- Level: For advanced

- Reading duration: 7 minutes

What to expect in this article

"The conversation"

If you’re into investing then you’ve almost certainly had ‘the conversation’. When someone finds out you’re an investor and asks you what they should buy. Is it gold? Or Amazon stocks? And what do you think about Bitcoin? Or perhaps they say they could never invest – it’s just too risky! You try to explain it’s not like that. That real investing is not gambling and it doesn’t have to be hard. In fact, there’s a really simple way to do it using low-cost ETFs that… ZZzzzz! It’s too late! Your friend or family member has already fallen asleep. Or got distracted by their phone. Or remembered an urgent appointment they simply must attend … It’s so frustrating! How can you tell a close friend or loved one about something that could be life-changing – if only they’d listen? We have some ideas. But first, let’s talk tactics because this isn’t going to be easy.- First, we must find a way to help the other person be an active participant in the conversation. Because nobody wants a lecture, no matter how well intended.

- Secondly, we must engage the heart as well as the head. For better or worse, our decision-making faculties are like a crazy parliamentary debating chamber: with our emotions lined up on one side, and our reason on the other. Both sides battling for control. When we take action, both aspects of our nature must usually agree to it. We won’t persuade anyone if we think purely rationally or purely emotionally.

- Thirdly, what makes the other person tick? Are they a big picture person? Or do they love detail? Do they respond to personal stories, or do they want to see hard evidence and numbers before they’ll do anything? How important is social proof to them? Do they need to know you’re not part of some weird cult but that actually millions of people and financial giants approve of ETF investing?

The question about the future

Question: How do you picture life in the future when you’ve achieved your financial goals? Here are some prompts:- Are you comfortably well off?

- Are you happily retired?

- Are you helping the kids to pay for university or their first house?

- Are you financially secure? Or even financially independent?

- What’s on your bucket list?

- What will you do when you have more freedom in your life again?

Here's how you can respond to the answers:

“Investing can help you secure this better life. It grows your wealth faster than cash in the bank. It makes you richer while you sleep. Because your money is hard at work invested in some of the most productive and innovative companies in the world. And there’s a way to invest that minimizes the risk you’ll never be able to finance your dreams.”Here is some proof

