the past does not give us any certainty that the ETF will continue to outperform its index in the future. However, we can regard it as a good indication of how efficiently an ETF provider manages its products.

MSCI World ETF vs. FTSE All World ETF: Performance Comparison 2019 - 2024

Source: justETF, as of: 27/06/2024

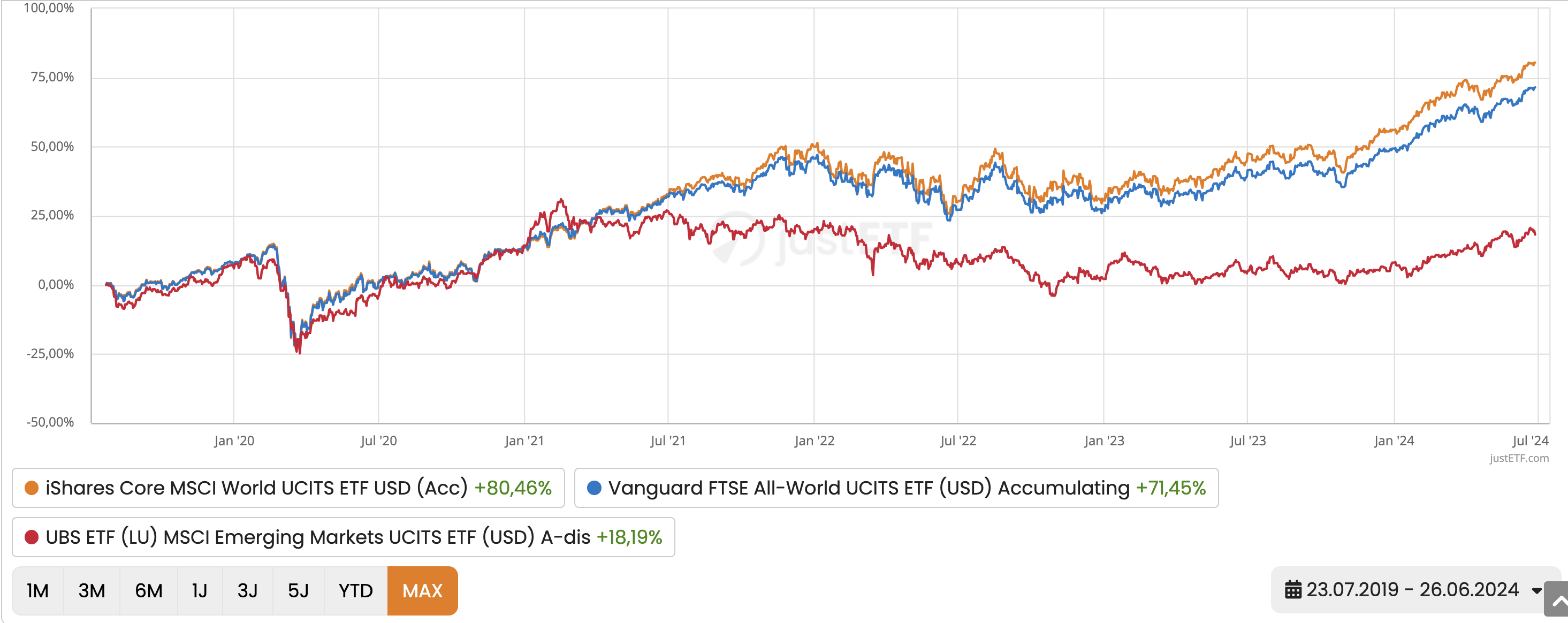

The MSCI World ETF (orange line) has performed slightly better than the FTSE All World since 2019. Why is that? This is due to the performance of emerging markets.

If we include an additional ETF on emerging markets for comparison, it becomes clear that emerging markets have not performed particularly well in recent years. This naturally has an impact on the performance of the index and therefore on the ETF.

MSCI World ETF vs. FTSE All World ETF vs. Emerging Market ETF: Performance comparison 2019 - 2024

Source: justETF, as of: 27/06/2024

MSCI World vs. FTSE All World: Which ETF should I choose?

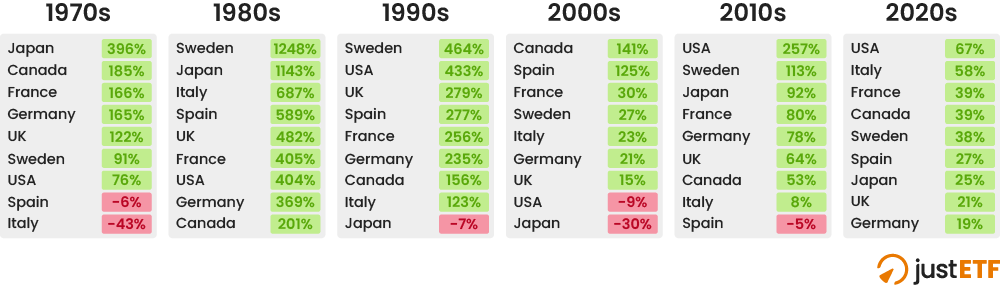

So what to do? Given this data, you may be wondering whether it wouldn't make sense to remove emerging markets from your portfolio altogether. As always, however, there is no clear answer. If you believe that the US will continue to grow and perform as well as it has so far, then everything else in the world could just be a burden on your portfolio. At that point, it would make sense to limit all other countries. And why not go for a US index like the S&P 500 or even the Nasdaq 100? Over the last years, the US market has outperformed all other countries. That is true. But will this also be the case in the future? And that's the big but: there is no guarantee that the US stock market will repeat in the next 15 years what it has done in the last 15 years. Studies show that countries with the best performance change from decade to decade:Returns by country from the 1970s to the 2020s

Source: justETF, as of: 28/04/2024

So if you think that the whole world will grow in the long term, but you don't know which countries will contribute the most to this growth and you would therefore prefer to have all the countries in the world in your portfolio, choosing a "real" world index such as the FTSE All World may be the right decision.

In this article, we have shown you two ways to invest around the globe:

- You can either use ETFs that invest in indices such as the FTSE All World. This allows you to include most of the world's companies in your portfolio with just one ETF.

- Or you can combine two or three ETFs to achieve the same thing, but you have a little more control over the weighting between industrialised and emerging markets according to your personal taste.