Investors voted with their feet and, as you can see in the graph below, synthetic products have waned since 2012 while the popularity of physical ETFs continued unabated.

Use of replication methods in ETFs since 2008

Source: Deutsche Bank, Bloomberg Finance LP, Reuters; as of 13/12/2017

Today, three-quarters of ETF assets under management are held in physicals. And the trend is set to continue as physical product launches predominate while existing synthetics are converted to physical replication.

Synthetic ETFs – an endangered species

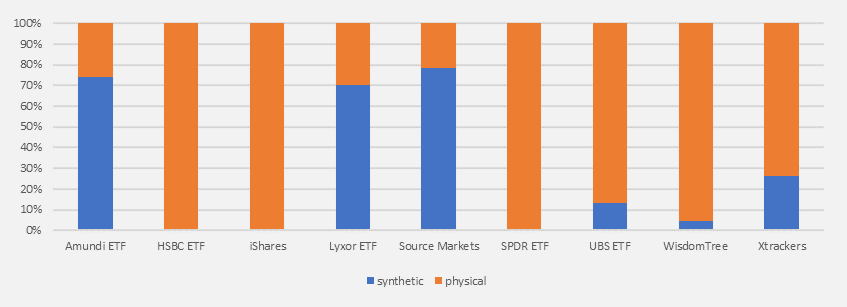

Just a few years ago, some European ETF providers only offered synthetic ETFs, but none do so today. Instead, providers now decide which replication method works best for the market each ETF seeks to track.While the major providers still maintain significant numbers of synthetics, they continue to increase their range of physical products in response to changing demand.

Replication method by provider (percentage of number of ETFs)

Source: justETF.com; as of 31/07/2018

However, looking at the number of ETFs only tells half the story. Most of the converted funds are so large that their assets under management features a high proportion of physical replication anyway. The biggest ETF provider, iShares, has all but eliminated synthetic ETFs from its range.

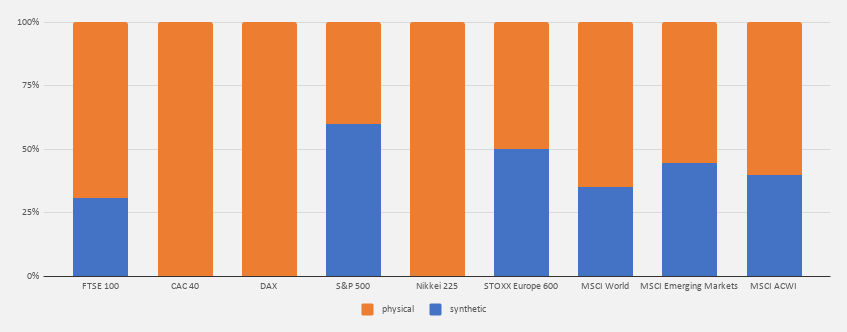

Replication method by index (percentage of number of ETFs)

Source: justETF; as of 31/07/2018

The retreat of synthetic ETFs is particularly pronounced in single country stock market indexes such as the FTSE 100, Nikkei and DAX. Although you can still take your pick of replication methods among the broader indices such as the S&P 500 and MSCI World.

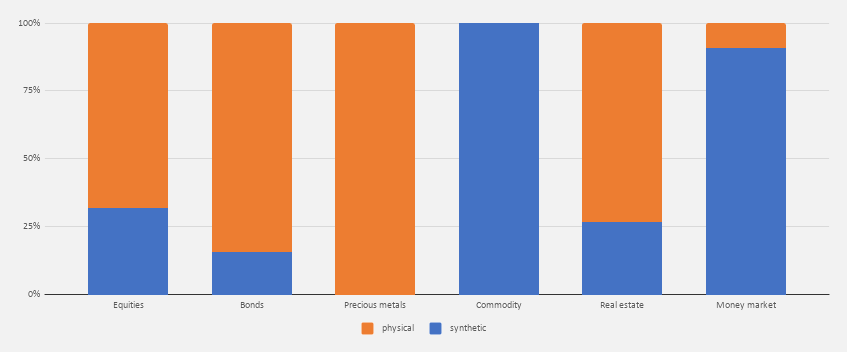

Replication method by asset class (percentage of number of ETFs)

Source: justETF; as of 31/07/2018

It’s still reasonably easy to find physical or synthetic ETFs to cover major asset classes such as equities, bonds and REITs. While some providers may prefer synthetic ETFs, the sheer liquidity of these markets has made it easy for physical products to compete.

However, some asset classes can only be replicated with synthetics due to legal and/or practical hurdles. Precious metals must be traded as ETCs under the UCITS guidelines, which in turn must be backed by the physical asset. Whereas commodity ETFs remain resoundingly synthetic as it’s impossible to physically store thousands of live cattle or millions of tons of wheat at a reasonable cost.

Money market ETFs can go either way depending on the index. Cash rates must be synthetically replicated but very short-term bonds can be tracked physically or synthetically.

Why is the US synthetic free?

Synthetic ETFs didn’t catch on in the United States because the legal regime for securities was more restrictive there. Hence swap-based ETF products are virtually unknown in the world’s biggest market, whereas they proliferated in Europe because they are technically easier to implement. Moreover, synthetics can offer more accurate replication and cost advantages in certain market niches.So have synthetic ETFs suffered from an unfair press? While no financial product can ever be truly described as ‘safe’, synthetic ETF providers made a number of changes to shore up confidence in their products alongside new regulations introduced by financial regulators. Such precautions should mean that counterparty risk is less significant now than in 2007, but memories of the crisis still linger and have become entangled with the increased product complexity of synthetics. Ultimately, each investor has to weigh up the risks associated with every investment product and to help you do that you can learn more about the workings of synthetic ETFs in our article Swap ETFs: Synthetic Replication of ETFs.