Let us analyze this scenario for you. We have carried out 11 simulations for a combined stock-bond portfolio with a share quota of 0% to 100%. The results are presented in the following.

Let’s start out first with the most aggressive portfolio: It invests up to 100% in stocks.

In order to obtain a result that is applicable in the most generic way possible, we have setup a simple back-test by using a representative financial index for the stocks and bonds a like. We have also not taken the costs and taxes into consideration.

On the stocks side, we use the MSCI world index. It is applicable as the leading index for the development of stock markets all over the world. With over 1600 stocks, it is a global and broad-based index. The stocks are weighted as per market capitalization and only the stocks from the industrial nations are taken into consideration.

We invest thereby from the point of view of the Euro-investor and observe the development of the value in Euros without hedging the currency risks.

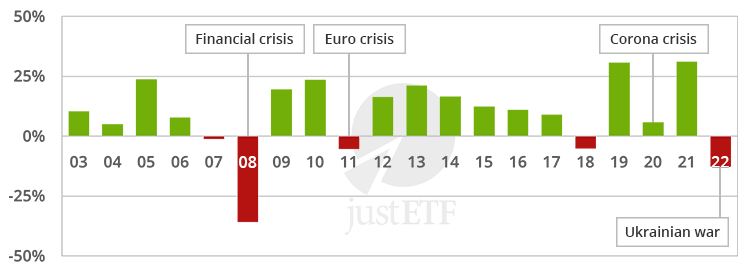

Development of global stocks (MSCI World) over a period of 20 years

Source: justETF.com

We had 10,000 € at the beginning of January 1996 in the simulation.

Stocks quadruplicate in spite of strong, temporary setbacks

At the bottom line, the investment has paid off: The value of the portfolio has quadruplicated until the end of 2015 to 43,875 €. The return per year is 7.7%.However, the investor who invested purely in stocks had to manage major setbacks during the observation period: the maximum temporary loss in the total period (maximum drawdown) was-53.7%.

In 2008, the year of the outbreak of the financial crisis, the investor lost -35.4%

The years 2000 to 2002 were particularly painful for the investor who had not diversified across asset classes: Three years in succession with negative results test the limits of the perseverance of an investor!

Many investors cannot deal with fluctuations that are as high as in the portfolio consisting only of stocks. The biggest risk is that the investor gets cold feet at the worst time and sells off his stocks with high losses.

If the market recovers, then the investor’s only option is to buy back at a more expensive rate and still remain stuck with the partial losses. In order to avoid this unfortunate but frequently occurring scenario, it is recommended to add bonds to the portfolio.

Addition of the German government bonds with annual rebalancing

In our simulation, we are conservative on the bonds-side: We invest in the German bonds index (RexP), the German government bonds with a validity of 1 to 10 years. The RexP is the leading index for the bonds in Germany, comparable with the Dax for the German stocks. As all the German government bonds are issued in Euros, there is no currency risk involved.The use of two (or more) asset classes brings a further change: the relative weightages of both asset classes fluctuate with market changes. In order to avoid a large deviation of the weightages from the starting level, we implement an annual Rebalancing.

The respective quota of shares is annually reset to the starting level by the model. For example, in the year 2008, if the stocks lose value while government bonds increase in value, then at the end of the year, we sell government bonds partially so as to top up the stock-side with the proceeds.

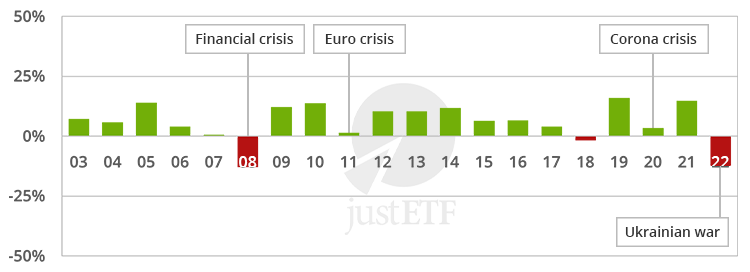

50:50 Stock-Bond portfolio over a period of 20 years

Source: justETF.com

With a quota of stocks of 50%, the losses in the observation period are much lower. Only 3 of the total of 20 years ended with a negative result.

