- Level: Advanced

- Reading duration: 5 minutes

What to expect in this article

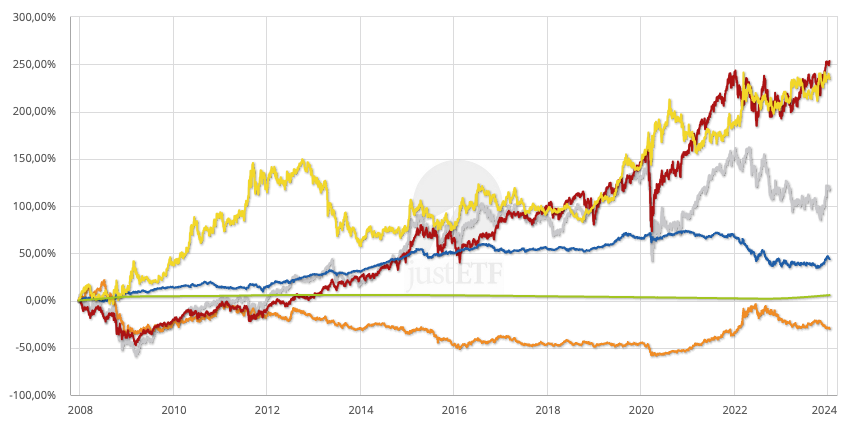

How to think about asset allocation

Equities are your long-term growth drivers that can be expected to outperform other asset classes when the economy thrives. High-quality government bonds are often a safe haven during recessions. Commodities have historically protected portfolios during times of stagflation. Gold comes into its own when the market fears an existential crisis and currency devaluation, as loomed large in 2008-2009. Real estate offers some inflation resistance over the long term and sits in the middle ground between equities and bonds. Essentially, your asset classes are members of a team and your asset allocation is your gameplan for harnessing their individual abilities to achieve your overall goal. The chart below shows how different asset classes have counterbalanced each other in the past.Correlation of different asset classes

MSCI World Government Bonds Europe Gold Commodities Global real estate shares Money Market

Source: justETF Research; as of 09/01/2024

Sure, you’d be incredibly wealthy if your portfolio only ever contained the winning asset class of the moment, but can you predict which one that is going to be?

Today’s winners are tomorrow’s losers

The table below shows you how unpredictable asset class performance is. Can you spot a pattern?Performance of different asset classes

| 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|

|

+19,24%

Equities

World |

+22,26%

Commodities

Broad Market |

+37,34%

Commodities

Broad Market |

+13,18%

Precious Metals

Gold |

+30,22%

Equities

World |

|

+9,45%

Precious Metals

Gold |

+7,05%

Precious Metals

Gold |

+32,10%

Equities

World |

+8,01%

Equities

Emerging Markets |

+21,13%

Precious Metals

Gold |

|

+7,82%

Corporate Bonds

Europe |

-0,03%

Money Market

Euro |

+5,39%

Equities

Emerging Markets |

+6,13%

Equities

World |

+20,90%

Equities

Emerging Markets |

|

+6,97%

Government Bonds

Europe |

-12,96%

Equities

World |

+4,05%

Precious Metals

Gold |

+4,85%

Government Bonds

Europe |

+9,76%

Commodities

Broad Market |

|

+5,81%

Equities

Emerging Markets |

-14,53%

Corporate Bonds

Europe |

-0,57%

Money Market

Euro |

+2,71%

Corporate Bonds

Europe |

+6,56%

Government Bonds

Europe |

|

+3,27%

Money Market

Euro |

-15,28%

Equities

Emerging Markets |

-1,42%

Corporate Bonds

Europe |

-0,57%

Money Market

Euro |

+6,06%

Corporate Bonds

Europe |

|

-11,97%

Commodities

Broad Market |

-18,55%

Government Bonds

Europe |

-3,58%

Government Bonds

Europe |

-11,33%

Commodities

Broad Market |

-0,49%

Money Market

Euro |

Equities Emerging Markets(MSCI Emerging Markets)

Government Bonds Europe (iBoxx® EUR Sovereigns Eurozone)

Corporate Bonds Europe (iBoxx® EUR Liquid Corporates Large Cap)

Commodities Broad Market (Bloomberg Commodity Index)

Precious Metals Gold (Xetra-Gold)

Money Market Euro (EUR Overnight Rate Swap)

Source: justETF Research; as of 09/01/2024

As ever, the past tells us nothing about the future. Buying a losing asset class at bargain prices can pay off handsomely when it jumps to the top of the table. This is sometimes termed mean reversion - the market realises it has undervalued an asset class and demand rises as investors’ faith is restored. This happens in reverse too: an asset class can be dumped like a radioactive waste when the market believes its overvalued. Market bubbles inflate and pop during the most extreme periods of this behaviour.

Hence asset classes flip from zero to hero at different times and leveraging this variance is the key to successful asset allocation. By accepting that you can’t predict the winners, or time the market, but are better off diversifying across the most useful asset classes, you create a portfolio that’s more than the sum of its parts. In other words, you can achieve a lower overall level of risk per unit of return by smoothing your results over time across complementary asset classes.

The nightmare scenario that good asset allocation helps us to avoid is two-fold. Firstly, trapping our wealth in a single asset class that ends up having a lost decade. Secondly, banking everything on asset classes that are so volatile they cause us to panic and sell out at the bottom of the market. That makes your asset allocation the most important investment decision you’ll make.

Determine your strategic asset allocation

Strategic asset allocation refers to the decision of how to split your portfolio between risky assets (like equities) and defensive assets (like high-quality bonds and cash). According to numerous academic studies, strategic asset allocation accounts for 90% of the variation in portfolio returns, so it's important to get it right. Diversification spreads your risks across the key asset classes but your goals and risk tolerance determine your individual asset allocation. To optimise your asset allocation for your specific situation you should think about:Investment horizon

If you’ll invest for many years before drawing down on your wealth you can afford to put more into equities. That enables you to take advantage of equities' higher expected returns versus other asset classes while being able to wait out any stock market turbulence along the way. If you need your money back in a few years, however, you should avoid equities and look at short-term UK government bonds or cash. These are the least volatile asset classes that will best preserve your wealth over short periods.Risk tolerance

What's relevant here is how much risk you are willing, able and compelled to take. Willing - some investors can coolly shrug off large stock market losses without worrying about it. If that’s really you (perhaps you weren’t bothered by the 2008 and 2020 meltdowns) then you can allocate more than normal to equities. If you still have whiplash from the 2020 stock market rollercoaster ride then you shouldn’t venture too much to volatile asset classes like equities, real estate and commodities. Able - if you don’t need the money then ironically you can afford to take more risk in the hope of a big pay off. But if you’re absolutely relying on your portfolio to pay the bills in the future then you should increase your allocation to less volatile bonds as that time approaches. Compelled - Your calculations may show that you need an annualised 4% real return per year to achieve your goals in ten years. The chances of achieving this with just bonds or cash are slim to none. Therefore a strong need requires a higher allocation to riskier assets. Note, however, that investing isn’t a game where you want to play a Hail Mary pass. If you’re relying on a decade of 10% annualised real returns then you need a miracle. Alternatively, you can do something more sensible like invest for longer or contribute more to your portfolio.Lifecycle

Young investors generally have little of their financial capital committed to the market in comparison to their human capital i.e. their capacity to work for many years into the future and recover from any mistakes or market turmoil. Older investors by contrast usually have more financial capital but less human capital and fewer years left to rectify losses. That truism has led to the following rule-of-thumb for portfolios that will ultimately fund your retirement:Percentage of risky asset classes = 100 minus your age