- Level: For beginners

- Reading duration: 10 minutes

What to expect in this article

justETF tip: Check out our explainer for a quick guide to the bond basics.

Focusing your bond ETF choices

Step one is to focus our selection on the bond ETFs that best protect us against stock risk. Afterall, most people’s portfolios are dominated by equities. So our most important diversification move is to hold the defensive assets that are most likely to perform when the stock market is in retreat. And those assets are high-quality government bonds. High-quality means developed world government bonds that are rated investment grade and above. These bonds are the least risky type because they’re backed by the economic strength of strong and stable countries that are extremely unlikely to default on their national debt. Investors often flock to the comparative safety of government bonds during a recession because countries are much less vulnerable than companies during times of crisis. The surge in demand for government bonds pushes up their price, and cushions the impact of equity losses on your portfolio. This “flight-to-quality” effect isn’t guaranteed everytime but it often works. It’s the main reason why high-quality government bonds are good diversifiers of equity risk and are the core defensive asset class used in ETF portfolios.Which high-quality government bond ETF?

A European investor should choose a Euro government bond ETF. A Euro government bond ETF holds a range of fixed income securities diversified across Eurozone countries. Why is it important to choose a Euro denominated fund? Because bonds that are not valued in your home currency expose you to currency risk. That adds unwelcome volatility to the defensive part of your portfolio. We want our bonds to improve portfolio stability so it’s best to eliminate currency risk from that side of the equation.justETF tip: There are some currency hedged global government bond options that work, too. We’ll cover those products below but they’re not a necessary addition as Eurozone ETFs are already well diversified.

Choosing the right bond ETF maturity

Our next most important decision is to choose our bond ETF’s maturity. An individual bond’s maturity date works like a fixed rate savings account. If a savings account (or bond) has a maturity of three years then, at the end of that time, the issuer pays back the original amount of money loaned (also known as principal). In the meantime, the bondholder is paid interest as compensation for the risk they bear. Long loans are riskier than short ones which is why the bank pays more interest when you lock up your money for five years instead of one. The same is true for bonds. This fact of life leads to a helpful rule-of-thumb: longer maturity bonds are riskier than shorter maturity bonds of the same type. They should also be more rewarding (over the long-run). Keep that guideline in mind because it’ll help you choose the right ETF once we’ve covered the bond risk-reward trade-off. Now a bond ETF is diversified across a portfolio of bonds with many different maturities. As principal is repaid, the fund automatically reinvests that money in new bonds. (You can also choose to reinvest your interest payments, too.) The upshot is that a bond ETF normally expresses maturity as a range of years. For example, ‘7-10Y’. That means the ETF invests in bonds with maturities of 7 to 10 years.justETF tip: You’ll typically see this figure mentioned in a government bond ETF’s name.

Choosing your spot on the maturity risk spectrum

ETF maturity figures can be helpfully summed up as short, intermediate, or long bonds like this:| Bond ETF maturity range (in years) | ETF holdings |

|---|---|

| 0-5 | Short bonds |

| 5-10 | Intermediate bonds |

| 10+ | Long bonds |

justETF tip: Only make apples-to-apples bond maturity comparisons. For example, intermediate Euro government bond ETFs are riskier than short Euro government bond ETFs. But that doesn’t make the intermediate government ETF riskier than a short high yield bond ETF.

Bond ETF performance during the Global Financial Crisis (GFC)

