How can they do this to Google and what is Google now in this brave new world of stock market classification? The answers are to be found in the new Global Industry Classification Standard (GICS) that was issued on 28 September 2018. The GICS is the joint attempt by MSCI and S&P to group the multitude of companies that inhabit the stock market ecosystem.

The world according to GICS, divides global stock markets into eleven different sectors such as Financials, Healthcare, Utilities and so on. Companies are split into these pots which can then be used to assess the diversification of big indices such as the MSCI World or the S&P 500 in much the same way as you can divide by geography or market cap.

But which sector should a company belong to? The bulk of Google’s sales are from advertising, so is it really a tech firm? Is Amazon a tech company or a retailer? Is Netflix a tech stock or a media stock? In a fast-changing world where companies and business models must quickly respond to new dynamics, it’s far from obvious which buckets many companies should fit into.

That’s why the GICS is subject to review and why this time an entirely new sector is being invented.

What’s the new sector?

The new sector is called Communication services and this is where the likes of Alphabet (Google) and Facebook now live.Communications Services is intended to reflect the new alliance of technology, media and communications that has emerged in the age of digital disruption.

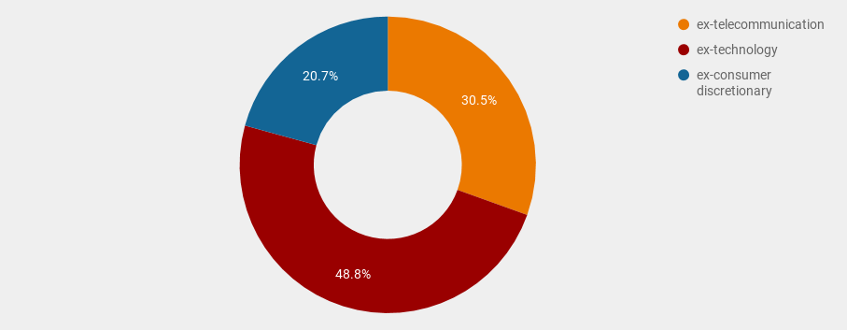

It’s the product of a merger between the Telecommunications sector and parts of Information Technology and Consumer Discretionary. The Telecommunications sector is eliminated entirely while former members of Technology and Consumer discretionary make up 70% of the new sector in the MSCI ACWI IMI and around 80% in the S&P 500.

How the Communication services sector is created in the MSCI ACWI IMI

Source: justETF Research; MSCI

The Technology sector now only contains companies that S&P and MSCI define as having technology as part of their core business. Neither Facebook nor Alphabet (Google) qualify because they focus on communication and advertising. Their technology is merely a platform that enables their core services.

How the changes affect the sectors

Around 21% of the market value of the Technology sector has shifted into Communications services, including heavyweights such as Tencent, Twitter and Activision.They’re joined by Netflix, Disney and Comcast as around 14% of the market value of Consumer discretionary reflows into the new sector.

The old Telecommunications sector is completely absorbed which adds big hitters like AT&T and Verizon to the new line-up. The net effect is Communications Services will account for approximately 8% of MSCI ACWI-IMI market capitalisation from November 2018.

How the old sectors are changing in the MSCI ACWI IMI

Source: justETF Research; MSCI

It will be interesting to see how viewing stock markets through the new lens will change investor sentiment. To take one example, the old S&P 500 Telecommunications sector looked very cheap by price-earnings ratio (P/E ratio):

P/E ratios – selected S&P 500 sectors

| Sector | Pre-change P/E | Post-change P/E |

|---|---|---|

| Technology | 19.5 | 18.1 |

| Consumer discretionary | 21.4 | 26.8 |

| Telecommunication | 6.6 | - |

| Communication services | - | 15.7 |

Source: justETF Research; SPDR

After the reclassification, the Telecommunications play seems to disappear as Communications services are dominated by the heady valuations of its Technology and Consumer discretionary members. No doubt other opportunities will become apparent as the changes bed in but it’s worth reminding ourselves that how we define the world has the capacity to alter how we see it.

Which indices are affected by the sector changes?

If you invest in ETFs that track broad stock market indices then you can relax. MSCI World and S&P 500 ETFs include every sector so the GICS change is no more than a rearrangement of the deck chairs. The equities included in your tracker and their respective weights remain the same. Only the industry affiliation of some companies changes and that has no impact on your returns or risk.But you need to be alive to the restructure if you invest in sector ETFs. The first thing to note is that it’s only ETFs that track MSCI and S&P indices that are affected. For example, ETFs that track STOXX Telecommunications indices won’t change one jot because STOXX doesn’t subscribe to the GICS standard.

Meanwhile, ETFs following MSCI or S&P Telecommunications indices are expected to map straight to the new Communications Services sector. That will change the nature of your holding. At current valuations, the huge market capitalisation of Facebook and Alphabet (Google) will make up 40-50% of Communications Services ETFs, depending on index methodology. The two Silicon Valley giants have rich P/E ratios which will pump up the P/E ratio of the reorganised ETFs too.

You should also take a good look at your tech investments. The chain reaction of changes will impact indices such as the MSCI World Information Technology, S&P 500 Information Technology and the MSCI Europe Technology. Ask yourself if those indices still work for you once shorn of their major league constituents.

Remember these changes do not apply if your ETF’s index provider is not MSCI or S&P. Then again, if you like the sound of the new sector, take a look at the SPDR S&P U.S. Communication services Select Sector UCITS ETF. It provides exposure to the Communications Services sector of the US stock market and has been available to European investors since mid-August.