Globálne megatrendy. Vysoko dynamická investičná akciová stratégia pepp.sk

Portfolio vytvorené správcom stratégie PEPP . SK na platforme European Investment Centre Komu je portfólio určené Portfólio je určené EUR investorom s dlhým investičným horizontom 10-15 rokov a vysokou toleranciou k riziku. 100% tvoria globálne akciové ETF zamerané na technologické trendy budúcnosti: Popis stratégie Vysoko dynamické portfólio, ktoré minimalizuje správcovské poplatky a odstraňuje daňové povinnosti. Investujte do najväčších globálnych megatrendov: blockchain, fintech, robotika, digitálna bezpečnosť, inovatívne technológie v zdravotníctve a biotechnológie, future mobility, cloud conputing, polovodiče, videohry a elektronické športy.

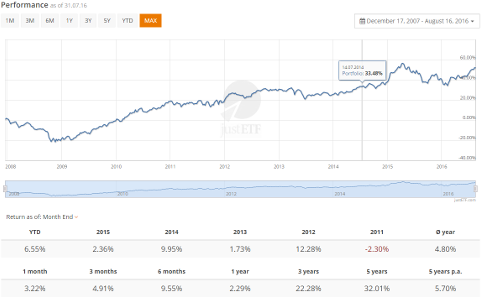

p.a.

| Asset class / Fund name | Chart 4 weeks | TER in % p.a. | Weight in % | |

|---|---|---|---|---|

| Actions, Monde, Technologie, Social/durable Show fund selection | | 0,45% | 10,00% | |

| Actions, Monde, Technologie Show fund selection | | 0,65% | 10,00% | |

| Actions, États-Unis, Technologie Show fund selection | | 0,49% | 10,00% | |

| Actions, Monde, Technologie, Social/durable Show fund selection | | 0,40% | 10,00% | |

| Actions, Monde, Technologie, Social/durable Show fund selection | | 0,40% | 10,00% | |

| Actions, Monde, Santé, Social/durable Show fund selection | | 0,40% | 10,00% | |

| Actions, États-Unis, Santé Show fund selection | | 0,35% | 10,00% | |

| Actions, Monde, Technologie, Social/durable Show fund selection | | 0,35% | 10,00% | |

| Actions, Monde, Technologie, Social/durable Show fund selection | | 0,55% | 10,00% | |

| Actions, États-Unis, Technologie Show fund selection | | 0,40% | 10,00% | |

| Portefeuille | 0,44% | 100,00% | ||

Learn more about the historic returns of this portfolio in the login area.

Login nowDon't have an account yet? Sign up, its free.