ETF Strategy Builder

ETF Strategy Builder

1 Investment Amount

2 Risk Profile

Choose your risk profile

A well-balanced portfolio consists of low-risk and high-risk assets. Adjust the risk portion of your portfolio to your personal risk capacity and your investment horizon.

The investment period largely determines the expected return of a portfolio. With a short investment period you have to expect a high volatility especially in the risk component. The longer your investing horizon is, the higher may be an appropriate risk rate you choose. Time is on your side.

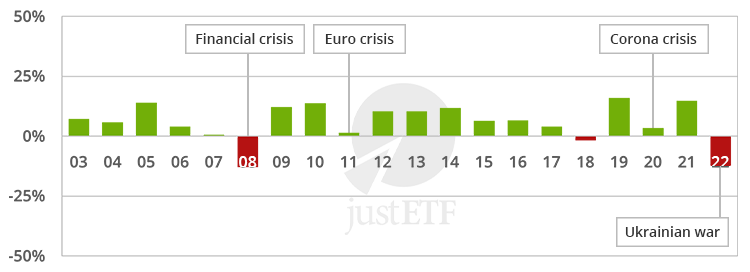

A historic analysis of a diversified portfolio can help you to choose the right level of risk. The simulation shows you the historic range of drawdowns and returns of a diversified portfolio with an equivalent risk rate, like the one you selected.

A diversified portfolio consists of low risk and high risk assets. Adjust the risk portion of your portfolio to your personal risk capacity and your investment horizon.

- Low volatility

- But not risk-free

- Expected returns are low

- High volatility

- High risk of big temporary losses

- Expected returns are high

2008 was the best year in the observation period with a return of 10.1%.

2022 was the worst year in the observation period with a return of -11.9%.

The maximum drawdown since 2003 has been -14.5% (Maximum Drawdown).

2014 was the best year in the observation period with a return of 8.1%.

2022 was the worst year in the observation period with a return of -11.9%.

The maximum drawdown since 2003 has been -12.1% (Maximum Drawdown).

2014 was the best year in the observation period with a return of 9.0%.

2022 was the worst year in the observation period with a return of -12.0%.

The maximum drawdown since 2003 has been -12.0% (Maximum Drawdown).

2019 was the best year in the observation period with a return of 10.0%.

2022 was the worst year in the observation period with a return of -12.1%.

The maximum drawdown since 2003 has been -12.1% (Maximum Drawdown).

2019 was the best year in the observation period with a return of 13.0%.

2022 was the worst year in the observation period with a return of -12.2%.

The maximum drawdown since 2003 has been -15.5% (Maximum Drawdown).

2019 was the best year in the observation period with a return of 16.0%.

2008 was the worst year in the observation period with a return of -12.8%.

The maximum drawdown since 2003 has been -21.6% (Maximum Drawdown).

2019 was the best year in the observation period with a return of 18.9%.

2008 was the worst year in the observation period with a return of -17.4%.

The maximum drawdown since 2003 has been -27.4% (Maximum Drawdown).

2019 was the best year in the observation period with a return of 21.9%.

2008 was the worst year in the observation period with a return of -22.0%.

The maximum drawdown since 2003 has been -33.1% (Maximum Drawdown).

2019 was the best year in the observation period with a return of 24.9%.

2008 was the worst year in the observation period with a return of -26.6%.

The maximum drawdown since 2003 has been -38.6% (Maximum Drawdown).

2021 was the best year in the observation period with a return of 27.9%.

2008 was the worst year in the observation period with a return of -31.2%.

The maximum drawdown since 2003 has been -44.0% (Maximum Drawdown).

2021 was the best year in the observation period with a return of 31.1%.

2008 was the worst year in the observation period with a return of -35.8%.

The maximum drawdown since 2003 has been -49.1% (Maximum Drawdown).

Historical analysis

You can see the historical performance of a diversified portfolio, consisting of equities and government bonds with your chosen equity ratio. The analysis shows how high the (temporary) drawdowns and the returns between 2003 and 2022 were. The analysis thus considers several economic crises (global financial crisis, Euro crisis, market crash at the beginning of the COVID-19 pandemic, Ukrainian war). These insights can be helpful for choosing your personal portfolio mix.

The analysis reflects the perspective of a European investor. All returns are calculated in Euro. Foreign currencies are not being hedged.

Please note: Past performance is not a reliable indication of future performance.

