- Level: Advanced

- Reading duration: 6 minutes

What to expect in this article

What is Proxy voting?

Did you know that ETF investors can vote upon the affairs of some of the largest companies in the world? That’s because the shares bought by ETFs on your behalf typically come with voting rights. And those rights can be used by shareholders to cast their votes on, for example, executive compensation at Apple. Or who’s on the board at Tesla. Or acquisition proposals at Nvidia or ESG resolutions at Google. The more shares you own in a company, the more votes you have. Shareholder meetings don’t work like democracy. But legally-speaking, your personal voting authority is delegated to your ETF (and the same is true of all other collective investment fund types). So it’s up to the likes of Blackrock (who own iShares), Vanguard, Amundi and other asset managers to vote your shares. What’s more, those asset managers are entitled to aggregate their investors’ holdings into large bloc votes. Which gives the biggest fund providers a powerful voice at shareholder meetings around the globe. However, the biggest ETF managers are now taking steps to hand over their votes to the ultimate owners of the shares - that’s you, me, and everyone else who invests in their products. Why? Because their voting power has become the stuff of conspiracy theories and political opportunism, especially in the US.What’s going on?

In brief, the conspiracy theory is that Blackrock and Vanguard control the most important public companies in the US. The conspiracists assert that Blackrock and Vanguard are controlled by a shadowy elite, who use their nefarious power to force companies to comply with a wokeist agenda. For example - according to the conspiracists - US companies are forced to cut their carbon emissions and meet diversity quotas.What’s the evidence?

Blackrock and Vanguard are listed as significant shareholders of most companies in the S&P 500. Along with State Street, these three giant asset managers held, on average, a 22 % stake in S&P 500 companies in 2021. However, the conspiracy theorists didn’t bother to look into who actually owns Vanguard or Blackrock. If they had, their theory may not have gone viral because the truth is not so shadowy. We’ll come back to that shortly. Sometimes Blackrock and Vanguard do vote in favour of ESG policies such as reducing greenhouse gases and promoting gender equality on company boards. That fact has been exploited by politicians waging the US culture war. Regardless of whether you think reducing carbon and increasing gender equality is a good thing to do, the voting record of Blackrock and Vanguard is publicly available. But the facts don’t square with politicians’ claims that companies are being forced to adopt policies against their will. More below on that.Why the conspiracy theorists are wrong

Why do the firms that run the world’s largest ETFs and index funds hold so many shares in S&P 500 companies? Because everyday investors like you and me (along with giant investment institutions such as pensions funds) have poured money into passive investing products. That money buys shares in the public companies listed on the world’s major stock markets (and tracked by indexes such as the S&P 500.) The owners of those shares must then be registered. Option A: Is to list the millions of people who’ve invested in ETFs and funds across the thousands of companies they’ve bought shares in. This option means you’d need to adjust the shareholder’s record for each company, every time each person traded. Expensive. Option B: Record the fund managers as shareholders instead, and create a legal structure that enables them to hold the assets on their investors’ behalf. Less expensive. Option B was chosen to make the administration of funds feasible - long before the world benefited from digital technology. Even today, option B is a cheaper and more convenient way of tracking share ownership. And as we know, the lower our costs, the better our investment results. So Blackrock and Vanguard have become large shareholders because of an administrative convenience. And because millions of investors choose their passive investing products to buy shares through. But it’s the millions of investors who really own the underlying shares. You can check this by comparing a fund manager's assets under management (AUM) with its market capitalisation.- AUM tracks the value of all assets held within a fund or a family of funds.

- Market capitalisation is the total value of a company as measured by its share price multiplied by the number of its tradable shares. In other words, market cap is what the stock market thinks a company is worth.

- Blackrock’s market cap is listed as $156.92 billion. Source: Forbes. 16 Jan 2025.

- Blackrock’s assets under management are listed as $11.6 trillion. Source: Reuters. 15 Jan 2025.

Does a shadowy elite own Blackrock and Vanguard?

