SRI indices track firms that take a positive approach to environmental, social and corporate governance (ESG) issues. This can be anything, from focusing on firms producing green tech or actively managing their carbon footprint to favouring companies that promote ethical and sustainable business practices. SRI indices are also likely to exclude so-called sin stocks - firms up to their neck in the alcohol, tobacco, arms, gambling, pornography, fossil fuel and nuclear industries, among others.

Although SRI is a fast-growing sector, the idea of influencing society through investing is not a new one.

In good company

The Quakers are often credited as pioneers of socially responsible investing, as they forbade their members to profit from the slave trade in the 18th Century. Other religious organisations have worried about ill-gotten gains too and regularly used the pulpit to steer their flocks away from vice-like liquor and guns.The social revolution and increased attention to UN human rights accelerated developments in the 1960s and 1970s. The first stock indices with ethical guidelines were constructed in the 1990s. Sustainable investment practices received a further boost with the Principles for Responsible Investment and the associated non-profit organisation UNPRI. Today, numerous institutional investors and investment companies are members of the UN initiative launched by then UN Secretary-General Kofi Annan in 2007.

The EU is also pursuing the goal of directing more investments into climate-friendly companies. Since March 2021, there have been basic EU standards for sustainable investment products and fund providers. By 2022, the regulation is to be worked out in detail and implemented. Large institutional investors such as pension funds and insurers must also make even greater efforts to address the issues of sustainability and climate protection, according to the EU. All this ensures more volume in ETFs and many new products on the market.

The SRI sector has blossomed ever since. More and more ETFs and funds arrived enabling investors to direct their cash towards green themes such as clean energy or water and, increasingly, towards broad-market SRI ETFs. European investors, in particular, attach great importance to sustainable ETFs. Around 60% of all funds invested in sustainable ETFs come from Europe.

In the first quarter of 2021 alone, 43.8 billion euros have been invested in sustainable ETFs alone. As a result, the funds invested across Europe rose to over 100 billion euros in more than 300 equity and bond ETFs.

That number is likely to increase as many market participants also believe that ESG companies are best placed to meet the challenges of the future - think pension sovereign wealth funds reducing their exposure to fossil fuel firms, for example. There is also evidence that millennials and women are more and more interested in SRI – Morgan Stanley found that 70% of females and 84% of millennials believed that ESG factors were important.

SRI performance

But is SRI too good to be true? Do you have to compromise your principles for performance? Several studies have examined this question and concluded that SRI funds largely perform on a par with their conventional counterparts and can beat them.How can sustainable indices outperform their conventional counterparts? Firms that are ESG-compliant often operate more efficiently. This translates into better cashflows, a lower cost of capital and, ultimately, a superior performance. Such companies are also better positioned to take advantage of the opportunities afforded by sustainable business practices.

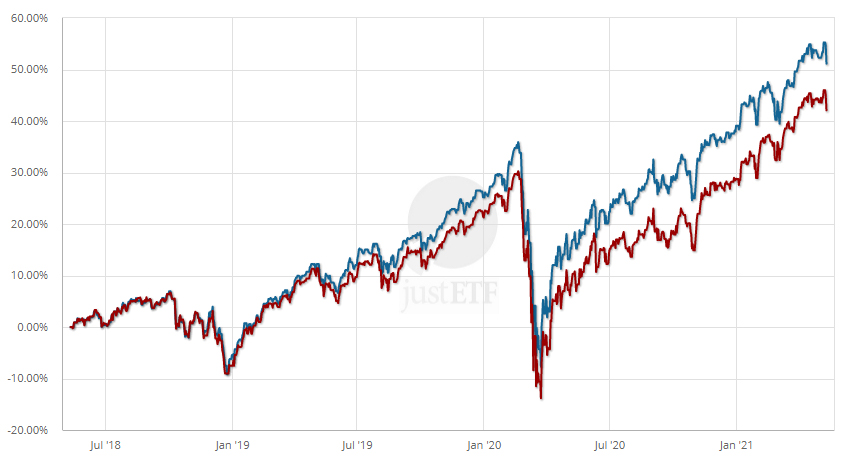

MSCI World SRI vs MSCI World

Xtrackers MSCI World UCITS ETF 1C iShares MSCI World SRI UCITS ETF EUR (Acc)

Source: justETF Research; as of 11/05/2021

In the example above, the ETF on the MSCI World SRI outperformed the conventional MSCI World ETF over the past three years. So it shows that SRI indices can do as much for your conscience as they can for your ETF portfolio.

