Restoring the strategic asset allocation

Maintain your risk structure and increase your potential returns in the long-term through disciplined rebalancing.Your current portfolio composition of the originally selected investment structure will often deviate in the course of time. The reasons for this are e.g.:

- A shift of your target allocation because of market movements

- A deposit in the portfolio

- A withdrawal from the portfolio

What is rebalancing?

How can I identify a change in the investment structure?

The justETF System will inform you by e-mail about a change in your investment structure. You can determine the tolerance bandwidth within which the weightage of an investment class or an individual ETF may fluctuate in the Portfolio monitoring. If the value moves away from the defined bandwidth, then you will be notified by e-mail.Rebalance your portfolio

For example, you will find the portfolio rebalancing function in Portfolio overview.

Free trial of rebalancing feature ![Free trial of rebalancing feature]()

Activate free trial now

justETF gives you the opportunity to test the rebalancing function free of cost and without obligation. How does the trial work?

Current vs. plan portfolio

A graph displayed on the portfolio rebalancing page shows the drift of your current portfolio to the target allocation before and after rebalancing.

In addition to the current drift of your portfolio from the plan, you can also see the changes effected by rebalancing. At the right edge of the graph, the drift of your portfolio from the target allocation after rebalancing is shown. Deviations cannot be usually avoided completely, since you can only buy whole units of an ETF on the stock exchange.

The deviation accordingly depends on the absolute level of the ETF quote and your investment amount. Your goal should be to reduce the deviation as far as possible. An indication in traffic color lights has been provided for better classification of the extent of deviation. The green light indicates that the drift is bleow 1%, between 1% and 3% the light is yellow and if the drift is above 3% the light is red .

What is target allocation?

The target allocation, also known as strategic investment structure or strategic asset allocation, describes the desired portfolio distribution. That is, the weightage that each item should have in the portfolio. The target allocation is determined while creating a portfolio. It is updated with each adjustment of the portfolio in the planning mode.Edit target allocation

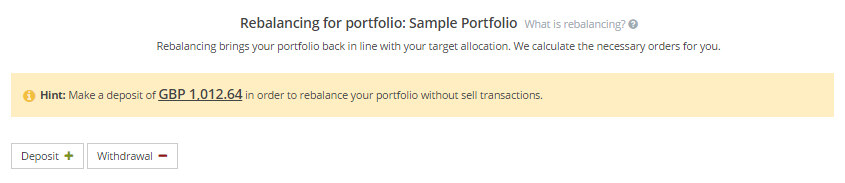

You can edit the target allocation at any time. For this purpose, use the button "Edit target allocation" which is located above the rebalancing graph.Portfolio deposit with rebalancing (Minimum deposit amount as hint)

In most of the cases, rebalancing involves the buying and selling of positions. You have the option to rebalance only through buying via a deposit in the portfolio. The advantage is that no taxable capital gains will apply here, unlike in the case of selling.The system calculates the minimum amount you have to deposit in your portfolio in order to rebalance without selling any position in a hint. Click on the deposit amount in the hint to take it over for the calculation. In case of a lower deposit amount, the best possible rebalancing is carried out.

Tutorial: Deposit/withdrawal with rebalancing

Order list for rebalancing

The justETF System automatically calculates an order list with all necessary buy and sell transactions for the portfolio rebalancing. This is done taking into consideration the saved order fees and the planned deposits and withdrawals. You can see the order fees above the order list and adjust if necessary. This will help you to check the efficiency of your adjustments.In the order list you can also adjust the number of shares if required. The resulting deviations can be seen in the rebalancing graph above.

Click on "Save" to save the changes in your virtual portfolio.