- Level: For Advanced

- Reading duration: 5 minutes

What to expect in this article

- Excludes or down weights so-called ‘sin stocks’. Sin stocks are shares in firms that have a negative environmental or social footprint – classic examples are corporations that profit from coal power or weaponry

- The index upweights or only includes companies with a high sustainability rating (e.g. renewable energy firms) or those that exhibit positive social values (e.g. firms that have built an ethical supply chain)

Implementing your values

While the market is moving in the right direction, expressing your individual values through the wide choice of ESG/SRI ETFs available can be a confusing task. A good starting place is to decide whether you want to buy into a product that avoids companies that you deem to be unethical or harmful. Industries that are commonly excluded from ESG/SRI indices include:- Armaments

- Tobacco

- Alcohol

- Gambling

- Adult entertainment

- Nuclear energy

- Coal mining

- Human genetics

justETF tip: Find out how different SRI indices enable you to invest according to your values.

Investing in sustainable companies using ETFs

Another option is to choose ETFs that purely invest in companies focussed on green technology, or otherwise operate in areas essential to a sustainable world. Investors who want to try to earn an above-market return by gaining exposure to these industries can use ETFs tracking thematic indices. Themes include investing in clean water, renewable energy, electric transport and future driving technology. However, be aware that themed indices usually select companies by the proportion of their business associated with a theme and not by ESG rating. See our guide on megatrends for more.justETF tip: Find the best ETFs for investing in renewable energy, water, climate change and electric mobility.

The impact of large institutions on sustainable investing

Large institutional investors manage billions of euros / pounds on behalf of pensions, insurance firms, and regular citizens. Their responsibility to invest that capital sustainably inevitably includes a moral dimension that actually gave rise to socially responsible investing in the first place. The scale of institutional capital means that many ESG/SRI indices and ETFs are designed primarily with large investors in mind. Institutional investors use sustainability audits to try to avoid extreme risks such as fraud scandals (Wirecard and Volkswagen are good examples) or industrial disasters (such as the Vale dam breach in Brazil or the BP oil spill). Similarly, they often exclude some controversial companies such as those that manufacture cluster bombs. Government regulation also moves the market which is why indices exist to facilitate compliance with the Paris Climate Agreement. From a retail investor’s perspective, you can be reassured that institutional investors will do their due diligence when selecting ETFs. So if an ETF is attracting significant capital flows from the institutional sector, you can regard that as a positive proof point so long as the product aligns with your values and you remember that investing success is not guaranteed.Putting it all together

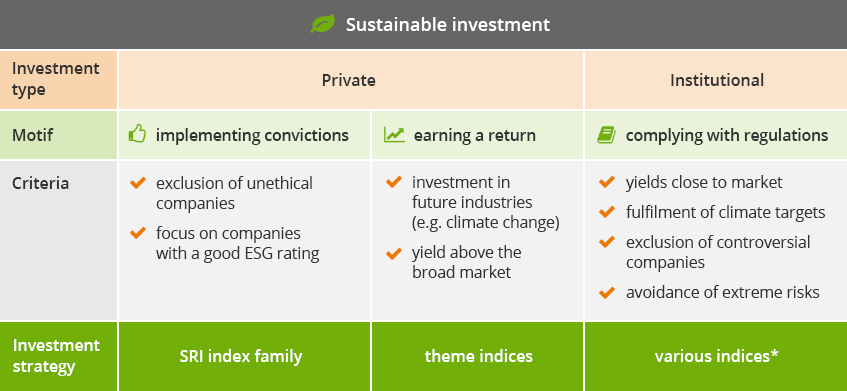

Now we’ve reviewed the ESG/SRI investing landscape, let’s sum up the key takeaways in one last graphic:Sustainable strategies for your investment goal

Source: justETF Research; as of 13/02/2024

*You can find more details on the indices in our investment guide The best worldwide ETFs for socially responsible investing (SRI).

*You can find more details on the indices in our investment guide The best worldwide ETFs for socially responsible investing (SRI).

Our tip: You can find an overview of sustainable index families in our investment guides The best socially responsible investing (SRI) ETFs for Europe as well as The best worldwide ETFs for socially responsible investing (SRI) and by searching our database using the terms sustainable equity ETFs and sustainable bond ETFs.