- Level: For beginners

- Reading duration: 5 minutes

What to expect in this article

For this matter, we use justETF’s detailed comparison. This is how it works:

- Go to the details page of an ETF. If you have not yet decided on an ETF, you can use the justETF search to find the right ETF for you

- On the details page of the ETF, click on the "Compare" button at the top left under the name of the ETF

- Repeat this for all ETFs you want to compare

- After completing the selection, you will find the number of ETFs selected for comparison in the top right-hand corner, next to the "My profile" section. From there you can review your selection in detail

Why choose global ETFs?

ETFs that track global indices are probably the most popular instrument for investors who want to take the most passive approach possible. With a monthly savings plan on an ETF that covers the whole world, you are already broadly positioned. Depending on the desired volatility and potential returns, you can combine it with a bond ETF. With just two ETFs, you are pretty well positioned. This is certainly the simplest, but also one of the most effective investment strategies. Looking back, a global ETF would have outperformed most Wall Street managers in recent years, net of costs. You may be asking yourself: what's the catch? How can someone with no expertise in finance easily achieve higher returns with a few ETFs than experienced portfolio managers? But there is no catch. This is the reality, and if you don't believe it, I invite you to read one of the many reports that prove it. A well known report is the SPIVA study, published annually by S&P Global. Now back to the topic. For many investors, an ETF that tracks a world index is the ideal choice. It requires little effort and minimal knowledge, but still delivers excellent results. The remaining question is which ETFs are suitable for this investment objective?3 global indices

Let's start with the indices.What is an index?

An index bundles many different securities such as shares or bonds and combines them into a kind of “sentiment barometer” as within the DAX or MSCI World. In turn, these indices are tracked (i.e. repurchased) by ETFs. This allows you to easily invest in broad markets without having to buy individual shares.

An index bundles many different securities such as shares or bonds and combines them into a kind of “sentiment barometer” as within the DAX or MSCI World. In turn, these indices are tracked (i.e. repurchased) by ETFs. This allows you to easily invest in broad markets without having to buy individual shares.

ETFs that track world indices

Now that we have identified the indices, we can search the justETF website for ETFs that track them. In the ETF search, we can filter ETFs by "index selection" and search for the three mentioned.ETFs on the MSCI ACWI IMI

Currently, only two ETFs for the MSCI All Country World Investible Market Index (MSCI ACWI IMI) exist. Both ETFs are issued by State Street. The accumulating one with the ISIN IE00B3YLTY66 was launched in 2011. The first thing that stands out is the size of the fund, which is ten times smaller than the other two ETFs we'll be looking at. This is surprising considering that the index it tracks is the largest. The reason may be that until recently, the TER of this ETF was around 0.4 %, which is much higher than the other two ETFs. Recently, the TER was lowered to 0.17 %, which is now in line with the others. Other features include the fact that the ETF is accumulating, meaning that dividends are reinvested in the fund. It also reflects a random replication with a limited number of companies compared to the index. The index consists of 9,000 companies, but the ETF only contains 3,500, which is even less than the FTSE All World Index. This could be another reason why the ETF has not attracted much capital. The difference in the weighting of the companies from 4,000 to 9,000 is small, but could disappoint expectations. However, a big pro argument in favour of this ETF is that it is the only one to offer real exposure to large, mid and small cap companies, while the other two indices only offer access to large and mid-caps.ETF on the FTSE All World Index

Secondly, let’s have a look at the ETF that tracks the FTSE All World Index. On the justETF website, we can find four ETFs that allow us to invest in this index. Here we take the ETF issued by Vanguard with the ISIN IE00B3RBWM25 as an example. This ETF has a TER of 0.22 %, is distributing and is also replicated by means of sampling. The underlying index comprises 4,294 companies, while the ETF contains 3,646. The difference is smaller than in the previous case. The size of the fund is acceptable, although the ETF was only launched in 2012.ETFs on the MSCI ACWI

Finally, let us look at the third index and the corresponding ETF. We can find four ETFs for the ACWI All Country World on the justETF website. Let's have a look at the ETF issued by iShares, with the ISIN IE00B6R52259 as an example. This accumulating ETF is the largest of the three ETFs analysed, with 2,448 companies. The TER (0.20 %) is similar to the other two.3 ETFs in comparison