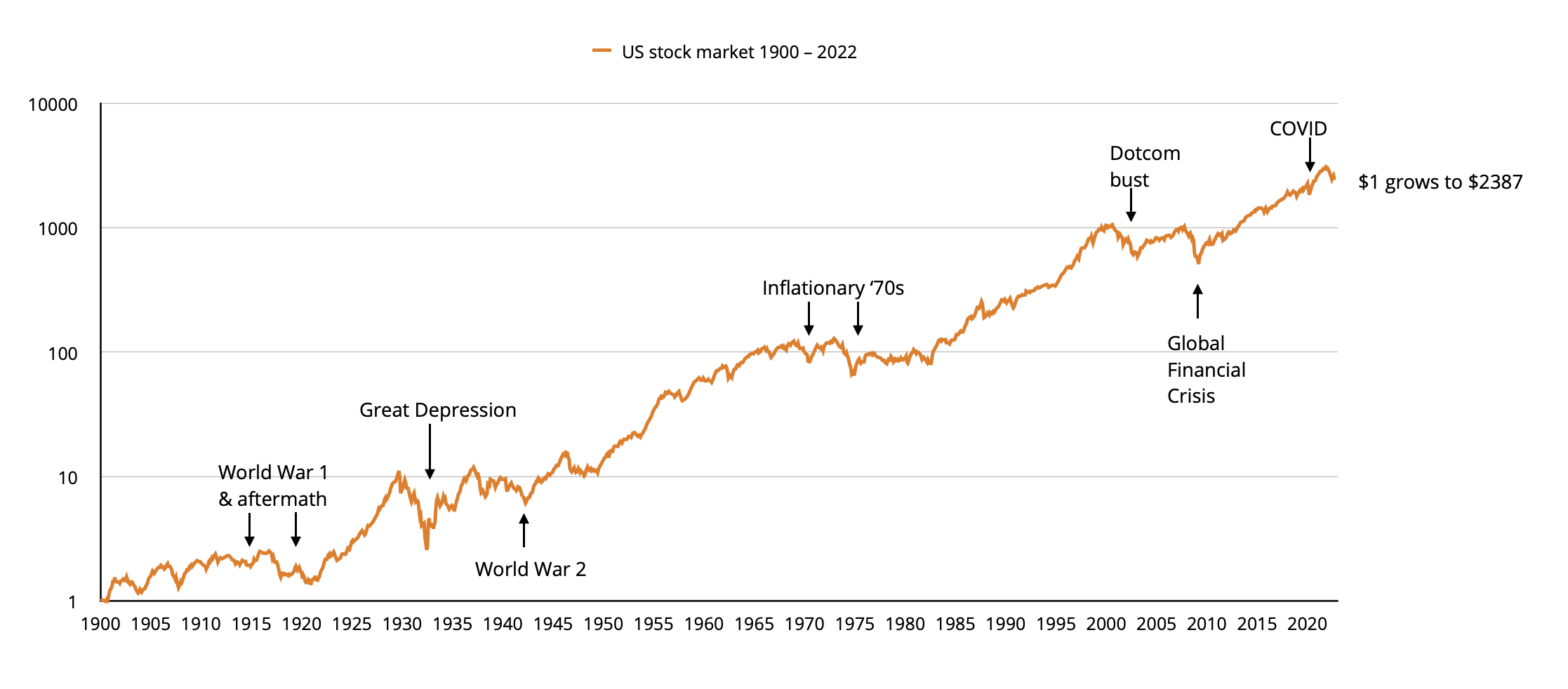

Here’s a chart of US stock market returns from 1900 to 2022. Equities grew the value of $1 to $2,387 over that time in real-terms (i.e. despite inflation).The stock market grows wealth despite regular global crises

Quelle: justETF Research, Stand: 1.12.2022

The value of the world’s most diversified stock market grew by over 238,000% despite two World Wars. Despite the Great Depression. Despite oil shocks, the Dotcom bust, the Global Financial Crisis, and the EU Debt Crisis. COVID was just a blip.

The world’s major stock markets have always overcome setbacks and kept rewarding investors with a bigger return than cash, bonds, gold, or property.

Why? Because the advance of the market, and your source of profits, is based on the success of the most competitive, most creative, and most resourceful companies on Earth.

justETF tip: Buying into the world stock market means buying into the story of human progress itself: Our collective ability to work hard, solve big problems, and ultimately create a better, more prosperous world.

Here’s what that can mean

The reason stock market investing matters is because equities power growth like no other asset. The example below shows how your wealth grows when you pit the returns of equities and cash against each other:

Quelle: justETF Research, Stand: 1.12.2022

The result: Equities smash cash over time. The equity-driven wealth pot grows 200% larger than the cash pot for the same monthly savings contribution.

In our example, we contributed 200€ savings a month for 40 years and assume average historical returns for world equities (5.4% annualised) and cash (0.8% annualised). The returns were adjusted for inflation and interest and dividends were reinvested.

For cash to match equities, you’d need to save three times as much every month – over 600€.

The problem with cash is its upside is very small. It’s just not a powerful wealth-generator. People like cash because they perceive it as safe. Hence banks don’t have to reward you with much interest for holding cash. Equities make your money work much harder.

What’s weird is that when you think about your financial future, cash is much riskier than it seems.

The question about fear

Question: Are you afraid of investing because people lose money? Your answer: That’s true, people lose money because they sell at the wrong time. Equities are risky in the short-term if you sell during a crisis (like the ones in the stock market chart earlier). But if you wait for the stock market to recover then you don’t lose. Even the unluckiest investors of the last 50 years didn’t lose money if they stayed invested in the MSCI World index – for 14 years or more. This is why pension funds, wealth managers, and sovereign wealth funds invest in equities. They know that this is a great way to earn money so long as you don’t sell too soon.justETF tip: The MSCI World is a benchmark collection of the developed world’s biggest firms. You can invest in it using a MSCI World ETF. This is one of the most popular ways to diversify your investments across the world’s major stock markets including the US.

In many ways, equities and cash are mirror opposites:

| Shares (non-cash assets) | Cash (financial assets) |

|---|---|

| Equities are risky in the short-term but the best way to preserve and grow your wealth over the long-term. | Cash is safe in the short-term but risky in the long-term because it’s eaten away by inflation. |

| The way you manage the risk is by not selling when the market is down. | It’s very hard to save enough cash to secure your financial future. |

| Equity returns are strong enough to beat inflation over the years. | The best way to manage the risk of cash is to not hold too much of it. Diversify into other assets, especially equities. |

The question of the right equity

You are asked: "How do you know which equities to invest in?" Your answer: "You don’t need to. Your best strategy is to diversify across as many of the world’s top firms as possible." And you do that by investing in a World ETF. That’s a fund designed to automatically invest in hundreds and even thousands of companies that dominate the global economy – from the US to Europe to Asia-Pacific. Remember our stock market graph earlier? You profit by owning the entire market. And that’s exactly what a World ETF does for a super-low cost. It’s because ETFs are so brilliantly designed for this purpose that they’ve grown from nothing into an industry that now manages trillions of dollars in wealth for millions of investors and large financial institutions such as pension funds. Meanwhile, gambling is betting on a particular stock to win this year. Or that oil prices might rise in the next five minutes. We’re not advocating that.justETF tip: Proper investing is about regularly buying into a diversified fund (as exemplified by the ETFs we’re talking about) and letting it grow in line with world stock markets.

Who wants to be lazy in terms of investment

You are told: Make it simple for me – I don’t want to have to think about it. Your answer: OK. All you have to do is:- Free up some saving cash.

- Use an ETF savings plan to automatically channel your money into your chosen ETFs for the lowest possible cost.

- Pick an ETF that lets you own the world’s major stock markets as we’ve discussed.

- Use justETF’s strategy builder to help with extra diversification like high-quality government bond ETFs.

- Grow your wealth over time by continuing to save and invest.

justETF tip: If you’d like to learn a little more about investing then check out our 9 habits that will make you a better ETF investor.