Create a professional ETF portfolio with the Portfolio Builder

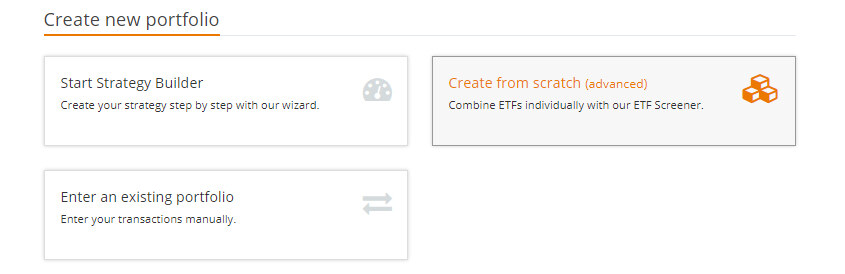

Start the professional planning mode of the Portfolio Builder by clicking on the button “Create new portfolio” on the Portfolio Overview and then select the option “Create from scratch (advanced)” in the “Create new portfolio” section.

In the Portfolio Builder, you create new portfolios and adjust them over time. In the first step, you plan your asset allocation. In the second step, you receive an order list with the required transactions to implement your strategic asset allocation.

Enter investment amount and select investment type

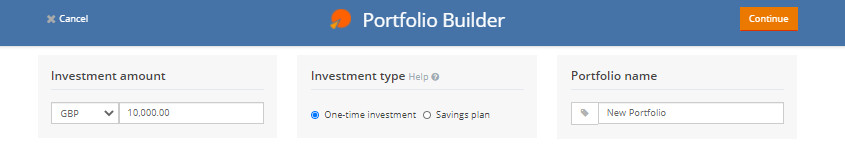

Create or change a portfolio according to your needs with our comfort functions. At the top of the Portfolio Builder, you can enter all necessary portfolio settings and search for ETFs.

1. Choose portfolio currency and investment amount.

2. Choose your investment type. For a one-time investment, the number of ETF shares has to be an integer. In a savings plan portfolio, you can purchase fractional shares. To learn more about ETF savings plan functionality, read our savings plan tutorial.

3. Name your portfolio.

Structure your portfolio

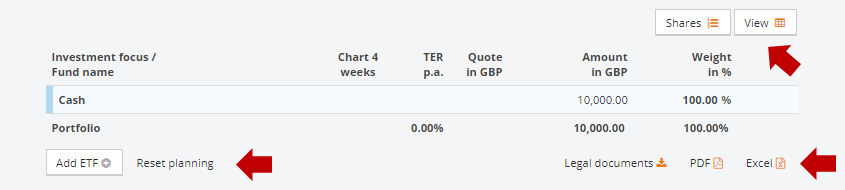

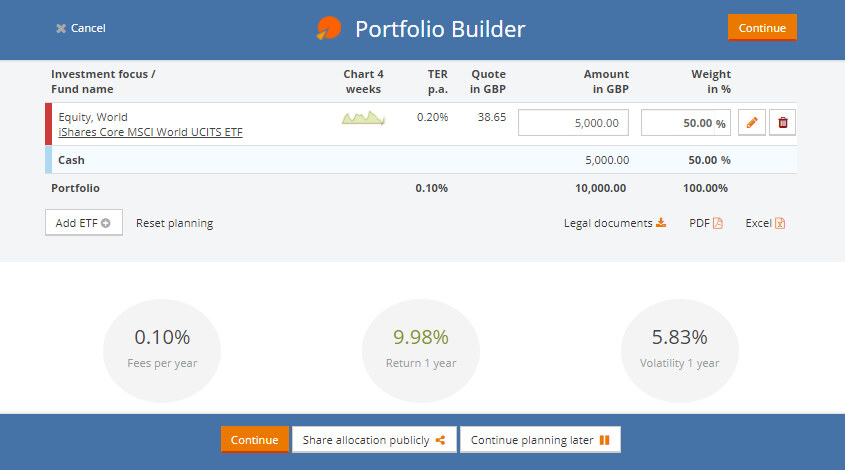

In the main section of the Portfolio Builder, you define the asset allocation of your portfolio and set a weight for each position. For a new portfolio, the only position is cash with a weight of 100%. As soon as you add an ETF by using the search function, the new position appears next to the cash balance.Click the "View" button to switch between different table views. With "Reset planning", you return to the original investment structure.

By clicking on "PDF" and "Excel" you can export your new asset allocation.

All legal documents (KIID, prospectus, etc.) for the selected ETFs can be downloaded as a ZIP file via the link "Legal documents".

Add/delete an ETF

Use “Add ETF” to add new ETFs to your portfolio using our ETF search. Click on the corresponding ETF's tick box in the ETF search to select it (you can also select several ETFs at once). You can add the ETFs to your portfolio using the "Selection" > "Add selection to portfolio" button.Alternatively, click on "Add to portfolio" on an ETF’s profile. After adding an ETF, you can define the weight in per cent, the number of shares, or the investment amount for this ETF.

You can also use the quick search to search for ETFs by name, ticker or ISIN.

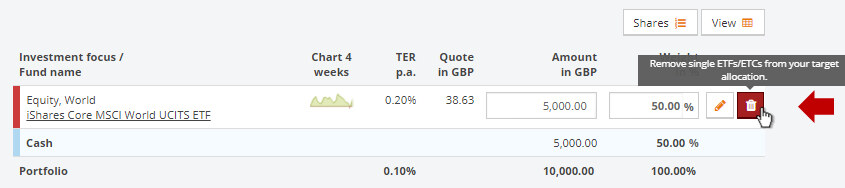

Delete an ETF from your portfolio by clicking on the “Trash”-icon in the last column of the respective row.

Adjust weight or amount of a position

In the table columns "Amount" and "Weight in %", you can adjust the weight of each position individually. In order to do this, click on the input fields and enter the desired value. After every change, all key figures below are recalculated immediately.Replace an ETF: Compare with similar products

You can replace an ETF in your portfolio by clicking on the "Pen"-button. All ETFs on the same index will be displayed. Click the tick box of the ETF of your choice to replace the current ETF.

Your portfolio at a glance

Below the table, you will find key figures for your new portfolio.

The fees per year give you an indication of the ongoing charges for your portfolio per year (based on the total expense ratio).

The return in per cent gives you an idea of the performance that the selected portfolio would have yielded if you had already invested in this asset allocation a year ago. Keep in mind that past performance may or may not continue.

Volatility is a measure for the price fluctuation of your portfolio. The higher the volatility, the higher the risk of your portfolio and the more significant the price fluctuations could be (in the positive and negative direction).

The key figures are calculated dynamically and are based on the ETFs in your portfolio. By adding or replacing ETFs as well as adjusting weights you can tailor your portfolio to suit your needs.

Do you want to simulate the performance of your portfolio? Discover our premium functions: Portfolio simulation in the planning mode.

Continue to order list

Once you structured your portfolio, click "Continue" to proceed to the order list. If you want to continue planning your portfolio later, click "Continue planning later" at the bottom of your screen.Click on "Share allocation publicly" to share your portfolio with friends and family.

If you want to exit the planning without saving the changes, click on "Cancel".

Continue with order list