- Level: For advanced

- Reading duration: 3 minutes

What to expect in this article

Money market ETFs: what are they?

Money market ETFs are part of the money market fund (MMF) ecosystem. All MMFs, including Money Market ETFs, invest in ultra short-term government debt and other fixed income securities backed by excellent credit ratings. Money market ETFs prioritise preservation of capital, liquidity, and returns that are closely aligned to the overnight rate. The overnight rate is a rate of interest that’s only offered to the largest, most secure financial institutions such as banks. The rate is usually calculated by the central bank that supervises the ETF’s target market, for example the Bank of England in the UK, the Federal Reserve in the US, and the ECB in Europe. The interest rates paid by easy access bank accounts are heavily influenced by the overnight rate, too. However, money market ETFs can beat the overnight rate because they hold some higher-yielding securities with maturity dates a few months out.justETF tip: Use our ETF search to explore the range of money market ETFs available.

How do money market ETFs perform?

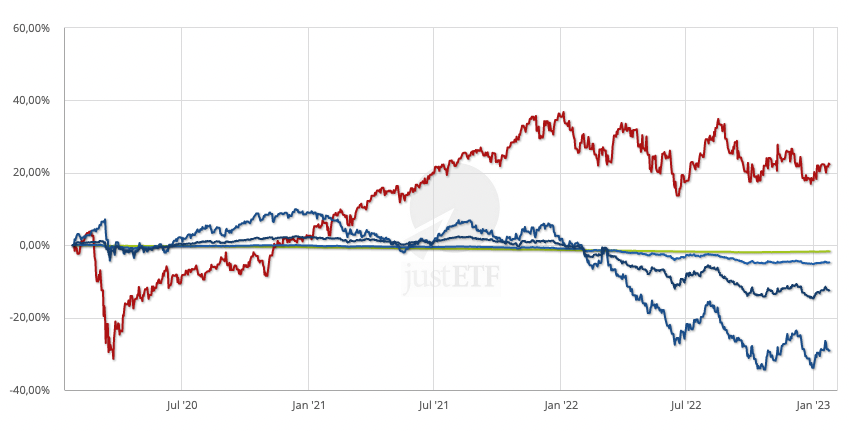

Like a cash account, a money market ETF is highly stable and does not normally fluctuate much in value. The fund achieves this by investing in high-quality assets with extremely short maturities – so they’re barely perturbed by changes in the main central bank rate. That makes money market ETFs an ideal substitute for an easy access bank account or the risk-free portion of the portfolio.At a glance: World equity ETF vs money market ETF vs bond ETFs (01/24/2020 - 01/24/2023)

MSCI World ETF Money market ETF Short-term Euro Government bonds Medium-term Euro Government bonds Long-term Euro Government bonds

Source: justETF Research (25/01/2023)

Who needs a money market ETF?

As money market ETFs are designed to perform similarly to cash in the bank, the obvious question is: Do I need one at all? On the one hand, you may be able to earn a higher rate of interest in a money market ETF as we’ve mentioned. On the other, it’s worth remembering that ETFs do not qualify for the £85,000 FSCS protection limit that applies to UK banks. Instead, ETFs are secured by EU-wide regulation that ensures your assets are ring-fenced and protected should the provider enter administration. In practice, it’s unlikely that either FSCS or ETF protections will ever be needed because central banks step in whenever a major crisis threatens financial stability – as happened during the Credit Crunch, the Covid Crash, and the recent turmoil at the Silicon Valley Bank. Moreover, cash invested in a money market ETF is backed by real assets of extremely high quality. These can be sold and the proceeds returned to the ETF’s investors. Thus many investors decide to park their spare cash in a money market ETF – in the expectation of earning extra interest – before they redeploy the money into higher growth assets. The other strong reason to use money market ETFs is to take advantage of a rising interest rate environment. In this scenario, longer-dated bond ETFs will take capital losses as yields increase. However, money market ETF capital values are almost immune to this effect because their assets mature so speedily. Moreover, money market products rapidly reinvest principal as their holdings mature, so they quickly benefit from the higher rates of interest offered by newly issued debt securities. The bottom line is that money market ETFs are much less volatile than bond funds and they’re quicker to pass on the benefit of rising interest rates, which banks are often slow to do.How much interest do I get?

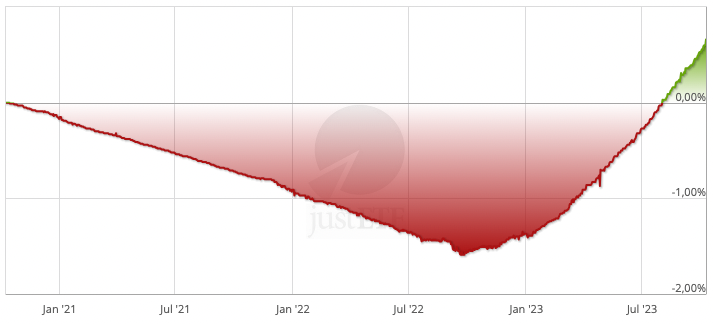

Your money market ETF interest rate will be in line with the overnight rate your product tracks minus investment costs. For example, the Lyxor Smart Overnight Return UCITS ETF C-GBP follows the Sterling Overnight Index Average rate (SONIA for short). If the SONIA rate is 4.1% and your ETF’s Total Expense Ratio / Ongoing Charge is 0.1%, then a reasonable approximation of your current annual interest rate is: 4.1% - 0.1% = 4% Note this can only ever be an approximate guide as the SONIA rate fluctuates daily – Google it for the latest info. Moreover, the ETF may slightly undershoot or overshoot the official rate. For bonus points, pop your estimated money market ETF interest rate into a compound calculator for a fair comparison with the Annual Equivalent Rate (AER) advertised by bank accounts. That said, the chart below shows that money market ETF volatility is nothing to worry about even during a year as dramatic as 2022.Money market ETF volatility (08/05/2022 - 08/05/2023)

Money market ETF (Amundi ETF Govies 0-6 Months Euro Investment Grade UCITS ETF EUR)

Source: justETF Research (09/05/23)

Money market ETFs vs bank accounts

| Bank account | Money market ETF |

|---|---|

| Based on the ‘Bank Rate’ as set by the Bank of England. Interest rate increases are passed on with a delay and not always in full | Maturing securities are reinvested into new assets, which is beneficial when yields are rising |

| Banks make money from interest rate spreads so High Street rates are typically lower than money market ETF rates | A higher rate is possible versus easy access accounts because the banks can’t deposit their cash for a higher rate than the overnight one |

| Available 24/7 | Trade anytime the stock market is open |

| Interest accrues daily | Interest accrues daily |

Source: justETF Research (25/01/2023)