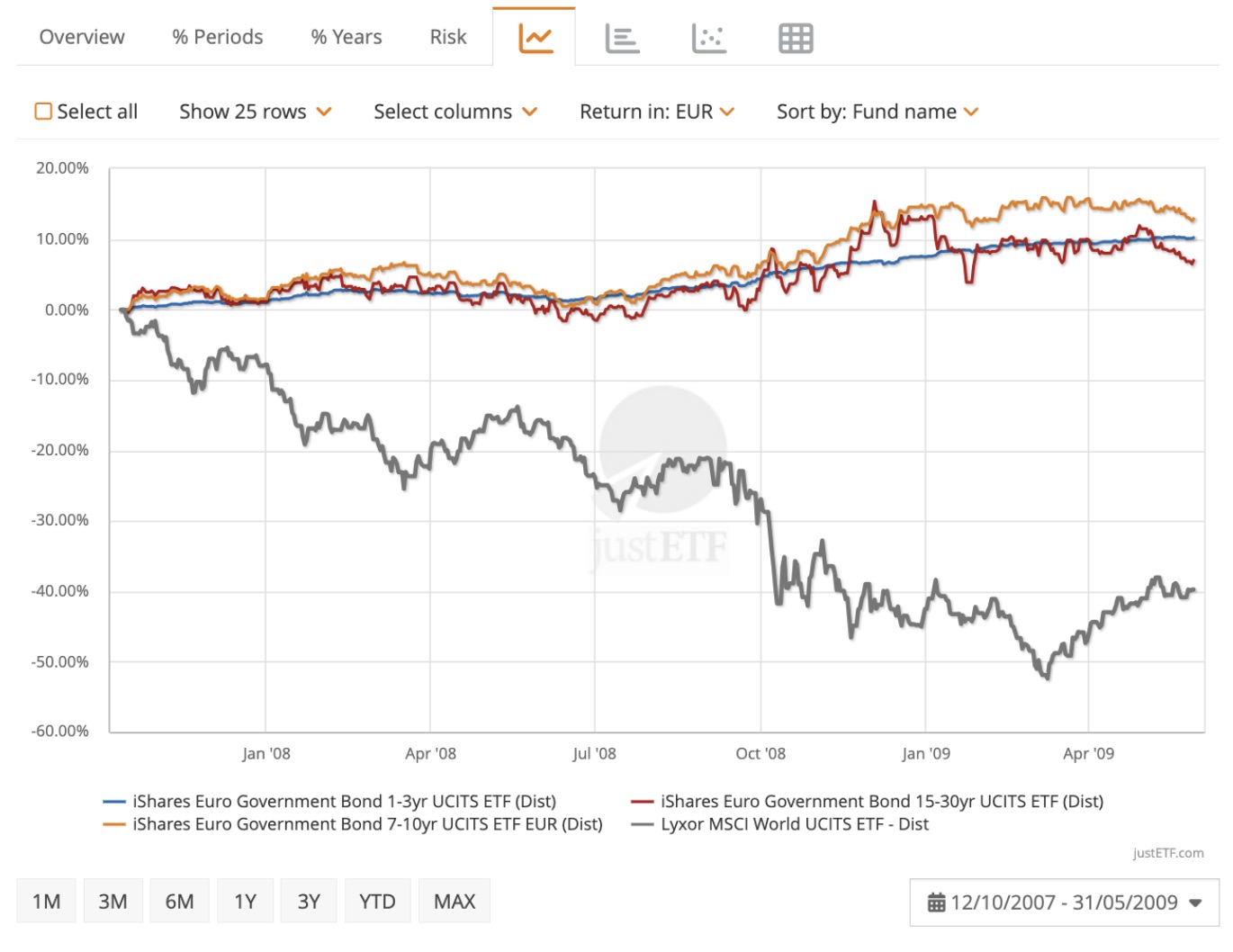

The chart shows how short, intermediate, and long bond ETFs helped when the GFC raged from 2007-2009:

![MSCI World returns at a glance]()

iShares Euro Government Bond 15-30yr UCITS ETF (Dist) iShares Euro Government Bond 1-3yr UCITS ETF (Dist) iShares Euro Government Bond 7-10yr UCITS ETF (Dist) Lyxor MSCI World UCITS ETF (Dist)

Source: justETF Research, 27 November 2023

- The grey line reveals the sharp decline of an MSCI World ETF during the crash.

- The blue line shows how a short bond ETF could partially offset that loss by rising 9.4% at the peak of the crisis.

- But the intermediate ETF (orange line) rallied 15.6%. Much better!

- Meanwhile, the long ETF (red line) only managed a 9.6% increase. That’s marginally better than the short ETF but not enough to compete with its intermediate counterpart.

justETF tip: Find out why bonds don’t always work.

Bond ETF performance when inflation takes off

Now let’s look at the same trio of bond ETFs as inflation and interest rates escalated during 2022-2023:

![Bond ETF performance when inflation takes off]()

iShares Euro Government Bond 15-30yr UCITS ETF (Dist) iShares Euro Government Bond 1-3yr UCITS ETF (Dist) iShares Euro Government Bond 7-10yr UCITS ETF (Dist)

Source: justETF Research, 27 November 2023

- The short bond ETF (blue line) is down only 2.3% over the period. Short bonds are much less susceptible to inflationary conditions than longer bonds.

- The intermediate bonds (orange line) fell -17%. This is an unusually large slide for a government bond ETF but it can happen.

- But by far the biggest hit is saved for the long bonds (red line): a steep -34% slump.

Bond ETF returns comparison

All three bond ETFs delivered a reasonable cumulative return for defensive assets but the pecking order is clear:

![Bond ETF returns comparison]()

iShares Euro Government Bond 15-30yr UCITS ETF (Dist) iShares Euro Government Bond 1-3yr UCITS ETF (Dist) iShares Euro Government Bond 7-10yr UCITS ETF (Dist)

Source: justETF Research, 27 November 2023

- As you can see, short bonds (blue line) gave up a fair chunk of return in exchange for their low volatility behaviour. The ETF’s cumulative result over the period equates to a 1.4% annualised return.

