Your selection basket is empty.

Define a selection of ETFs which you would like to compare.

Add an ETF by clicking "Compare" on an ETF profile or by checkmarking an ETF in the ETF search.

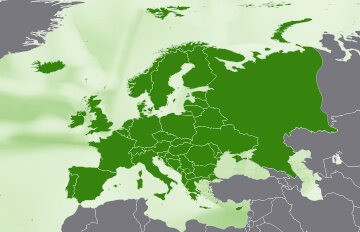

The easiest way to invest in the whole European stock market is to invest in a broad market index. This can be done at a low cost by using ETFs.

In this curated investment guide, you will find all ETFs that allow you to invest broadly diversified in European stocks. Currently, there are 18 ETFs available.

The total expense ratio (TER) of ETFs tracking stocks from Europe is between 0.05% p.a. and 0.25% p.a..

Source: justETF Research; As of 05/01/2026; Performance over 1 year in GBP.

| Index | Investment focus | Number of ETFs | Number of constituents | Short description |

|---|---|---|---|---|

| FTSE Developed Europe | Europe | 2 ETFs | 525 (28/06/2024) | The FTSE Developed Europe index tracks large and mid cap stocks from developed countries in Europe. Index factsheet |

| MSCI Europe | Europe | 12 ETFs | 403 (28/11/2025) | The MSCI Europe index tracks the leading stocks from 15 European industrial countries. Index factsheet |

| STOXX® Europe 600 | Europe | 3 ETFs | 600 | The STOXX® Europe 600 index tracks the 600 largest European companies. Index factsheet |

| Solactive GBS Developed Markets Europe Large & Mid Cap | Europe | 1 ETF | 421 (28/06/2024) | The Solactive GBS Developed Markets Europe Large & Mid Cap index tracks large and mid cap securities from European countries. Index factsheet |

| Index | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | 5 years in % |

|---|---|---|---|---|---|---|

| Solactive GBS Developed Markets Europe Large & Mid Cap | 2.53% | 6.47% | 12.75% | 26.10% | 49.50% | 67.77% |

| FTSE Developed Europe | 2.53% | 6.41% | 12.53% | 26.20% | 50.35% | 67.18% |

| MSCI Europe | 2.73% | 6.56% | 12.64% | 26.42% | 49.41% | 67.83% |

| STOXX® Europe 600 | 2.50% | 6.37% | 12.38% | 26.46% | 49.56% | 65.58% |

Source: justETF.com; As of 31/12/2025; Calculations in GBP based on the largest ETF of the respective index.

| ETF ISIN | Fund size in m GBP | TER in % | Inception date | Use of profits | Fund domicile | Replication method |

|---|---|---|---|---|---|---|

| Amundi Core Stoxx Europe 600 UCITS ETF AccLU0908500753 | 13,203 | 0.07% p.a. | 03/04/2013 | Accumulating | Luxembourg | Full replication |

| iShares Core MSCI Europe UCITS ETF EUR (Acc)IE00B4K48X80 | 12,218 | 0.12% p.a. | 25/09/2009 | Accumulating | Ireland | Optimized sampling |

| iShares Core MSCI Europe UCITS ETF EUR (Dist)IE00B1YZSC51 | 9,170 | 0.12% p.a. | 06/07/2007 | Distributing | Ireland | Optimized sampling |

| Xtrackers MSCI Europe UCITS ETF 1CLU0274209237 | 6,130 | 0.12% p.a. | 10/01/2007 | Accumulating | Luxembourg | Full replication |

| Vanguard FTSE Developed Europe UCITS ETF DistributingIE00B945VV12 | 3,677 | 0.10% p.a. | 21/05/2013 | Distributing | Ireland | Full replication |

| Amundi Core MSCI Europe UCITS ETF AccLU1437015735 | 3,381 | 0.12% p.a. | 29/06/2016 | Accumulating | Luxembourg | Full replication |

| Xtrackers STOXX Europe 600 UCITS ETF 1CLU0328475792 | 2,991 | 0.20% p.a. | 20/01/2009 | Accumulating | Luxembourg | Full replication |

| Vanguard FTSE Developed Europe UCITS ETF (EUR) AccumulatingIE00BK5BQX27 | 1,802 | 0.10% p.a. | 23/07/2019 | Accumulating | Ireland | Full replication |

| UBS Core MSCI Europe UCITS ETF EUR disLU0446734104 | 770 | 0.06% p.a. | 05/10/2009 | Distributing | Luxembourg | Full replication |

| Amundi MSCI Europe UCITS ETF AccFR0010261198 | 512 | 0.25% p.a. | 09/01/2006 | Accumulating | France | Full replication |

