The compound interest effect refers to the snowball of money that grows on your behalf when you reinvest your interest.

The compound interest effect: Interest on interest

An interest (or dividend) payment you put to work in the market today will generate more interest for you tomorrow. That’s because your interest also earns interest. And the longer you give your interest to pile up, the mightier your snowball becomes. Let’s look at a practical example to illustrate the compound interest effect...If you invest £10,000 at a 5% rate of return then you will earn £16,288.95 over ten years, not just £15,000.

The compound interest effect creates an extra £1,288.95 that you would not have earned if you had just spent the interest every year.

The effect becomes more powerful over time.

Imagine that an investor - we’ll call him David - wants to save up a nest egg of £100,000 by the time he retires at age 65.

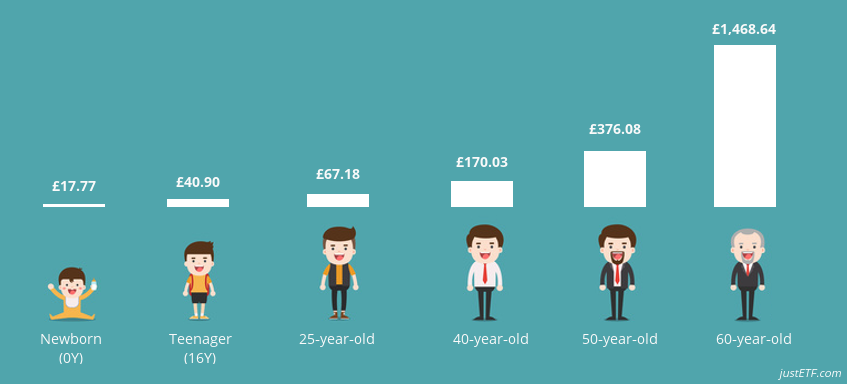

The chart below shows how much David needs to put away to reach his goal depending on how soon he starts saving. (We assume an annual growth rate of 5%, which is quite conservative by the standards of the last 40 years.)

Monthly savings required to reach £100,000 by age 65

The key takeaway is that the longer compound interest gets to work its magic, the less David needs to pay in himself.

If David does nothing until age 60 then he needs to find a whopping £1,468.64 per month to hit his target. There is little time for compound interest to help his cause.

But if some kindly relative starts saving for David from the day he is born then only £17.77 needs to be found a month – a snip for David to save himself once he starts earning.

Even if David waits until age 25 then he need only put aside a modest £67.18 per month to reach £100,000 by 65.

The difference in required savings between each of the start dates is how much of the £100,000 is taken care of by your accumulating interest payments.

Even small contributions can snowball if compound interest is given enough time to generate its own momentum.

Let your money do the work

If you start early enough then compound interest payments will eventually surpass the amount of money that you pay in.Returning to our David example, you can see below how much of his £100,000 target comes from compound interest (orange bar) versus paid in savings (white bar).

How time and interest work together

David would only need to save £13,856.99 over the course of his life to hit £100,000 if those kindly relatives get him going as a newborn.

In this scenario, David’s interest payments are 6.2 times greater than his actual paid in savings! Compound interest does the vast majority of the work – bringing home £86,143.01 without David having to lift a finger.

The 25-year-old David is in a comfortable position as well. About two-thirds of his £100,000 comes from interest payments. He only has to personally find £32,245.83.

| Age Bracket | Age | Time left until retirement | Necessary monthly saving | Paid in capital | Interest payments |

|---|---|---|---|---|---|

| Newborn | 0 | 65 | £17.77 | £13,856.99 | £86,143.01 |

| Teenager | 16 | 49 | £40.90 | £24,047.82 | £75,952.18 |

| 25-year-old | 25 | 40 | £67.18 | £32,245.83 | £67,754.17 |

| 40-year-old | 40 | 25 | £170.03 | £51,009.92 | £48,990.08 |

| 50-year-old | 50 | 15 | £376.08 | £67,693.73 | £32,306.27 |

| 60-year-old | 60 | 5 | £1,468.64 | £88,118.64 | £11,881.36 |

An early start benefits you in the long run

The earlier you can start saving, the more compound interest will do the heavy lifting for you.It’s one of the most valuable yet underestimated factors in an investor’s long-term plan because its effect is relatively imperceptible at first. Compound interest is the financial equivalent of the old Chinese saying: The man who moves a mountain begins by carrying away small stones.

The greater your return on investment, the more powerful the compound interest effect becomes, which is why it’s best leveraged by reinvesting the profits you make in the stock market.

Even small monthly contributions will be sufficient to save £100,000 and more over time. Monthly saving is made easy when you use ETF saving plans. They enable you to invest a regular amount into a diversified basket of stocks such as an MSCI World ETF.