Diversify across asset classes

Some asset classes complement each other because they tend to perform differently under different economic conditions. So a good way to think of asset allocation is as a portfolio-building technique that features some shock resistance when the economy is turbulent and can capture some of the upside when business is booming.For example, equities generally do well during periods of high growth while high-grade government bonds will often prove their worth during periods of recession.

Commodities tend to flourish during periods of inflation while gold is most prized as a form of insurance against economic collapse and currency debasement.

Because countries rise and fall at different times, it’s also a very good idea to spread your risks internationally rather than, for example, invest solely in the UK and take the chance that your home market underperforms the rest of the world for the next ten years.

Diversify within asset classes

Some investors drill down deeper and make sure they are broadly diversified across industries too, ensuring that their portfolio isn’t over reliant on a particular sector like banking.Asset allocation is the investing equivalent of teamwork. Even if your forward line is having an off-night, it may be that your defence is performing brilliantly and making sure you’re still on for a good result.

It works because of the well known reversion to the mean phenomenon. In short, this is the tendency for assets to follow up periods of outperformance with periods of underperformance and so deliver a reasonably consistent average return over very long periods of time.

So if you’ve been buying equities during a period when prices have fallen, you are likely to be rewarded in the long-run as those cheap equities bounce back when the market realises they’ve become undervalued.

Today’s loser might be tomorrow’s winner

This is why it can make sense to hold on to assets that have been on a bad run. It’s notoriously difficult to predict when the losing streak will end and the status of any asset can suddenly swing from that of shunned loser to the hot investment that everyone is piling into.That’s especially true for asset classes that are at their best in circumstances quite at odds with the prevailing conditions. For example, you’re likely to be very grateful you kept government bonds in your portfolio the next time the economy falls into recession.

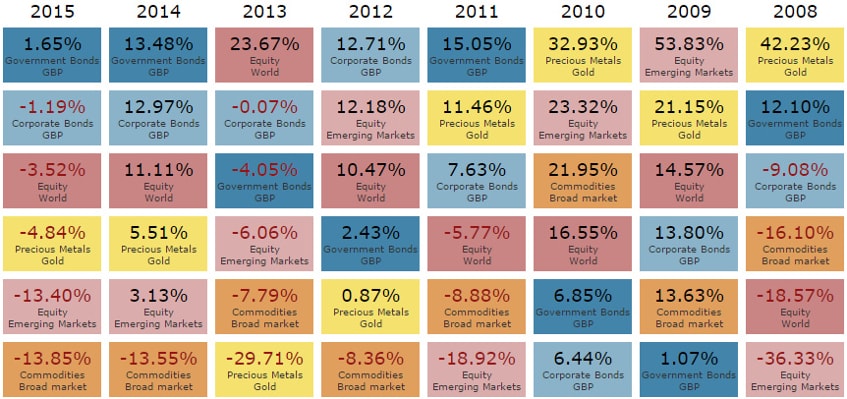

Performance of different asset classes by year

Equity World UK Goverment Bonds Commodities Broad Market Equity Emerging Markets GBP Corporate Bonds Gold

Source: justETF.com; *2015 January till September; All calucations in GBP; As of 30/09/2015

Steer your investment objectives

The other important role of asset allocation is to ensure your portfolio has the best chance of meeting your investment objectives.This requires customising your investments to suit the target sum you need, your time frame and your risk tolerance.

For example, as a rule of thumb, if you have less than five years left before you need your money back then equities are generally considered to be too volatile to rely upon. Short-term domestic government bonds are usually thought to be a better bet over short time frames.

Whereas if you require an average 4% growth over the next 20 years then you’re more likely to tilt heavily towards equities. The historical track record of bonds shows they are unlikely to deliver those kind of returns and you’ll probably have plenty of time to recover from any periods of equity underperformance during that time.

Regardless of your goals and time horizon, if your risk tolerance is low then you’ll need a high percentage of quality bonds that limits your exposure to the volatility of equities.

While if you’re after a good risk-adjusted return then look into diversifying as widely as possible across global equities, bonds, property and commodities as investment theory suggests that a broad blend of assets can deliver long-term performance while protecting your portfolio from the worst of any downturns.

Interaction between the different asset classes over time

Equity World UK Government Bonds Commodities Broad Market Gold Real Estate Europe

Source: justETF.com; All calculations in GBP; Period: 01/01/2007 - 13/10/2015