The simulated equity/bond portfolio reflects an investment in global equity markets and German government bonds. The risk allocation matches the equity portion you have selected. The equity allocation is represented by the MSCI World index (global equities from developed countries). The fixed income allocation consists of German government bonds (RexP).

Example with 50% equity allocation:

50% German government bonds, 50% equities worldwide

Maximum drawdown is a measure of risk. It measures the largest temporary losses, which occurred at some point of time within a time period.

In the analysis an annual rebalancing takes place. This prevents that portfolio weightings deviate too much from the strategic allocation at the start.

The model resets the respective equity allocation annually to the starting level. Year 2008 for example: Stocks lose value while government bonds rise. Now the model sells parts of the government bonds in order to increase the equity portion with the proceeds. When stocks are rising, equity shares are sold accordingly.

The time series used for the analysis reach from January 2003 to December 2022 (20 years). All calculations are based on monthly figures.

German government bonds: Rex Performance index, Source: German Bundesbank

Developed market equities: MSCI World Net index, Source: MSCI

The conversion of US dollar investments into Euros is done via the official ECB EUR/USD exchange rate.

3 Risk Share

Choose your equity strategy

The risk share of a portfolio mainly consists of company stocks. We show you strategies, which allow you to easily invest in hundreds or even thousands of companies worldwide with just a few ETFs. The strategies differ in number of positions needed and investment focus.

For easy evaluation, we have added information on diversification and concentration.

Diversification

| No. of constituents | No. of countries | |

|---|---|---|

| < 100 constituents | < 15 countries | |

| 100 - 500 constituents | 15 - 25 countries | |

| > 500 constituents | > 25 countries |

Concentration

| Weight of top 3 countries | |

|---|---|

| < 50% | |

| 50% - 70% | |

| > 70% |

4 Mix of Risk Share

Choose your commodity strategy

Commodities offer the chance to strenghten the risk/return profile of your portfolio.

Commodities include energy (e.g. oil, gas), agricultural products (e.g. wheat, corn), l ive cattle, industrial metals (e.g. aluminium, copper) and precious metals (e.g. gold, silver).

Precious metals, especially gold, have an exceptional position among commodities. It is highly valued by investors in times of crisis. Besides a broad-diversified commodities basket, gold by itself can be a very interesting portfolio building block.

Set the commodity slider to 0%, if you do not want commodities within your portfolio.

Diversification

| No. of commodities | No. of segments | |

|---|---|---|

| < 5 commodities | 1 segment | |

| 5 - 15 commodities | 2 segments | |

| > 15 commodities | > 3 segments |

Concentration

| Weight of Top 3 commodities | |

|---|---|

| < 50% | |

| 50% - 70% | |

| > 70% |

5 Bond Share

Choose your bond strategy

Fixed-income securities in domestic currency are the "low risk" component of a portfolio. They are also known as bonds. Investors grant a loan to governments or companies and therefore receive interest payments.

Fixed-income usually has a significantly lower volatility than stocks. However, this does not mean they are risk free. This part of the portfolio may also lead to losses.

Government bonds offer the best credit quality. More yield, but also more risk, is provided by foreign government bonds and corporate bonds. An alternative to fixed-income securities are bank deposits.

For a better evaluation of the different strategies, you find more information on the duration and credit quality of the underlying securities.

6 ETF Selection

ETF Selection Filter with cost optimisation

The ETF savings plan offerings vary from broker to broker. With discount offers which apply for individual ETFs, you can sometimes order ETFs with no trade fees at all.

justETF has a comprehensive database which includes the ETF saving plan offers of all online brokers. This includes current special offers and if an ETF is available as a savings plan. The filter shows you the best offers for your savings plan strategy.

The filter favors ETFs with particularly low order fees (especially promotional offers). As a second ETF selection criterion, the filter prefers ETF with the largest fund size.

Here you can define whether you prefer distributing ETFs.

Here you can define if you prefer physically replicated ETFs.

Individualise the ETF selection with the edit button and compare all alternative ETFs which are eligible for saving plans at the selected broker.

Find the best offer for your savings rate of 300.00 EUR. The ETF selection is optimised by order cost and fund size.

All provided information is solely to help German investors to make a better financial decision. This website and their operators do not provide and do not intend to provide financial advice. The recommendation to the asset classes are based solely on your input and does not take into account your personal financial situation. Historic returns are no indication for future returns. We and our data providers cannot be held responsible for the displayed content. Especially not for completeness, correctness and accuracy. In addition, please also consult the legal notice and the legal terms for this website by justETF GmbH.