How do SRI indices work?

SRI indices vary a lot, so it is important to make sure that your chosen ETF tracks one that matches your concerns.Often an SRI index starts as a clone of a well-known parent index such as MSCI World. Firms that are not in line with the index's principles are excluded. For instance, MSCI World SRI knocks out companies with their fingers in the following pies:

- alcohol

- gambling

- tobacco

- armaments

- firearms

- adult entertainment

- genetically modified organisms

- nuclear power

- thermal coal

Some indices enhance exposure to companies that score highly against ESG criteria, such as environmental practices, respect for human rights and employee treatment, by increasing the weight of these companies. Some indices also take lower-rated companies into account if their sustainability rating has improved in the recent past.

The screening process implies that an SRI index is more concentrated than its amoral parent – MSCI World has 1,583 constituents versus only 361 for MSCI World SRI (as of 30/04/2021).

Some indices compensate by retaining their parent’s regional and risk-return characteristics.

As one might expect, MSCI is the dominant index family for SRI. Although there are also sustainable indices from other providers:

Moral focus of SRI indices

| Index family | UN Global Compact | Controversial weapons | Conventional weapons | Nuclear power | Unconventional oil & gas exploration | Thermal coal | Alcohol | Tobacco | Gambling | Pornography | Genetically modified organisms (GMO) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow Jones Sustainability ex alcohol, Tobacco, Gambling, and others | |||||||||||

| DAX ESG | |||||||||||

| FTSE ESG Low Carbon Select | |||||||||||

| FTSE Global Choice | |||||||||||

| MSCI Climate Change ESG Select | |||||||||||

| MSCI ESG Enhanced Focus CTB | |||||||||||

| MSCI ESG Leaders | |||||||||||

| MSCI Screened | |||||||||||

| MSCI ESG Universal | * | * | |||||||||

| MSCI Select ESG Rating and Trend Leaders | |||||||||||

| MSCI SRI | * | ||||||||||

| S&P ESG | |||||||||||

| Solactive Core | |||||||||||

| STOXX SRI |

Excluded Contained

Source: justETF Research; as of 30/11/2024

*further exclusion in subindex

*further exclusion in subindex

SRI ETF selection

Naturally, the choice is the winner as the popularity of SRI ETFs grows. You can invest responsibly in a global SRI ETF; across regions; in single countries or in single, sustainable industries or investment themes.For sustainable ETFs, too, you should not disregard the usual criteria for ETF selection. Our investment guides on sustainable world ETFs and sustainable ETFs for Europe offer you valuable support in selecting sustainable equity ETFs. To find SRI ETFs search justETF's screener using the filter “social/environmental”.

Our tip: Are you interested in theme investments such as water, electric mobility or clean energy? Then use our investment guides.

Green bond ETFs

In addition to the now established sustainable equity ETFs, an increasing number of green bond ETFs are entering the market. As with equity ETFs, the companies and partly sovereigns behind the financial instrument are reviewed, selected or excluded based on sustainability criteria.The methodology is similar to the one used for evaluating equity issuers. MSCI, the market leader for equity indices, cooperates with Bloomberg Barclays, a well-known provider of bond indices.

With our ETF Strategy Builder, you can put together your own portfolio of sustainable equity and bond ETFs.

Our tip: Find the best sustainable ETFs: Our investment guides on sustainable world ETFs and sustainable ETFs for Europe compare the special features of sustainable indices and support you with rankings and current savings plan offers for sustainable ETFs when choosing an index or ETF.