In the weakest year (2008), the portfolio lost only -12.6% of the value (as compared to -35.4% in case of 100% stocks) absorbed by 50% bonds. The highest temporary loss in value was -23.5% (as compared to -53.7% in case of 100% stocks)

50:50 Stock-Bond combination with attractive rates of return and significantly fewer fluctuations

In spite of the low fluctuation (volatility), there was an attractive rate of return of 7.0% per year. From the initial 10,000 €, it became 38,412 €.The total result is thus somewhat weaker than in the case of the 100% stocks portfolio, but with significantly lesser temporary losses.

This was particularly a result of the very positive development of the bonds, which alone obtained a rate of return of 5% per year and with significantly lower risk than stocks. But rebalancing also played an important role here.

As depicted, we have not only simulated a portfolio with 100% and 50% stocks, but 11 portfolios in total with a quota of stocks from 0% to 100%

All the results have been summarized in the following tables.

Results for all the portfolio combinations of 1996 - 2016 for 10,000 €

| Share of stocks | Rate of return p.a. | Temporary Loss (Maximum Drawdown) |

Best Year | Worst Year | End value after 20 years |

|---|---|---|---|---|---|

| 0% | +5.0% | -4.8% | 1998 (+11.2%) | 1999 (-1.9%) | 26,771 € |

| 10% | +5.5% | -3.6% | 1998 (+11.8%) | 2006 (+1.1%) | 29,270 € |

| 20% | +5.9% | -4.0% | 1998 (+12.3%) | 2008 (+1.0%) | 31,733 € |

| 30% | +6.3% | -10.9% | 1997 (+14.8%) | 2008 (-3.5%) | 34,113 € |

| 40% | +6.7% | -17.4% | 1997 (+17.5%) | 2008 (-8.1%) | 36,357 € |

| 50% | +7.0% | -23.5% | 1999 (+21.5%) | 2008 (-12.6%) | 38,413 € |

| 60% | +7.2% | -29.4% | 1999 (+26.2%) | 2008 (-17.2%) | 40,223 € |

| 70% | +7.4% | -35.9% | 1999 (+30.9%) | 2008 (-21.7%) | 41,729 € |

| 80% | +7.6% | -41.9% | 1999 (+35.6%) | 2008 (-26.3%) | 42,876 € |

| 90% | +7.6% | -47.4% | 1999 (+35.6%) | 2008 (-26.3%) | 42,876 € |

| 100% | +7.7% | -53.7% | 1999 (+44.9%) | 2008 (-35.4%) | 43,875 € |

Source: justETF.com; MSCI World in € for stock proportion, RexP for bond proportion. Time: 31.12.1995 - 31.12.2015. Approval: Yearly rebalancing, no costs, no taxes.

All buy and hold portfolios have developed very positively in spite of the different crises and problems in the past 20 years. The more one invested in stocks in this time, the higher were the losses, which one had to forego temporarily as an investor. Simultaneously, the final profit increased at the end of 20 years.

Bonds with lower interest rate cannot be extrapolated for the future

The historical observations do not allow any extrapolations for the future.Especially in the area of bonds, one must expect weaker results with higher probability in the future: The ongoing rates of return of the German government bonds are currently at an all-time low and the interest rate is negative. Thereby, a high proportion of bonds in the portfolio must be calculated with significantly lower results.

However, the historical observations are very helpful with respect to susceptibility to fluctuations of the rate of returns. Also in the future, we expect a significantly higher fluctuation in the portfolios with a higher proportion of stocks.

Similarly, we expect that diversification and rebalancing will continue to have a positive effect on a portfolio in the future as well.