We condensed for you the first two quarters of 2017, from a UK investor’s point of view.

In the last six months, like in 2016, the stock markets were heavily influenced by political events. Especially, the elections in the Netherlands and France fuelled the fear of the Eurozone breaking apart, and repeatedly caused turmoil on the global markets.

In contrast to 2016, the pollsters’ prognoses were mostly correct, wherefore, a lasting plunge has not occurred.

The central banks still play an important role, as they still fuel the stock markets with low interest rates. The Fed has already raised interest rates slightly, and plans further steps in the coming months. Whereas the ECB has not yet decided to tighten up the monetary policy. The ECB intends to continue buying government bonds at least until December 2017.

MSCI Emerging Markets outruns MSCI World

After January 1st, the MSCI World pursued no clear direction, while the MSCI Emerging Markets already made a strong move.The MSCI World reached its peak on June 20th, at 7.9 percent.

The MSCI Emerging Markets peaked on June 26th, at 15.2 percent.

Within the last few days of June, both indices plummeted, whereby the MSCI World closed at a plus of 5 percent, while the MSCI Emerging Markets closed at 12.5 percent.

MSCI World vs. MSCI Emerging Markets in the first half of 2017

MSCI Emerging Markets MSCI World

Source: justETF.com; 30/06/17; Information in GBP, based on the largest ETF of the respective Index.

Europe is leading major global markets

European stocks have delivered the best performance among the major markets USA, Japan and Europe. While the development of the three regions was quite similar until the end of April, the MSCI Europe outperformed its peers from late April on. Encouraged by the strong election results in favour of pro-European parties, the MSCI Europe closed at 9.6 percent. The index received valuable contributions from Swiss (MSCI Switzerland: 12 percent), French (CAC 40: 10.9 percent) and German stocks (DAX: 10.2 percent).In the profit zone, but far less successful, the MSCI Japan closed at 4.1 percent.

The S&P 500 kept its proximity to the MSCI Japan and closed with a profit of 3.5 percent.

S&P 500, MSCI Japan and MSCI Europe in the first half of 2017

MSCI Europe S&P 500 MSCI Japan

Source: justETF.com; 30/06/17; Information in GBP, based on the largest ETF of the respective Index.

Country spotlight: FTSE 100 below European average, BRIC moderate, Asia strong

Let’s take a look at a few country-indices.United Kingdom

While the development of the FTSE 100 was quite similar to the MSCI Europe, the FTSE 100 could not keep up with the surge of continental European stocks at the end of April, and closed, at 4.7 percent.BRIC

The performance of the so-called BRIC countries was mixed during the first half-year.China delivered the best performance. The MSCI China reached 18.2 percent with little fluctuation.

The MSCI India performed similar, closing a little lower at 13.7 percent.

While keeping up with the MSCI China and MSCI India over a long period, the MSCI Brazil suffered severe losses, caused by the corruption scandal of the Brazilian government in mid-May. The scandal lead to a drop of 20 percent in the main index over the course of just a few days. The MSCI Brazil has not yet recovered from the plunge and closed at -2.7 percent.

Dragged down by the economic crisis, and the reinforced European sanctions against Russia, the MSCI Russia closes after a constant downward movement at -18.8 percent.

Asia

The South Asian stock markets mostly delivered strong profits. South Korea performed best, with the MSCI Korea closing at a huge plus of 21.8 percent. About 7 percent deeper, the MSCI Taiwan closed at 15.0 percent. Furthermore, the MSCI Indonesia, as well as the MSCI Thailand, both generated profits of 9.8 percent, respectively 5.2 percent.Best and worst performing country ETFs of the first half of 2017

Source: justETF.com; 30/06/17; Information in GBP, based on the largest ETF of the respective Index.

Global sectors: Technology takes the lead

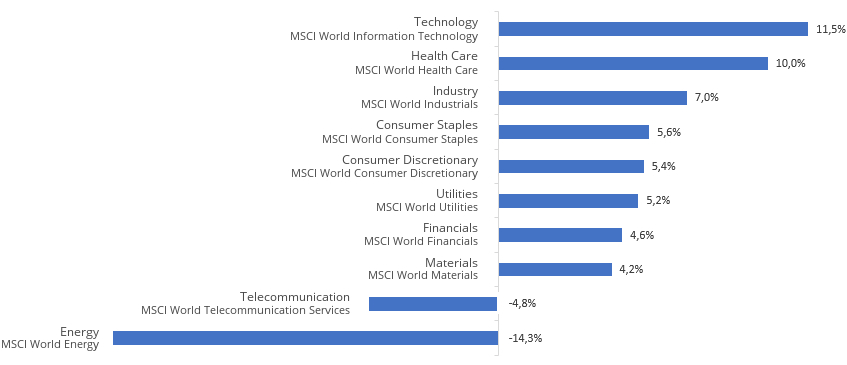

Let’s take a look at the global development of the sectors during the past six months.The technology sector is in the lead with profits of 11.5 percent, closely followed by health care, returning 10.0 percent, and industrials with 7.0 percent.

Losers are the energy sector, dragged down by the oil price, with a performance of -14.3 percent, and telecommunication sector losing -4.8 percent.

Performance of MSCI World sectors in the first half of 2017

Source: justETF.com; 30/06/17; Information in GBP, based on the largest ETF of the respective Index.

Commodities: Small profits, severe losses

The performance of commodities was anything but satisfactory over the past six months.Gold gained a small profit of 1.6 percent. Meanwhile, the broad commodity basket, including agricultural and oil, suffered severe losses, and closed lower at -10.4 percent.

Bonds: Not-so-safe haven

European government bonds of all maturities generated profits of 1.4 percent in the last six months. UK Gilts of all maturities were below average returning only 0.1 percent. Meanwhile, European corporate bonds generated profits for UK investors of 3.3 percent.Dragged down by the weakness of the US dollar, long-term (7-10 years) U.S. government bonds lost -2.9 percent, while short-term (1-3 years) U.S. government bonds lost -4.7 percent.