- Level: Beginners

- Reading duration: 4 minutes

What you can expect in this article

1. High fees

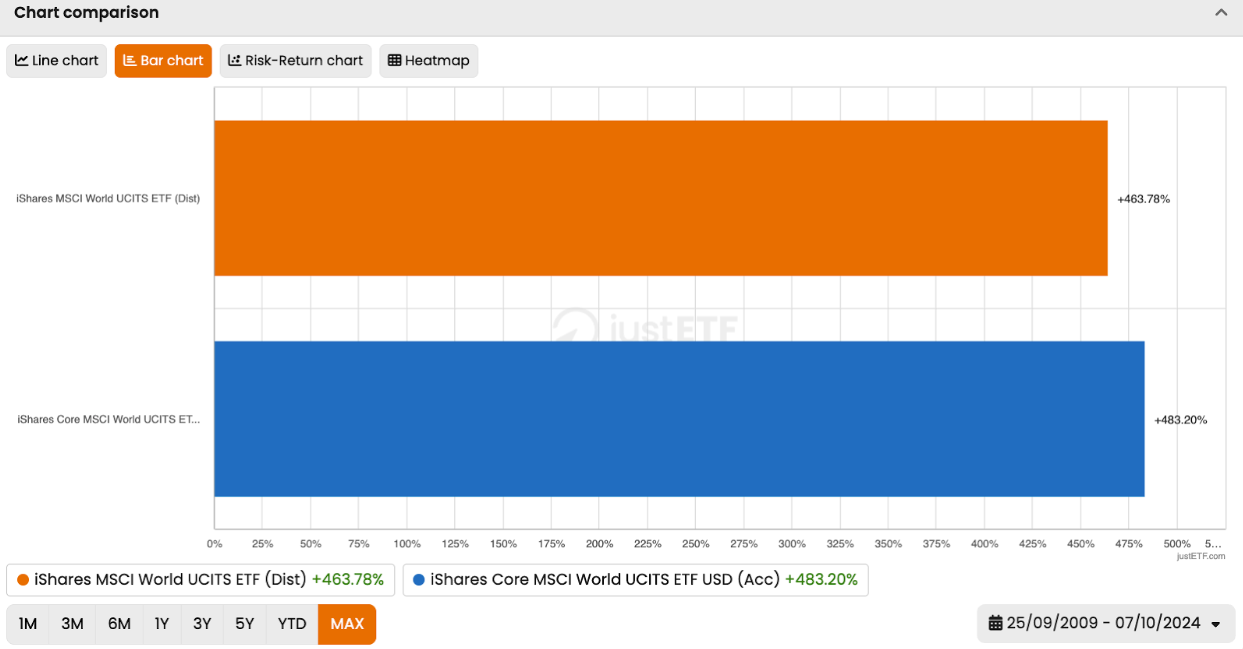

This one is a no-brainer. Why pay more than you need to for the same product? The answer is you should not. Because high fees hit your wallet as surely as buying your groceries from an expensive supermarket. Many ETF categories have their share of pricey legacy products. These should be left on the shelf in favour of leaner, cheaper versions that perform the same task. For example, iShares has two MSCI World ETFs on the market. iShares Core MSCI World has a competitive 0.2 % TER. Whereas the older iShares MSCI World ETF is weighed down by an old-school 0.5 % TER. Let’s see how the price differential affects performance:The influence of TER

Source: justETF Research

True to form, the cheaper product has outperformed the dearer version. Why? Because less of the Core ETF’s profit was smoked by fees.

The expensive product does not deliver premium performance. That’s no surprise because the two are close to identical.

The Core version holds 1,443 securities versus 1,431 for the legacy ETF.

Their top 10 holdings are the same, and exposures by sector differ by the occasional one-hundredth of one per cent.

In short, the Core ETF serves savvy price-sensitive investors. While the legacy product is served by consumer inertia.

Of course, some ETF categories are more expensive than others. But once you’ve chosen your market, use justETF’s screener to rank comparable ETFs by TER to spot the bargains.

