The reason is obvious. Companies operating in similar areas of the economy will typically face similar opportunities and challenges and are also likely to be impacted as a group by developments in the economic cycle.

A car manufacturer might produce superior vehicles or be more efficiently run than a rival, for instance. But external factors such as new government regulations, a rise in raw material costs or a recession will hit all carmakers to some degree.

Why invest in sector ETFs

Sector ETFs make such observations investable. They enable you to gain simple and cost-effective instant exposure to a basket of stocks in an industry sector via the purchase of a single ETF. In contrast, the manual compilation of a basket of stocks from individual securities of a specific sector would be very time-consuming.For instance, an ETF on the MSCI World Health Care index tracks the health care sector of Developed Markets worldwide. Top holdings include Johnson & Johnson, Novartis, Pfizer, and Roche.

To gain exposure to this sector before the advent of sector ETFs, you would have had to purchase these stocks individually (which would be costlier to implement and riskier because you're picking individual stocks) or else put money into an actively managed healthcare fund (where you will pay higher annual fees and risk underperformance due to poor fund manager decisions).

In contrast today, with sector ETFs, anyone can trade in and out of different sectors cheaply and easily. This means it's now practical for you to pursue alternative methods of portfolio construction when it comes to your equity holdings, such as diversifying across sectors rather than by geographic allocation.

You can also employ a sector rotation strategy. Here you seek to overweight the sectors most likely to benefit from the next stage of the economic cycle. Alternatively, you might not trade your positions but instead, permanently overweight particular sectors that you think have the best long-term prospects. For instance, if you assume information technology will become more important as a result of increasing digitalisation, you might hold a large position in a technology ETF.

To get a flavour of how the returns from different sectors diverge over time, see our Market Overview tool.

Our tip: If you want to invest in a specific sub-sector of industry, such as cybersecurity, electromobility or artificial intelligence, theme ETFs are a good alternative to conventional, broadly diversified sector ETFs. For an overview of the investment themes that can be invested in via ETFs, please consult our investment guides.

What do sector ETFs invest in?

Sector ETFs are index-tracking funds. They track sector indices maintained by the index providers. These indices are based on one of two different internationally recognised sector classification schemes: The Industry Classification Benchmark (ICB) and The Global Industry Classification Standard (GICS).In practical terms, the classifications are very similar. STOXX uses the ICB system for its indices, while MSCI employs GICS. Families of sector ETFs focus on the broadest categories, and sector ETFs are available to track regional as well as global sector indices.

In addition, the range of sector ETFs was expanded with ETFs focused on specific themes. These allow you to invest in sub-sectors such as battery technology, renewable energies or robotics. We offer investment guides with further information on most of these investment themes.

Note, however, that investing in thematic ETFs is similar to the "stock-picking approach" of selecting individual, promising companies. So it is more a niche investment than a broader sector allocation or rotation strategy.

Some potential downsides of sector ETFs

It's always important to consider costs when investing, and sector ETF fees are typically higher than those of regional or country-based ETFs without sector focus.Our tip: Be especially vigilant with more exotic or niche sector ETFs that may have a relatively small amount of Assets under Management, and hence higher costs.

How to find the right sector ETF

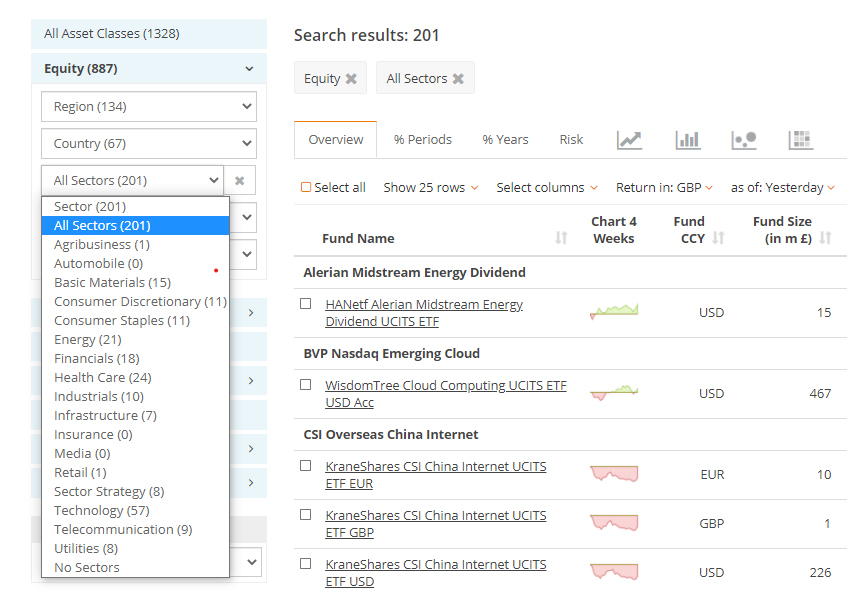

You can find an overview of the range of available sector ETFs in our ETF theme list. Alternatively, you can filter the available ETFs by industry, region and a variety of other criteria in our ETF search.Selection of a sector-based ETF

Source: justETF Research

Our tip: Filter for "All Sectors" to get all ETFs that focus on sectors. If you want to exclude all sector ETFs from your search, choose the "No Sectors" filter.