| Amundi Core MSCI Europe UCITS ETF DistLU1737652310 | 441 | 0.12% p.a. | 19/12/2017 | Distributing | Luxembourg | Full replication |

| Invesco STOXX Europe 600 UCITS ETFIE00B60SWW18 | 418 | 0.19% p.a. | 01/04/2009 | Accumulating | Ireland | Unfunded swap |

| SPDR MSCI Europe UCITS ETFIE00BKWQ0Q14 | 325 | 0.25% p.a. | 05/12/2014 | Accumulating | Ireland | Full replication |

| HSBC MSCI Europe UCITS ETF EURIE00B5BD5K76 | 279 | 0.10% p.a. | 01/06/2010 | Distributing | Ireland | Full replication |

| Amundi Prime Europe UCITS ETF DR (D)LU1931974262 | 175 | 0.05% p.a. | 30/01/2019 | Distributing | Luxembourg | Full replication |

| UBS Core MSCI Europe UCITS ETF EUR accLU0950668524 | 81 | 0.06% p.a. | 04/08/2025 | Accumulating | Luxembourg | Full replication |

| HSBC MSCI Europe UCITS ETF EUR (Acc)IE000ZQOIPB1 | 65 | 0.10% p.a. | 12/07/2022 | Accumulating | Ireland | Full replication |

| Invesco MSCI Europe UCITS ETFIE00B60SWY32 | 55 | 0.19% p.a. | 23/03/2009 | Accumulating | Ireland | Unfunded swap |

| ETF ISIN | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | 5 years in % |

|---|---|---|---|---|---|---|

| Amundi Core Stoxx Europe 600 UCITS ETF AccLU0908500753 | 2.50% | 6.37% | 12.38% | 26.46% | 49.56% | 65.58% |

| iShares Core MSCI Europe UCITS ETF EUR (Acc)IE00B4K48X80 | 2.73% | 6.56% | 12.64% | 26.42% | 49.41% | 67.83% |

| iShares Core MSCI Europe UCITS ETF EUR (Dist)IE00B1YZSC51 | 2.72% | 6.57% | 12.59% | 26.34% | 49.37% | 67.78% |

| Xtrackers MSCI Europe UCITS ETF 1CLU0274209237 | 2.00% | 6.08% | 12.01% | 26.34% | 48.69% | 67.50% |

| Vanguard FTSE Developed Europe UCITS ETF DistributingIE00B945VV12 | 2.53% | 6.41% | 12.53% | 26.20% | 50.35% | 67.18% |

| Amundi Core MSCI Europe UCITS ETF AccLU1437015735 | 2.38% | 6.19% | 12.23% | 25.95% | 48.66% | 66.92% |

| Xtrackers STOXX Europe 600 UCITS ETF 1CLU0328475792 | 2.49% | 6.36% | 12.33% | 26.30% | 49.26% | 64.90% |

| Vanguard FTSE Developed Europe UCITS ETF (EUR) AccumulatingIE00BK5BQX27 | 2.51% | 6.40% | 12.52% | 26.20% | 50.35% | 67.18% |

| UBS Core MSCI Europe UCITS ETF EUR disLU0446734104 | 2.37% | 21.66% | 12.27% | 26.04% | 48.86% | 66.83% |

| Amundi MSCI Europe UCITS ETF AccFR0010261198 | 2.35% | 6.17% | 12.19% | 25.86% | 48.28% | 65.85% |

| Amundi Core MSCI Europe UCITS ETF DistLU1737652310 | 2.37% | 6.19% | 12.23% | 25.93% | 48.64% | 66.91% |

| Invesco STOXX Europe 600 UCITS ETFIE00B60SWW18 | 2.46% | 6.26% | 12.15% | 26.23% | 48.99% | 64.09% |

| SPDR MSCI Europe UCITS ETFIE00BKWQ0Q14 | 2.35% | 6.14% | 12.11% | 25.77% | 48.36% | 66.13% |

| HSBC MSCI Europe UCITS ETF EURIE00B5BD5K76 | 2.33% | 6.15% | 12.16% | 25.86% | 48.79% | 67.04% |

| Amundi Prime Europe UCITS ETF DR (D)LU1931974262 | 2.53% | 6.47% | 12.75% | 26.10% | 49.50% | 67.77% |

| UBS Core MSCI Europe UCITS ETF EUR accLU0950668524 | 2.44% | 6.22% | - | - | - | - |

| HSBC MSCI Europe UCITS ETF EUR (Acc)IE000ZQOIPB1 | 2.38% | 6.18% | 12.15% | 25.88% | 48.83% | - |

| Invesco MSCI Europe UCITS ETFIE00B60SWY32 | 2.36% | 6.14% | 12.14% | 25.80% | 48.32% | 66.14% |

Source: justETF.com; As of 31/12/2025