- Risky long bonds managed (red line) a 2.4% annualised return.

- But intermediate bonds (orange line) produced a 2.8% annualised return for almost half the risk of the long bonds.

Putting it all together

Here’s a quick recap of the strengths and weakness of the three main bond maturity types:| Bond ETF maturity range | Pros | Cons |

|---|---|---|

| Short (0-5 yrs) | Less price volatile Less vulnerable to inflation / rising interest rates Good equity diversifier |

Less beneficial in recession Lower expected return over time |

| Intermediate (5-10yrs) | Beneficial in recession Better expected return over time Very good equity diversifier |

Susceptible to inflation / rising interest rates Quite volatile (typically much less so than equities) |

| Long (10+ yrs) | Beneficial in recession Higher expected return over time Very good equity diversifier |

Highly susceptible to inflation / rising interest rates Very volatile (equity-like at times) |

Use our ETF screener to choose your bond ETFs

With the bond ETF essentials at your fingertips, you can quickly pull a suitable selection of products together using our data. Go to our ETF Screener to select from every bond ETF available in Europe. From the drop-down menu select:- All asset classes > Bonds

- Region > Europe

- Bond Type > Government

- Maturity > 0-3 (Short bonds), 5-7 (Intermediate bonds) or 10+ (Long bonds)

Compare your selection

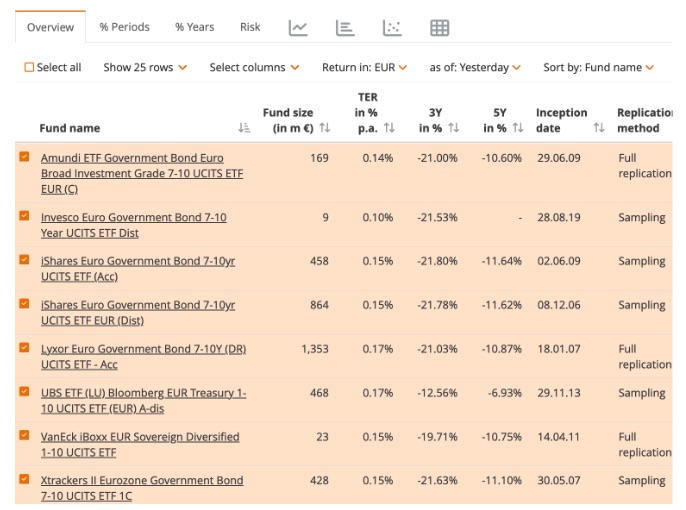

The screener will automatically put your chosen ETFs into a tidy comparison table for you:

Source: justETF Research, 27 November 2023

We’ve selected 7-10 year intermediate government bond ETFs in the example above. (Check out how to compare your ETFs using the method outlined in How to choose a global ETF. This process works just as well for bond ETFs.)You can quickly snip your longlist down to a short list by culling:

- New ETFs: any with less than 3 years of data

- High costs: chop any ETFs with a TER significantly higher than the rest

- Small fund sizes: ditch those below 100€ million

- Currency hedged ETFs: we’re using Euro denominated funds only

Alternative bond ETF options

Global government bond ETFs

Global government bond ETFs hedged to the Euro behave in much the same way as Euro government bonds.

The benefit is extra diversification: mostly in the form of US, Japanese, and UK government bonds. The downside is that hedged products normally charge more in fees.

If you choose the global route then make sure you select ETFs with EUR hedged in the name to guard against currency risk. ETF Screener dropdown settings:

- All asset classes > Bonds

- Region > World

- Bond Type > Government

- Maturity > As before

- Currency Hedge > EUR hedged

Aggregate bond ETFs

Aggregate bond ETFs add riskier corporate bonds and municipal bonds to the government bond mix. Choose this option for the hope of a little extra return but know that you’re giving up some recession protection in exchange.

ETF Screener dropdown settings:

- All asset classes > Bonds

- Region > World

- Bond Type > Aggregate

- Maturity > As before

- Bond Rating > Investment Grade

- Currency Hedge > EUR hedged

Inflation-linked bonds

Finally, inflation-linked bonds are worthwhile as a second bond ETF due to their anti-inflation properties.

That said, inflation-linked bonds are not a perfect inflation hedge when yields rise steeply. And they’re generally not as effective during recessions as the normal government bonds we’ve covered above.

So please take the time to familiarise yourself with the strengths and weaknesses of inflation-linked bonds before investing.

ETF Screener dropdown settings:

- All asset classes > Bonds

- Region > Europe

- Bond Type > Inflation-linked/li>

- Maturity > As short as possible