- Level: For advanced

- Reading duration: 7 minutes

What to except in this article

- Total Expense Ratio (TER) does not show all costs

- What costs are included in the TER?

- What costs are not included in the TER?

- Total Cost of Ownership (TCO): All costs at a glance

- A look behind the scenes of cost figures

- Total Cost of Ownership for an ETF investment

- Tracking difference as cost figure

Total Expense Ratio (TER) does not show all costs

However, the total cost of owning an ETF (or any other investing vehicle) isn't completely captured by Total Expense Ratio (TER). The TER or its near-identical twin the Ongoing Charge Figure (OCF) is the estimated annual cost of owning an ETF. These are the charges that you will see quoted on a products website or in the Key Investor Information Document (KIID). This cost will be deducted pro-rata from your holdings on a daily basis, but it isn’t the full price you’ll pay. For that, we need to turn to the Total Cost of Ownership (TCO). Here is what you should know about the Total Expense Ratio TER:- The TER is a percentage that indicates the annual running costs of an ETF.

- These costs have nothing to do with the costs payable to the broker for placing orders or executing savings plans.

- The TER does not include all ETF costs.

- ETFs with a lower TER do not necessarily outperform ETFs with a higher TER.

What costs are included in the TER?

- Management fees: These are management and operating costs incurred by the ETF provider for index tracking. They include, for example, costs for portfolio management, auditing, review and other operating costs.

- Custodian fees: The securities in which the ETF invests are held in a separate custody account. This incurs costs at the ETF's custodian bank.

- Licence fees: The ETF provider must pay licence fees for the index it tracks.

- Distribution fees: These include the costs incurred for the marketing or distribution of the product, such as the preparation of fund documents and brochures.

What costs are not included in the TER?

- Swap fees: Synthetically replicating ETFs pay fees to draw the index return.

- Securities lending income: These are profits earned on the lending of securities.

- Transaction costs at the fund level: These arise when the ETF rebalances its portfolio, i.e. adjusts it to the index or reinvests returns. These include, for example, broker fees and spreads (bid-ask spreads). Since the composition of most ETFs hardly changes, such transaction costs are much lower than for active funds.

Total Cost of Ownership (TCO): All costs at a glance

You won't generally find the TCO on any website or factsheet. That's because the TER and OCF have been agreed between the investment industry and the European Union, while there is no standard definition of the TCO. Nevertheless, investors should consider the TCO when selecting ETFs because the product with the cheapest TER isn’t necessarily the cheapest product you can buy. We'll tell you how to work out the TCO below.A look behind the scenes of cost figures

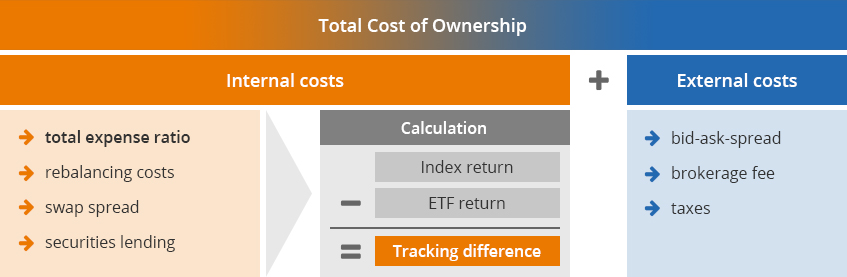

The TER and OCF include the ETFs annual management charge plus various other expenses including index licensing fees, legal fees, administration, marketing, regulation, auditing and so on. The TCO, meanwhile, captures extra internal costs that are missed by the TER including dealing fees, spreads and taxes or swap fees in case of synthetic replication, respectively, that are incurred on the ETFs underlying holdings. Gains from security lending are also attributed to it. These costs are an inevitable part of running any type of investment fund. On top of that come various external costs that are more visible to the investor: these include platform charges, dealing fees and the bid-offer spread you pay when you trade the ETF. Those external costs are relatively transparent because your platform must disclose its platform charges and dealing fees to you while you can check the bid-offer spread (the difference you sell and buy for - think buying foreign currency when you go on holiday) by looking up the prices of your ETF.Total Cost of Ownership for an ETF investment

Source: justETF Research

Tracking difference as cost figure

But how can you uncover the additional internal costs of the ETF if they’re not included in the TER? The answer is to look at the ETF’s tracking difference. Tracking difference is the discrepancy between an ETF’s returns and the returns of the index it aims to replicate. For example, if an index returns 10% and the ETF returns 9% then the tracking difference is 1%. In this example, the internal costs of the ETF thus lead to it realising a return 1 percentage point lower than the underlying index. And that 1% difference is effectively your TCO plus the external investor costs discussed above. Strangely, tracking difference can be in favour of the ETF on occasion. This is because an ETF can earn extra revenue from activities such as securities lending, or it can benefit from a more favourable tax regime than is taken into account by the calculation of the index return. It may even be because the ETF’s composition differs slightly from the index, and this plays out to the advantage of the ETF for a period. The best way to see the tracking difference is to chart your shortlist of ETFs against the index they follow over a longer time period. You may ignore any comparison below one year. However, it is difficult to find appropriate index data for a significant comparison like outlined above. Alternatively, you can compare the returns of several ETFs replicating the same index. Just choose the appropriate ETFs and chart them against each other. Usually, the one ETF with the highest returns - within several time periods - shows the lowest TCO. Please also note that such comparisons only refer to the past. Future performance may also differ. For example, it is possible that an ETF has only recently reduced its costs. Such a cost reduction would have little impact on a long-term historical view, but a very large impact on the future performance of the ETF. For this reason, you should consider the TER as an essential criterion when selecting an ETF - taking into account the limitations mentioned above.Our tip: For the most popular indices, we offer investment guides with clear comparisons and rankings of the available ETFs, such as for MSCI World ETFs.