PEPP TAA Tactical Asset Allocation

Portfolio Description

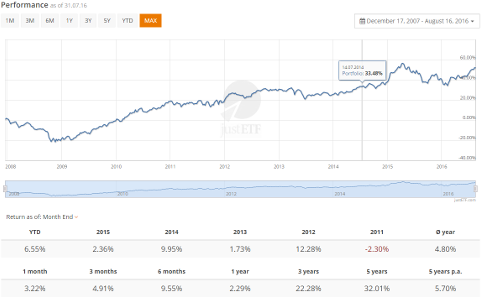

This portfolio follows the principles of Tactical Asset Allocation. Once a quarter the composition of ETFs in the strategy is realocated to fit the actual market expectations on business cycle development: Slowdown -> Recession -> Recovery -> Expansion reflecting actual expectations on growth and inflation in major world economies. As of the end of September is the composition of ETFs in the strategy is set to capture end of recession expectations and start of the recovery in US, keeping the rest of the investable world underweighted.

0,21%

Fund fees

p.a.

p.a.

20,78%

Return 1 year

11,29%

Volatility 1 year

EUR

Currency

10

Nombre de fonds

Risk category

Allocation in detail

| Asset class / Fund name | Chart 4 weeks | TER in % p.a. | Weight in % | |

|---|---|---|---|---|

| Actions, Monde, Technologie Show fund selection | | 0,30% | 10,00% | |

| Actions, États-Unis, Biens de consommation cycliques Show fund selection | | 0,15% | 8,00% | |

| Actions, Monde Show fund selection | | 0,17% | 35,00% | |

| Actions, États-Unis, Small Cap Show fund selection | | 0,30% | 8,00% | |

| Actions, États-Unis, Industrie Show fund selection | | 0,15% | 8,00% | |

| Actions, Monde, Matières premières Show fund selection | | 0,25% | 4,00% | |

| Actions, États-Unis, Pondéré/équipondéré Show fund selection | | 0,30% | 10,00% | |

| Obligations, EUR, Monde, Obligations d’entreprise, Toutes les durées Show fund selection | | 0,20% | 8,00% | |

| Obligations, USD, Monde, Obligations d’entreprise, Toutes les durées, Social/durable Show fund selection | | 0,16% | 5,00% | |

| Immobilier, États-Unis Show fund selection | | 0,14% | 4,00% | |

| Portefeuille | 0,21% | 100,00% | ||

Login now

Learn more about the historic returns of this portfolio in the login area.

Login nowDon't have an account yet? Sign up, its free.