This article has great tips on narrowing down your choice, but remember: ETFs are simple products at heart, and a premium price is no guarantee of premium quality.

2. Concentration risk

A major benefit of ETF investing is that it enables you to diversify across thousands of stocks at the click of a button. But some markets are dominated by a handful of giants. The top 10 holdings might account for 90 % of the market share. Or near 50 % of the ETF could be held in just two stocks. If that’s the scenario, it doesn’t matter if the product includes hundreds of other stocks, its performance depends on the fortunes of a few market behemoths. In situations like that, the diversification advantage of the ETF format is overwhelmed by the concentration risk of the market. That’s OK, if you’re prepared to accept the risk and really want exposure to that market. But it’s something to pay attention to. Even a tech titan like Apple is worth less than 5 % of the MSCI World. But you’re exposed to a new range of idiosyncratic risks when your ETF rests on a narrow base of stocks. For example, a lynchpin firm could go bankrupt, or be mired in scandal, or laid low by environmental disaster, lose key personnel, suffer huge losses due to the failure of a new product... Broadly diversified ETFs are not exposed to these types of risks (known as unsystematic risks) but highly concentrated ones are.3. Fails to deliver the market return

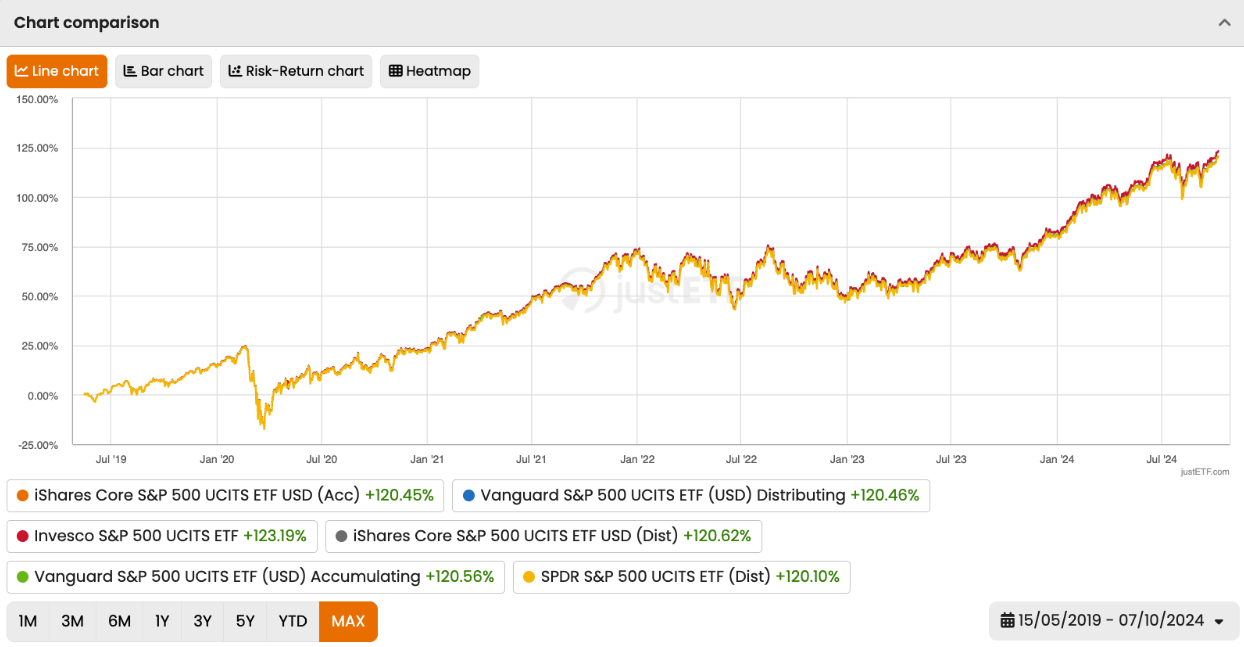

Most ETFs are designed to deliver the return of a specific market. For example, here’s a performance comparison of six of the most popular US equity ETFs that track the S&P 500 index:Comparison of S&P 500 ETFs

Source: justETF Research

It’s a photo-finish! You can scarcely fit a cigarette paper between them because each ETF does a great job of tracking its market (i.e. the largest 500 companies in the US as defined by the S&P 500 index).

