The fundamental idea of buy and hold is to avoid excessive trading. Instead, you define a strategic asset allocation and follow it over years. This sets it apart from stock-picking and market timing.

But keeping the same portfolio strategy over years is a challenge in its own right. Even without active changes to your portfolio, its structure will drift over time. This is due to the market movements of the single portfolio positions. It can cause a major misalignment of your originally planned strategic asset allocation. If this happens, it is time for rebalancing. Positions with strong gains will proportionally be sold and positions that have lost in value will proportionally be bought. This will bring your portfolio back to your original asset allocation.

Free trial of rebalancing feature ![Free trial of rebalancing feature]()

Activate free trial now

justETF gives you the opportunity to test the rebalancing function free of cost and without obligation. How does the trial work?

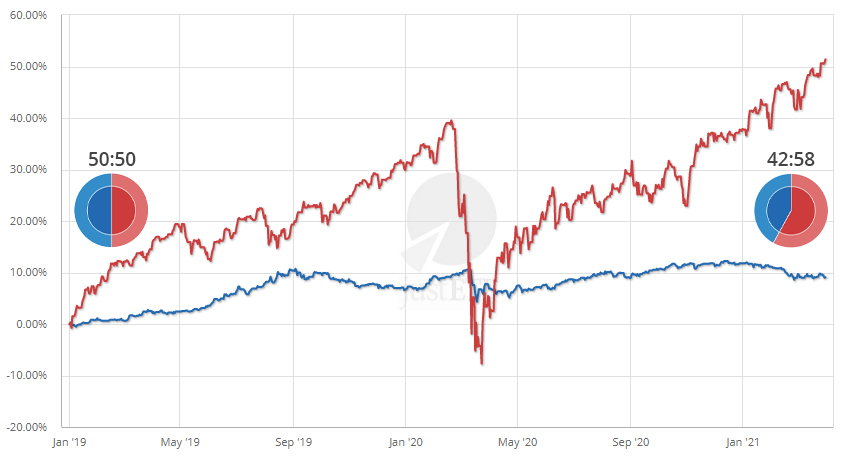

Change in the asset allocation of a simple 50:50 equity bonds portfolio

Equity Bonds

Source: justETF Research

We have created a simple sample portfolio of 50% equity and 50% bonds to illustrate portfolio rebalancing.

The sample portfolio shows a strong increase of 52% for the equity share. The bonds share only grew by 9% in value. This caused a shift in the asset allocation from a 50:50 distribution to a 58:42 distribution. As you can see from the chart, the equity share shows a much higher fluctuation (volatility) compared to the bonds share. This equates to a now higher overall risk of your portfolio.

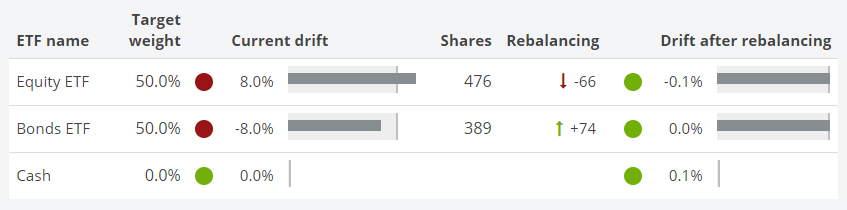

A rebalancing resets the portfolio to a 50:50 distribution. In the case of the sample portfolio, this means that 66 shares of the equity ETF should be sold and 74 shares of the bond ETF should be bought.

Portfolio rebalancing in the case of a 50:50 equity bonds portfolio with justETF

Source: justETF Research

Why does rebalancing make sense?

There are three good reasons why portfolio rebalancing will provide a benefit to you in the long run:Risk control

Just like the economy, the stock markets go through boom and bust periods. By this, it’s natural that in some periods your portfolio will hold a higher risk than actually planned. In our example portfolio above, the equity-bond distribution was already clearly tilted towards equities at the beginning of 2020. The price collapse in equities at the beginning of the Corona crisis in March 2020 would therefore have had a much greater impact on the portfolio than with the originally defined 50:50 distribution. Portfolio rebalancing helps you to steer your risk level in a simple manner; cost-efficient and time-saving.

Anti-cyclical investment decisions

Portfolio rebalancing tends to provide anti-cyclical buy and sell signals. This means you most likely will reduce positions in risky assets (like equity) in strong bull markets and increase them again in bear markets. This will result in a better long-term return. Even in this case, a look at our example portfolio helps to clarify the situation: the losses in the equity component in March 2020 would have been greatly reduced by a previous rebalancing (e.g. in 01/2020 in the course of a routine, annual rebalancing).

Investment discipline

Portfolio changes based on a rebalancing strategy eliminate the need for market timing. Actually, the market tells you when to become active. Therefore, it is an ideal strategy to avoid the common pitfalls of private investing.

How much does rebalancing cost?

Portfolio rebalancing is not free of charge. In general, it involves trading fees and possibly taxes on capital gains. Therefore, it is vital to watch out for the cost-benefit ratio of any rebalancing. If the costs are too high, it might make sense to only rebalance some positions or even completely skip it.Cash flow rebalancing with a contribution

Besides a classic portfolio rebalancing with buying and selling transactions, it might be reasonable to do a cash flow rebalancing in some cases. You simply rebalance the portfolio with a contribution of new money. This only requires buy transactions and avoids tax-impacting sell transactions.Classic portfolio rebalancing vs. cash flow rebalancing with a contribution

Sell transaction Buy transaction Contribution

Source: justETF Research