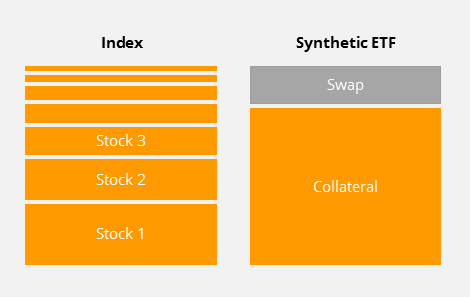

Replicating an index with a swap contract

Synthetic ETFs (also called swap ETFs) are a cost-effective alternative to invest in niche markets or asset classes such as commodities and money market, which would otherwise not be accessible to most investors. In addition, swap ETFs are able to track some markets more efficient and accurate than physical ETFs. However, swap ETFs generally have a counterparty risk, which is minimized by various security measures.Synthetic replication of ETFs

How does a swap work?

The swap contract (also called the total return swap) is a derivative transaction. In practice, the swap counterparty of the ETF is often the parent company of the ETF issuer (e.g. Deutsche Bank, Commerzbank).In the swap contract, it is agreed that the swap counterparty pays the index return including all dividend payments to the ETF. In exchange, the swap counterparty receives a fee (swap fee) and the return of the securities in the collateral portfolio.

The funds of a synthetic ETF are invested in a basket of securities that serves as a collateral for the swap counterparty. The securities in the collateral portfolio do not necessarily coincide with the securities of the replicated index. For example, a synthetic ETF on European equities (e.g. MSCI Europe) in the collateral portfolio may also include Japanese equities.

Types of swap ETFs: Unfunded swap vs. funded swap

Depending on how the collateral is held, a distinction between two the types of synthetic ETFs can be made: Unfunded swap and funded swap.In the case of a funded swap, the swap counterparty collects collateral and deposits it with an independent trustee, who then holds it on behalf of the ETF.

Unfunded swap vs. funded swap

According to the UCITS regulation, the counterparty risk is limited to a maximum of 10 percent of the fund’s assets. In practice, however, the risk is significantly reduced by various security measures. The risk is thus minimized by daily swap reset, overcollateralization or the use multiple swap counterparties. High transparency standards from many ETF issuers allow you to view the collateral portfolio on a daily basis, as well as the level of counterparty risk on the issuer’s website.

Why are there swap ETFs?

Synthetically replicated ETFs allow for an index to be more efficiently and accurately replicated in certain cases. Synthetic ETFs can offer advantages, especially for very large or illiquid market indices. Physical replication can become difficult, especially in markets with trade restrictions, property restrictions, and different time zones. In some cases, tax considerations can also be applied to the use of swap ETFs. In addition, some asset classes, such as commodities or money market, could not be invested without synthetic replication.One of the main advantages of synthetic replication is the reduction of tracking error. The tracking error measures the fluctuation of the daily deviation from the performance of the index and the ETF. However, even if the fluctuation is low, that does not necessarily mean that the overall difference between the ETF and index is small. This difference is also the key factor when looking at the cost of a swap ETF, as the swap fees are not included in the total expense ratio (TER).

Filter ETFs by replication method

In the ETF search, you can use the filter criterion "Replication method" to easily define your individual preference for the different replication methods. For example, you could limit your ETF universe to physically replicated ETFs if you only feel comfortable with these. To compare, you can also display the replication method directly in the search results.

In the ETF search, you can use the filter criterion "Replication method" to easily define your individual preference for the different replication methods. For example, you could limit your ETF universe to physically replicated ETFs if you only feel comfortable with these. To compare, you can also display the replication method directly in the search results.