How does portfolio accounting work at justETF?

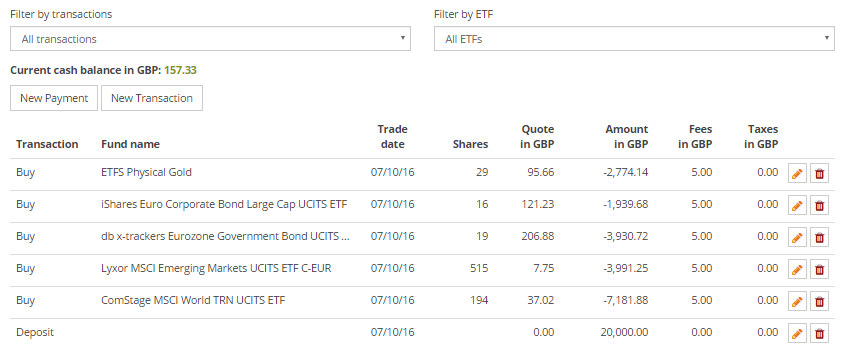

You can create portfolios in various ways at justETF. A portfolio is saved in the justETF system on the basis of transactions and not on the basis of positions. Thus the analyses are more meaningful.All entered transactions are always displayed on the "Transactions" page of your portfolio. You can process transactions and create new transactions manually at any time here.

Go to transaction list of a portfolio:

Portfolio overview > Actions > Transaction list

Portfolio overview > Actions > Transaction list

Important: justETF is a virtual portfolio management system

This means that all the transactions entered in the justETF system are purely virtual. You can decide for yourself, whether you want to manage your portfolio only virtually and execute real transactions through your bank or your online broker. If available, you can use the direct order transfer to the online broker at the time for executing the orders or you can save the order list in the portfolio plan and print it out. Thus justETF is compatible with every bank.Create new transaction (Buy transaction/Sell transaction)

If you want to make a change in your portfolio, we recommend you to use the "Structure Portfolio" function. You will reach the planning mode via this function and you can easily change the weight of a position, sell the complete position or buy, for example, a new ETF. Subsequently, the system will automatically generate an order list for you with all required transactions for execution at your bank.Another advantage of this procedure is that the system automatically saves your new changed strategic asset allocation. This enables you to do a portfolio rebalancing or a deposit in this portfolio structure at any later point of time.

If you want to create a transaction in the past, create a new transaction on the transaction page.

Tutorial: Create transaction (Buy transaction/Sell transaction) in the past>

Edit transaction

You can edit the parameters of a transaction at any time. Thus you can change the trade date or the execution prices or the order charges and taxes subsequently.Delete transaction

You are able to delete any transaction in your portfolio. Please note that you cannot delete any transactions that lead to a negative cash balance in the portfolio.Transactions do not completely vanish after deletion. The transaction filter will help you to find the deleted transactions. This function provides you with the opportunity to create the transactions that were mistakenly deleted again.

Align strategic asset allocation with manual changes

If you process or delete a transaction manually on the Transactions page, your strategic asset allocation is not aligned automatically. You can change this manually on the Monitoring page, if required.What does "Cash" or "Cash balance" mean?

"Cash" shows the liquidity available to you. The cash balance in the justETF system is comparable to the checking account in your bank. This is the amount of money available to you from which your buy transactions and fees will be paid. This enables you to manage your investment as realistically as possible.Cash balance must be always positive

The system does not permit negative account balance ("Cash"). If you receive the "negative cash balance" warning while processing a transaction, then you must either align the parameters of the transaction or increase your cash balance by manual deposit.Important: The transaction types Buy transaction and Sell transaction always have a direct influence on the cash balance. As against this, the transaction types "Delivery" or "Dispatch" do not have any effect on the cash balance.