Compound interest is a dull name for an astonishing phenomenon: the capacity for interest to grow exponentially until it delivers a huge proportion of your wealth while all you do is sit back and wait.

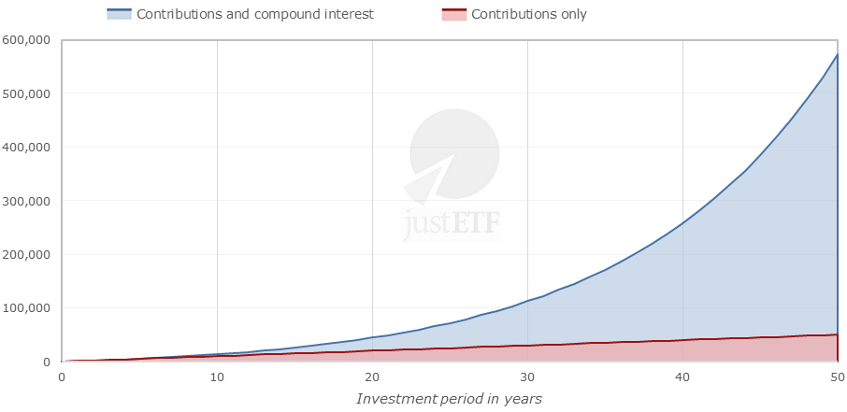

The concept is best illustrated visually.

Compound interest effect

Source: justETF Research

This graph shows the growth of a £1,000 investment that earns 8% interest for 50 years. The investor also makes a new contribution of £1,000 at the start of every year.

The blue line shows the growth of wealth due to interest. The red line shows growth from contributions only.

The longer the investment period the stronger the effect of compound interest

As you can see, the blue line shoots up while the red line barely rises: dramatically illustrating that interest is capable of delivering far more growth than contributions once your time horizon stretches beyond 10 years.After 15 years the effect of interest alone is approximately equal to that of contributions. After 23 years interest has provided approximately double the wealth delivered by contributions.

As the time frame stretches so the effect multiplies with interest responsible for triple the amount of wealth of contributions at 30 years and nine times by 45 years.

What’s at work here is the benign effect of interest earned on interest.

Imagine you invest £1,000 and it earns 10% interest in one year (or £100). At the start of year two, you now have £1,100 in the kitty.

If that £1,100 earns 10% interest then you bring in £110 in year 2 and end up with £1,210.

That £1,210 earns 10% interest and brings in a little more again. 30 years later, you have not contributed a single extra penny to your pot, but it’s producing £1,586 in interest at 10% per year.

Meanwhile, your total wealth has shot up from £1,000 to £17,449. That’s a 1645% increase - all provided by compounding interest, bar the first £1,000.

If you’d like to live off your interest then it is possible if you can leave your assets invested for long enough. The compounding effect of interest on interest is more potent the longer you give it to work.

This is why it’s important to invest as much as you can, as early as you can, and have low-cost investment products, like ETFs, that are capable of providing strong long-term returns.

When it comes to investments, any type of growth can compound: dividends or capital gains as much as traditional interest on savings.

And just as the effect of compound interest multiplies with time, the same is also true of the growth rate. For example:

£1000 compounded at 4% for 30 years = £3,243

£1000 compounded at 8% for 30 years = £10,063

As you can see, your wealth more than doubles when the growth rate doubles. In fact, it’s shot up by 210% in this example.

Reinvesting of dividends increases returns significantly

This is why reinvesting your dividends can make such a difference to your returns over time. Each extra percentage of growth has a proportionally greater effect on your total wealth over time.For example, this graph shows the effect of dividends upon investment in the global equity index MSCI World since 1969.

MSCI World price index vs. total return index (in USD)

Source: MSCI.com; as of 04/12/2019

The $10,000 initial investment grew by factor 16 to $166,200 without dividends.

But with dividends invested, the initial sum was transformed into $636,000 - an increase by factor 63.

The final effect of time to bear in mind is that investment returns are never as smooth as in the examples above. Equities, in particular, can rise and fall dramatically in any year – volatility that’s reflected in the jagged charts you’ll see showing the returns of any given index.

Volatile equity returns smoothen out in the long-run

In the 46 years 1969 to 2015, the average annual return of the MSCI World index was 11%. But the largest loss over that time was -40% (2008). Meanwhile, the largest gain was +43% (1986). 34 years ended in a gain and 12 in a loss.Ultimately, while any year can result in a large rise or fall for equities, returns tend to average out over longer time horizons. So the longer you invest, the more likely it is that your returns will look like the average.

The volatility of equities is why they are not recommended for time horizons shorter than 5 years and why a diversified portfolio is the best way to ensure you enjoy smoother returns over longer periods.