Viewing the components of an ETF in the ETF profile

The "Exposure" tab on the ETF profile allows you to obtain information on the securities in which the ETF under consideration invests. Simply click on the "Exposure" tab on the ETF profile to get to the corresponding place in the ETF profile.

ETF constituents

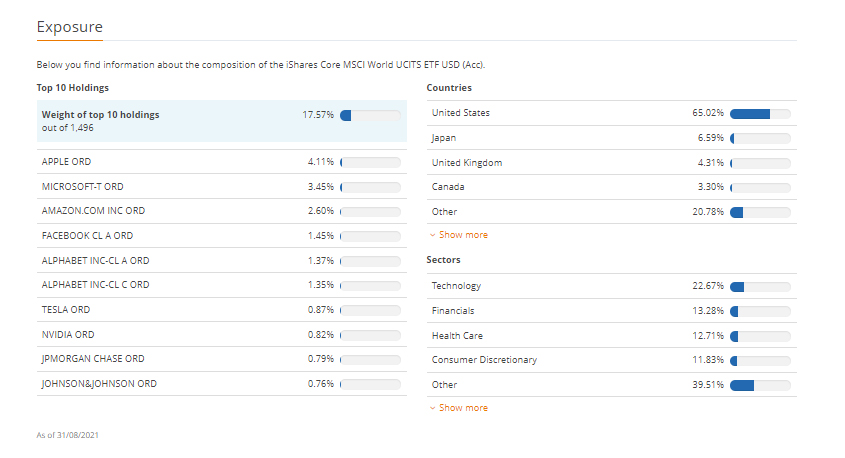

The "Exposure" section in the ETF profile provides you with information on the components of the ETF under consideration in the form of three tables. Using this information, you can check, for example, which are the largest securities contained in the ETF or whether an ETF invests particularly heavily in a specific country or economic sector. The corresponding data is updated once a month; the current status is indicated below the tables.Largest positions in the ETF

The table "Top 10 Holdings" provides you with information on the securities in which the ETF under consideration is most heavily invested. You will receive information on what share (in %) these positions make up of the entire ETF and how many securities are contained in the ETF in total.Below is a list in which the largest positions of the ETF are sorted in descending order by weight. Next to the name of a security, you will see the percentage share that the corresponding security makes up in the ETF, illustrated as a number and graphically in the form of a bar.

Thanks to this information, you can determine, for example, how broadly diversified an ETF is or whether its performance is particularly dependent on individual securities.

Largest countries in the ETF

The table "Countries" informs you in which countries you invest with the ETF under consideration. In the case of an equity ETF, for example, the countries from which the companies contained in the ETF originate are analysed. The weights of all companies from a certain country are added up. The individual countries are then sorted in descending order according to their total weight in the ETF. In addition to the country name, you see the percentage share that the respective country makes up in the ETF as a number and graphically illustrated as a bar.By default, up to five countries are displayed. If an ETF invests in more than five countries, you can expand the table using the "Show more" button and display more countries.

Largest sectors in the ETF

The "Sectors" table provides information on the economic sectors and industries in which the ETF under consideration invests. For this purpose, the economy or all the companies under consideration are divided into different areas - also called sectors - according to a clearly defined scheme. In our case, the companies are classified according to the standard most commonly used in the financial industry, the so-called "Global Classification Standard" (GICS for short).The weights of all companies from a given sector are added up. Then the individual sectors are sorted in descending order according to their weight in the ETF. In addition to the sector name, you see the percentage share that the corresponding sector makes up in the ETF displayed as a number and graphically as a bar.

By default, up to five sectors are displayed. If an ETF invests in more than five sectors, you can expand the table using the "Show more" button and view all additional sectors.

Note: Information on ETF composition is only available for ETFs that physically track the benchmark index. ETFs that track the index synthetically, i.e. via a swap, do not invest directly in the securities contained in the index. Accordingly, no information on the ETF composition is available for these ETFs. For this reason, the "Composition" tab is not displayed in the ETF profile for synthetic ETFs.