You can look this up too. Blackrock is a public company so it is owned by its shareholders. The majority of Blackrock shareholders are institutions. That means other asset managers (banks, pension companies, fund firms etc) who hold Blackrock shares for their investors. For example, Vanguard is the main institutional shareholder in Blackrock. Meanwhile, Blackrock is also listed as a shareholder in itself. Why? Because Blackrock is an S&P 500 company and so must be bought by its own ETFs and funds that invest in large US stocks. All of which means that Blackstock is majority-owned by the millions of investors who buy its shares - mainly through ETFs and funds. Vanguard, on the other hand, is directly owned by its US domiciled funds in a mutual structure. Those funds are in turn owned by their shareholders i.e. the millions of people who invest them. To sum that up: Vanguard is owned by its customers in America. (We should clarify that Vanguard’s mutual ownership model only extends to its US funds. The company’s European customers do not own Vanguard itself.)Do Blackrock and Vanguard force companies to act against their will?

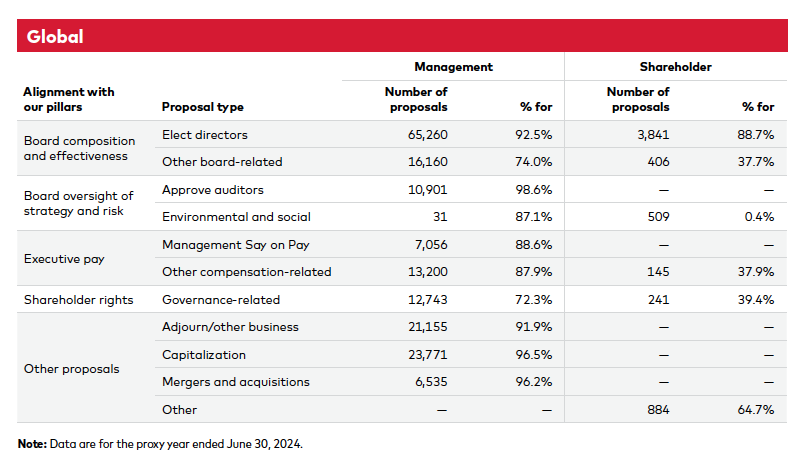

There’s a simple test. Every proposal that shareholders can vote upon typically comes with a management recommendation: either “for” or “against”. The management recommendation indicates the course that the senior leadership team believes is best for the company. (Sure, some management teams don’t always act in their shareholders’ best interest. But mostly you can expect management and shareholders interests to be aligned.) If Blackrock and Vanguard overwhelmingly vote against management recommendations, then that would add credence to the charge that they are imposing their own agenda upon Corporate America. So do Blackrock and Vanguard force companies to act against their own wishes? In a word, “No.” Blackrock voted in favour of management recommendations 87 % of time according to BlackRock Investment Stewardship 3Q 2024 statistics. Vanguard don’t provide an overall number, but you can see that they vote in favour of management proposals the vast majority of the time (Management % for column):Vanguard Investment Stewardship 2024

Source: Vanguard Investment Stewardship 2024 Proxy Year Voting Report.

When you dig into the numbers, it’s impossible to genuinely conclude that Vanguard and Blackrock are pulling the strings. In fact, it’s just the opposite. Mostly they wave through management proposals.

And if you’re worried about a woke-ist plot, you can read independent assessments of the big asset manager’s support for ESG proposals. Spoiler alert: Vanguard’s support is rated as “Low” and Blackrock’s as “Medium”.

There’s nothing secretive about any of this.

- Blackrock reports their voting track record here.

- You can verify it at this third-party site.

- Vanguard reports their voting track record here.

- You can verify it at this third-party site.

Individual investor voting

All the same, conspiracy theories can take on a life of their own. Hence Blackrock and Vanguard have taken steps to show they’re not interested in ruling the world. They’re doing this by giving investors the opportunity to assert their own preferences through a choice of “voting policies”. The range of policies enables investors to select a voting posture that best expresses their values and objectives. For example, you might choose between:- An ESG policy

- A company board-aligned policy

- A shareholder value maximisation policy

- Or your asset manager’s policy