That’s what good looks like.

It’s also true to say that the perfect ETF should deliver its index return minus the ETF’s costs over the long run. That’s its job.

justETF tip: Indexes are costless because they don’t trade or pay humans to manage them. The performance gap between an ETF and its index is called its “tracking difference”. Tracking difference is normal and nothing to worry about when it's small.

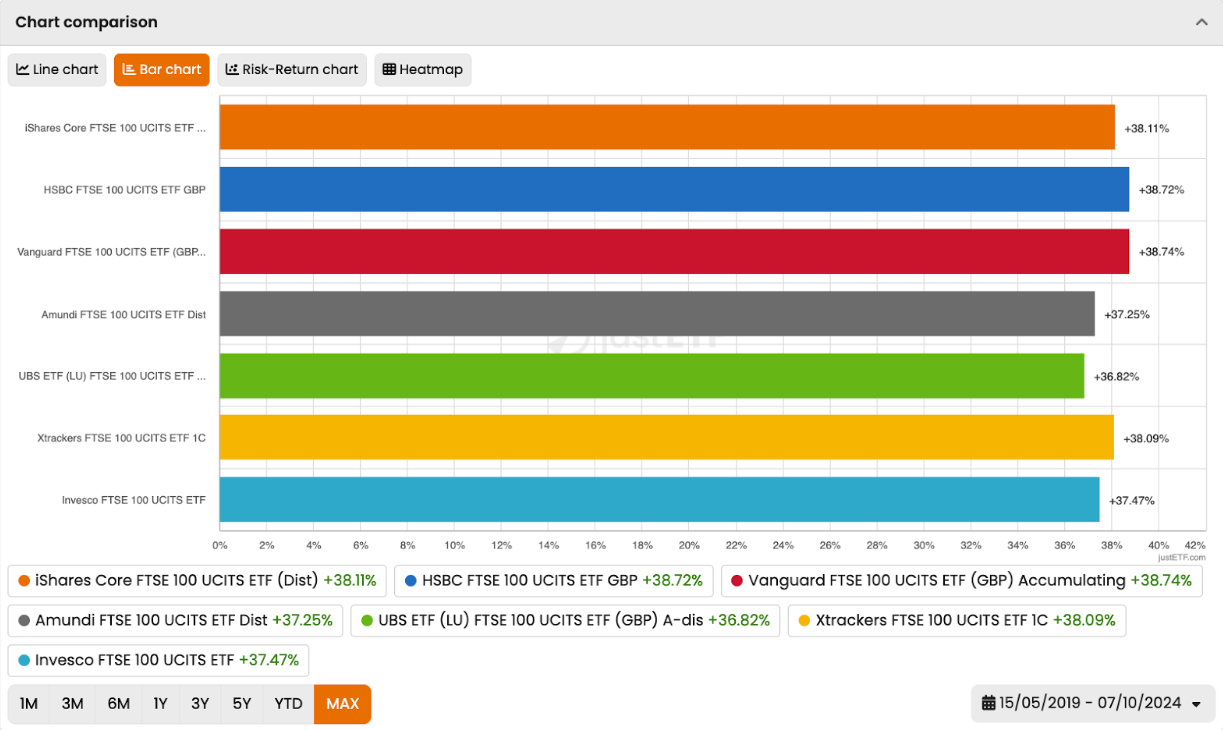

Comparison of FTSE100 ETFs

Source: justETF Research

The UBS ETF (green bar) is less efficient at delivering its market’s return than its competitors. Why? The most likely explanation, in this case, is that it’s twice as expensive as most other FTSE 100 ETFs.

In truth, the performance gap over five years is not huge, but it’s your money, so it pays to be ruthless.

That said, don’t worry about minor differences between comparable ETFs over time-frames of less than three years.