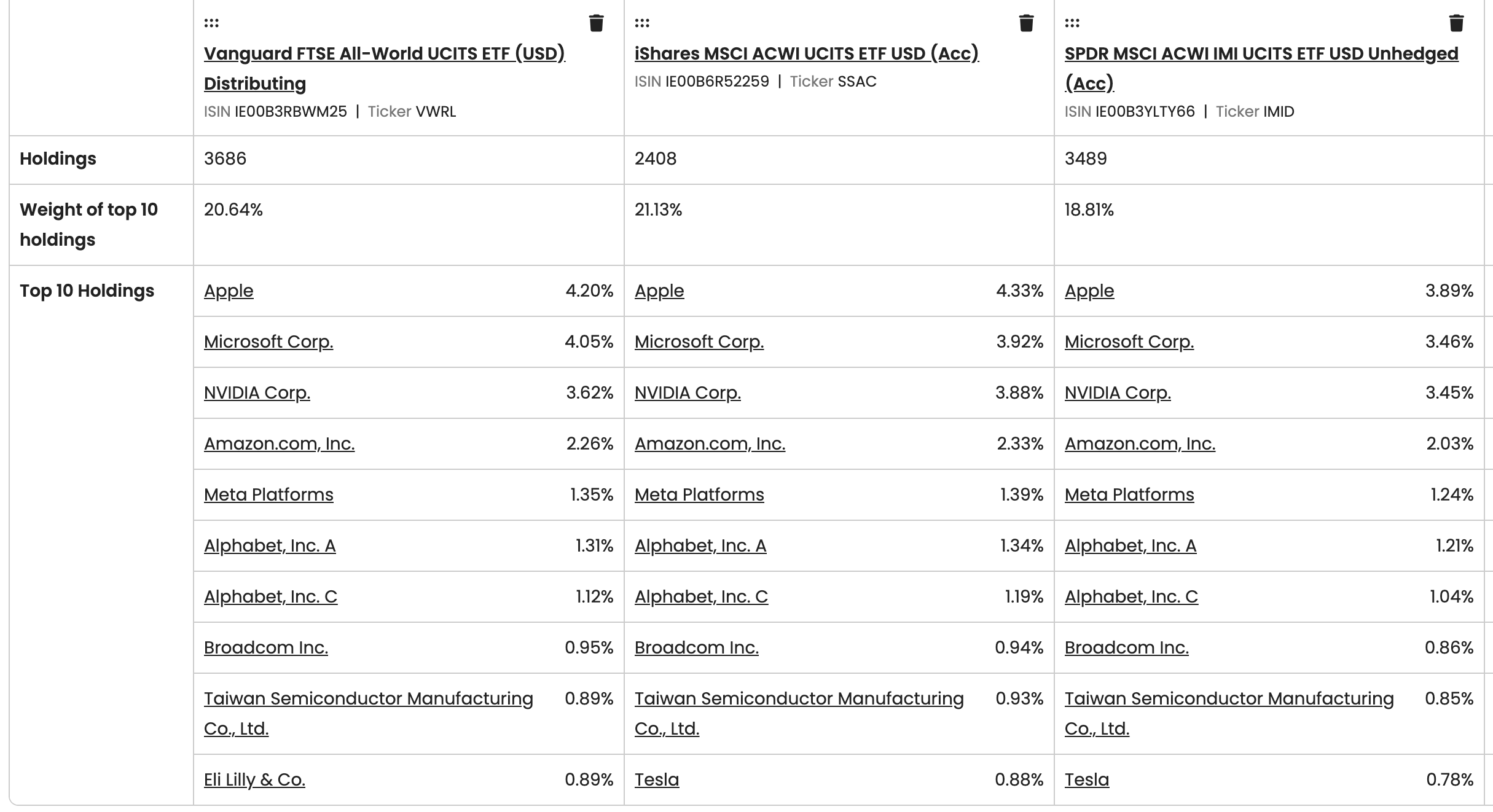

If we analyse the three ETFs, we see that they are closely resembling in their characteristics and show few differences in their composition.

