What to expect in this article

Distributing or accumulating?

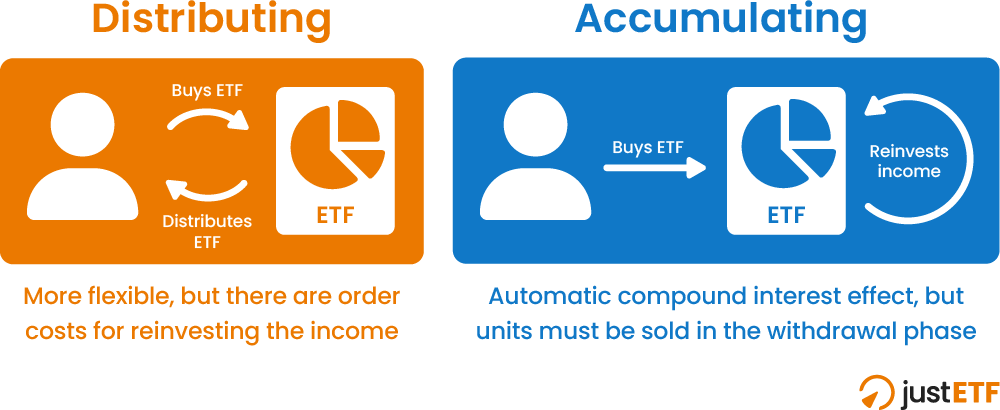

Your decision depends on your goals:- Option 1 - You want to generate regular income from your portfolio. Go for distributing ETFs. They transfer cash straight to your investment account where you can withdraw it to spend on the good things in life.

- Option 2 - You want to maximise your future investment returns. Accumulating ETFs are the best choice as they automatically reinvest your income back into the fund at no extra expense. This compounds your returns, saves you time and spares you dealing fees.

Distributing vs. accumulating: the difference

Best regular income ETFs

Happily, ETFs give you plenty of income options. You can select from hundreds of accumulating and distributing ETFs. Some ETF providers even offer distributing and accumulating versions of the same product. Select the Use Of Profit filter on our ETF Screener to focus your selection. Your asset allocation will also influence the amount of income generated by your portfolio:- Equity and real estate ETFs distribute dividends from their underlying holdings.

- Bond ETFs pay interest thrown off by their portfolio of fixed income securities.

- Gold and other commodity assets do not produce dividends, so neither do their associated ETFs.

Dividend income from equity ETFs

Dividend income is generated when companies pay out a proportion of their profits as cash. ETFs gather these dividends on behalf of their shareholders and periodically hand them over (or reinvest them) 1 to 12 times a year. You might expect a dividend yield of about 2% from a broad global index like MSCI World; though that percentage will vary in line with economic conditions. You can achieve a significantly higher yield with ETFs that target high-dividend-paying companies. If generating a steady stream of passive income is important to you then check out our article on Income investing with ETFs.Tip: You can achieve a significantly higher yield with ETFs that target high-dividend-paying companies. If generating a steady stream of passive income is important to you then check out our article on Income investing with ETFs.

You still pay tax on accumulating ETFs

You owe the same amount of tax on income regardless of whether you choose the distributing or accumulating route. To recap:- You owe nothing if your investments are completely sheltered within SIPPs or ISAs.

- Income from unsheltered equity or real estate ETFs is liable to dividend income tax and can be offset by your Dividend Allowance.

- Income from unsheltered bond ETFs can be offset by your Personal Savings Allowance or even the Starting Rate for Savings.

- Firstly, beware paying tax twice on your CGT bill if you hold unsheltered accumulating ETFs. The unwary can accidentally inflate their tax bill because accumulating ETFs add reinvested income to their Net Asset Value (NAV). So when you calculate your CGT liability, make sure you deduct any reinvested income (known as ‘notional distributions’) from your total gains.

- Secondly, you may trigger a capital gain if you switch from an accumulating ETF to a distributing ETF. This can occur as you approach retirement and wish to draw a regular income from a distributing ETF rather than reinvesting it in an accumulating ETF. You can manage this by ensuring any capital gains incurred by selling ETFs fall within your annual CGT allowance, or by switching ETFs in your ISAs or SIPPs.