It’s only worth acting upon consistent performance gaps that are liable to affect your profits over the long term.

You can quickly compare like-for-like ETFs by selecting from the categories on our ETF screener. Once you’ve picked your shortlist, choose the Compare selection in detail option, then the bar chart icon.

4. Which index?

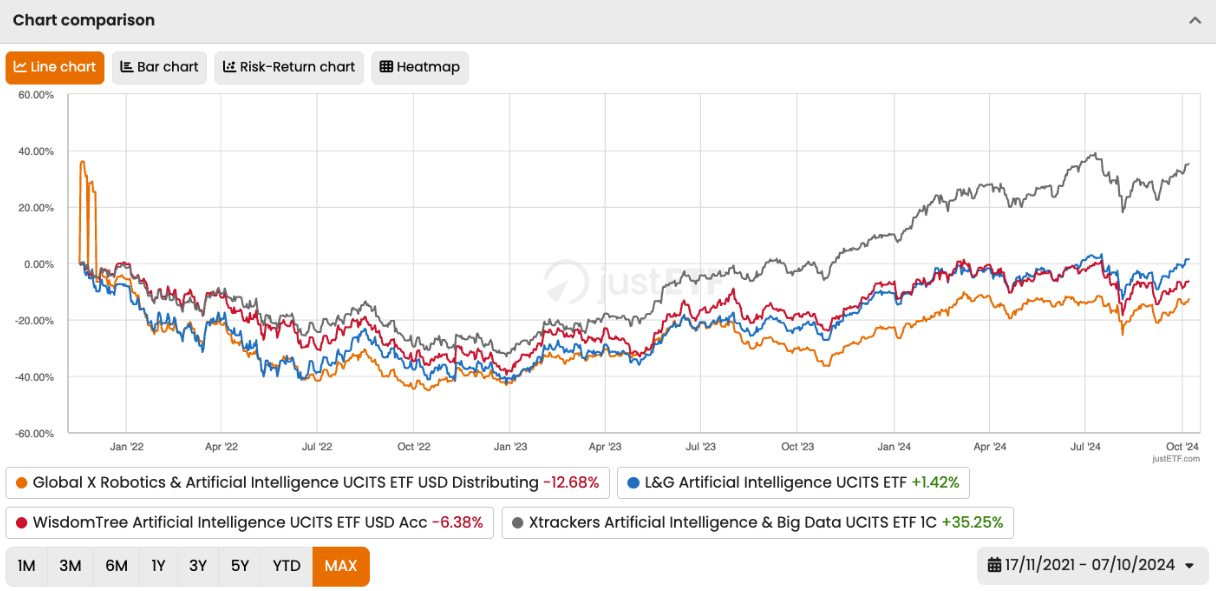

It’s easy to compare ETFs in broad and deep market equity markets like the US, Europe and the UK. But what about an exciting subset like artificial intelligence? The track record of AI ETFs (with over one year’s worth of returns) looks like this:Comparison of AI ETFs

Source: justETF Research

Ok, Xtrackers is the clear winner here. We can just pick that ETF and be done with it, right?

Sadly not. Each of those AI ETFs follows a different index. And those indexes each track a different mix of stocks.

Meanwhile, AI is an extremely fast-moving space, wreathed in hype, and there’s no consensus view on the definitive index.

In short, there’s no guarantee that the Xtracker ETF will triumph in the future. Its particular spin on the AI sector could be the one that underperforms in the years to come.

Moreover, six of its top 10 holdings are also present in the MSCI World’s top 10. That casts doubt on the diversification value of this particular AI ETF - if you already hold a strong global equity position.

So the red flag isn’t about any of these ETFs as such. It’s more the notion of jumping into a niche market on the assumption that it’s like picking a World or US equities product.

As we’ve seen, comparable broad market ETFs deliver similar performance, so it’s hard to go far astray.

But half of the AI ETFs above delivered negative returns, while the other two delivered positive results over precisely the same timeframe.

That’s a signal that choosing the right product in this market requires a much deeper dive during your research phase.