Whatever your reasons for choosing sector ETFs, it's vital to know how they are invested – which as always with ETFs means understanding the indices being tracked by a sector ETFs' underlying holdings, and how those indices classify the tens of thousands of investable stocks available into different sectors.

Two sector classification schemes

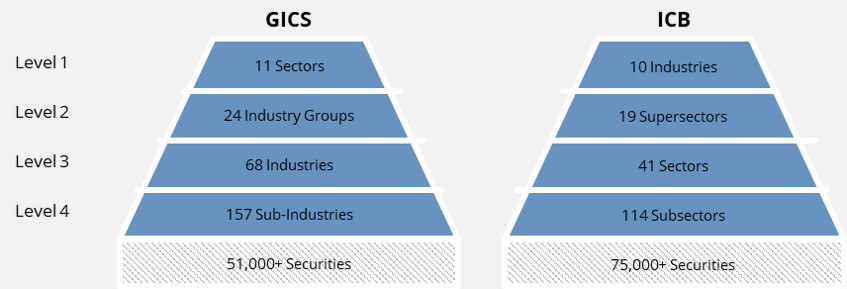

The main providers of sector indices – MSCI and STOXX Limited – base their indices on one of two different internationally recognised sector classification schemes:- The Global Industry Classification Standard (GICS), which divides 51,000 securities into 11 sectors, 24 industry groups, 68 industries and 157 sub-industries.

- The Industry Classification Benchmark (ICB), which classifies 75,000 securities into 10 industries, 19 supersectors, 41 sectors, and 114 subsectors.

GICS vs. ICB classification at a glance

Source: MSCI; ICB Benchmark; March 2018 STOXX Limited and FTSE use the ICB system as the basis for their indices, while MSCI and S&P employ GICS.

How the sector classification schemes work

Both schemes are based on a hierarchy of groupings – from broad sector classifications down to more specialist niches.You can think of it as similar to how we classify the animal kingdom into family, genus, species and so on.

For example, companies (i.e. stocks) that derive the majority of their revenue from aerospace operations are placed by the ICB scheme…

- … into the Aerospace Subsector

- … which is part of the Aerospace and Defense Sector

- … which is in the Industrial Goods and Services Supersector

- … which sits within the Industrials Industry

You can see that the top level under the GICS system is 'Sector', which is the third level of the hierarchy under the ICB system. Yet these are just labels – the ICB's 'Industry' level is functionally the same as the GICS 'Sector' level.

And of course commentators – including us – employ the word 'sector' to refer to all sorts of different industry groupings, not just to the specific meaning under the GICS or ICB methodologies.

Top level sectors/industries of GICS and ICB in comparison

| GICS | ICB | Filter for ETFs |

|---|---|---|

| Energy | Oil and Gas | Show ETFs |

| Materials | Basic Materials | Show ETFs |

| Health Care | Health Care | Show ETFs |

| Industrials | Industrials | Show ETFs |

| Financials | Financials | Show ETFs |

| Information Technology | Technology | Show ETFs |

| Telecommunication Services | Telecommunication | Show ETFs |

| Utilities | Utilities | Show ETFs |

| Consumer Staples | Consumer Goods | Show ETFs |

| Consumer Discretionary | Consumer Services | Show ETFs |

| Real Estate | - | Show ETFs |

Up in the air

While the two classification schemes are superficially fairly similar, there are some real differences as you dig down into how they each categorize certain industries – and hence where those industries sit in their respective groupings.- For instance the ICB places Airlines in its Travel & Leisure Sector.

- In contrast, the GICS system has Airlines in its Airlines Industry category, which is part of its Transportation Industry Group.

Rather, we want to highlight why you do need to thoroughly research an ETF before buying it to ensure it will correctly expose you to the performance of the kind of stocks you're looking for.

Sectors, regions, and optimized ETFs

In practical terms, while the deeper levels of the sector classification hierarchies are important to know about, only the higher levels of the GICS and ICB are actually investable through ETFs.See the table below for an overview of what's currently available.

One more wrinkle is that sector ETFs come in regional and global flavours.

For example, Xtrackers has sector ETFs focused on the MSCI Emerging Markets base index, as well as MSCI World.

Again, please see the table below.

There are also sector ETFs that track 'optimized' and 'capped' versions of certain indices.

For instance Source offers sector ETFs based on the STOXX Europe 600 optimized index.

ETFs tracking these optimized indices may offer risk management benefits over ETFs that track standard indices, as they limit the total exposure the fund will have to any one company.

Investors may also prefer them for the potentially superior liquidity of their underlying holdings.

Finding the right sector ETF

justETF's screening tool will help you to find the ETF that's most appropriate to your needs.You can use its drop-down filter to search for ETFs by sector and further restrict your search by region or country.

You can then research the different ETFs listed by noting what index they track and thus which classification scheme they're based on.

There are also convenient links to ETF factsheets, which will tell you more about how the ETF is invested and - where applicable - its top holdings.

All this research enables you to ensure you're buying the right product for your needs.

An overview of the range of sector ETFs

| Region | Base index | Number of investable sectors on base index | ETF provider | Costs |

|---|---|---|---|---|

| Developed markets | MSCI World | 10 | Xtrackers, Lyxor, Amundi, SPDR | 0.30% - 0.35% |

| Europe | STOXX Europe 600 | 10 + 8 sub sectors | Xtrackers, iShares, Lyxor | 0.30%- 0.50% |

| Europe | STOXX Europe 600 Optimised | 10 + 8 sub sectors | Source | 0.30% |

| Europe | MSCI Europe | 10 + 2 sub sectors | SPDR, Amundi | 0.25% - 0.30% |

| USA | S&P Select Sector Capped 20% | 9 | Source | 0.30% |

Source: justETF.com; As of 20/03/18