Source: justETF Research, as of 09/2024

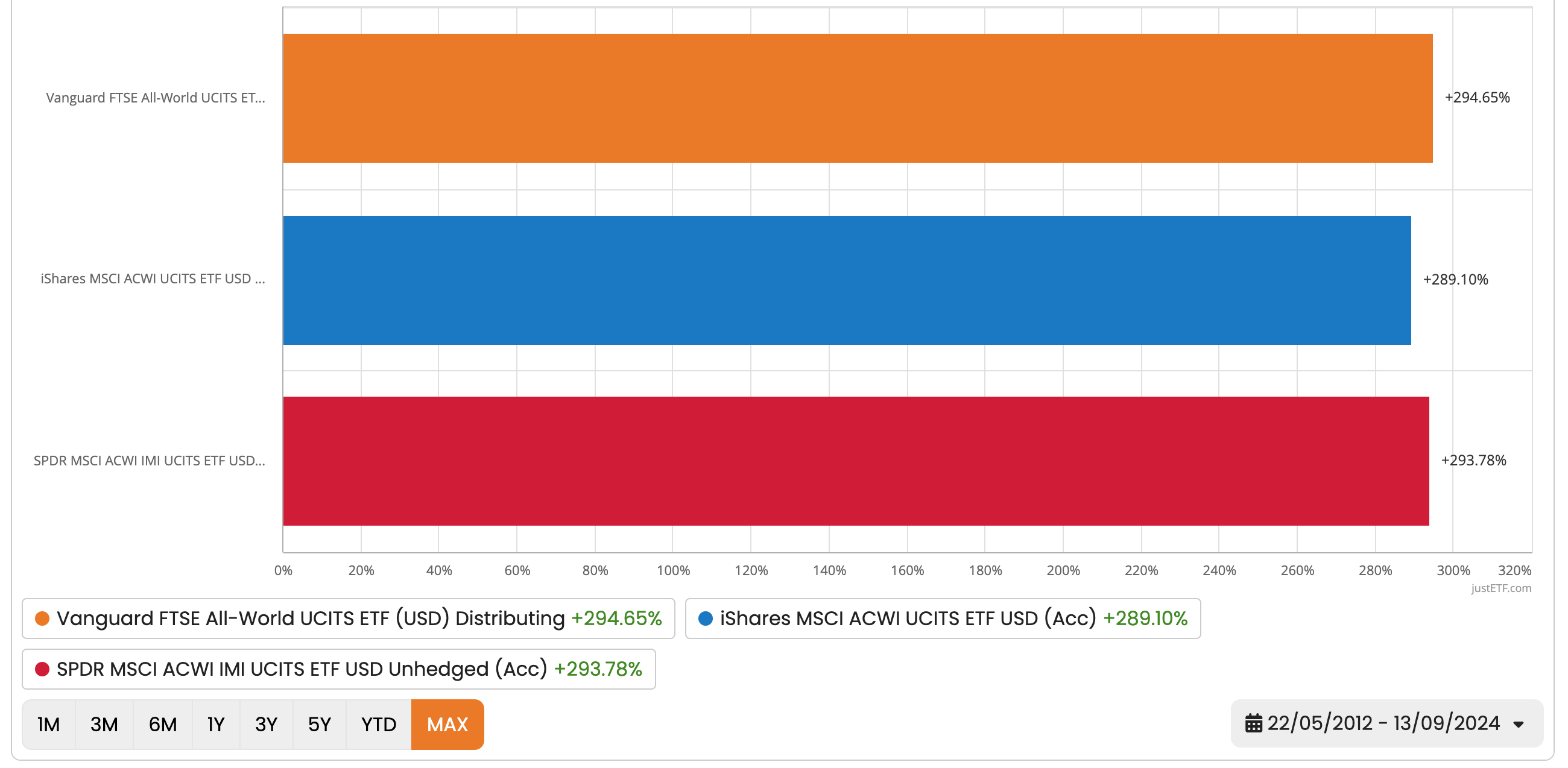

If we now consider the past performance starting from 22nd of May 2012, the time from which the data is available, the three ETFs have also been very similar.

Source: justETF Research, as of 09/2024

The reason for this is that most of the stocks in all three ETFs are the same, and the differences in the individual ETFs only have a minor impact on the total return.